This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I’m a huge advocate of using credit card transfer partners, and while it USUALLY means a far better value, it shouldn’t be your default position. Case in point. I’m looking to travel through Doha in the beginning of April, and am considering a variety of hotels from Marriott, Hyatt, and IHG. In checking my options I wanted to weight out the pros and cons of whether it would make more sense to pay outright and book with Virtuoso/Amex FHR benefits or transfer into one of the hotel loyalty programs.

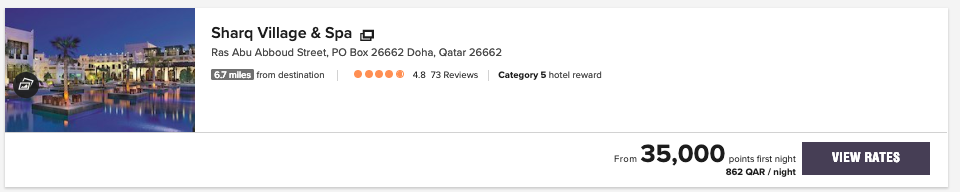

Let’s look at Sharq Village, a Ritz Carlton hotel.

If I were to book via Marriott and use points…it would set me back 35k points. I could populate my Bonvoy account from either Chase or Amex.

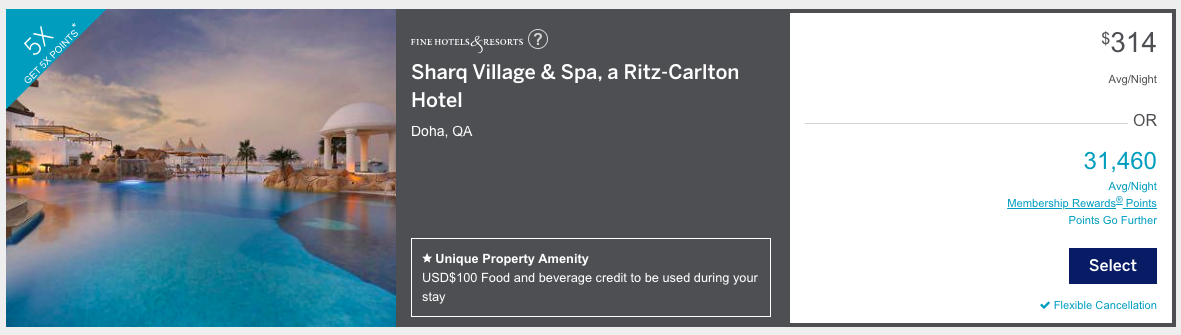

However, Sharq Village is also part of the Amex FHR program. Only 31,460

Not only does this hotel represent a savings in points needed to book the room, but I will also enjoy all of the benefits of FHR. In fact, the FHR benefits provide $150 worth of value per room.

- Early Noon Check-in and 4pm late checkout

- Room Upgrade when available

- Daily Breakfast for two people ( I’m valuing at roughly $50 )

- $100 food and beverage credit per room

Will you get hotel loyalty points and elite nights as well? You should.

In the past FHR would earn you status nights and loyalty points in addition to Amex points for the stay. Then Amex introduced 5x points via FHR and a big question was raised. Would you still earn the hotel loyalty points and status nights? Correct me if I’m wrong, but the evidence I’ve seen and heard is that you do. If that’s the case, since using Amex points is buying the night, it serves us to believe that using points to pay for the room would also earn you hotel loyalty points and elite nights as well.

Analysis

Everyone values their points differently, and this certainly isn’t the best value for using Amex points by my standards. In fact, it’s only getting a penny a point, and it damn near kills me to get less than two cents. That said…if you’re sitting on an absolute grip of points, which a lot of small business owners are, and you’re looking to get the best value at specific properties, don’t overlook using your points to simply pay for the room instead of transferring into a partner program. In this scenario, it’ll not only save points, but provide incredible benefits during our stay.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.