We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Amex to Qantas transfer bonus

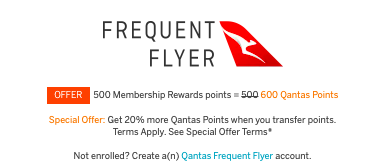

Shortly after Amex added Qantas as a transfer partner in mid 2019 they ran a 20% transfer bonus, and thankfully, Amex has brought it back! My account was targeted, but it doesn’t mention an expiration for the bonus, and also take note that some transfer bonuses are only good for a single transfer.

Most Amex transfer partners require a minimum of 1000 points to transferred; however, the Amex to Qantas transfer can be done in 500 point increments. Let’s take a look at the offer and then some instances in which it could make sense to utilize the program, and this bonus.

A few ways to use Qantas points…

El Al

El Al is an Israeli airline that operates several routes between the USA and Tel Aviv. El Al is also an Amex partner, but Qantas creates a far more attractive option for redemption. They’ve recently introduced a gorgeous new business class, as seen in the promo picture below, and one I’d love to try out. I would note that it used to be far more attractive to redeem Qantas for El Al, but here are a few US to Tel Aviv redemption prices.

Accessing El Al by using Qantas points for their gorgeous new Biz:

- Boston, Newark, JFK to Tel Aviv : 90k Miles, or 75k Amex with the transfer bonus

- Chicago and Miami: 104.5k Miles, or 87k Amex with the transfer bonus

- San Fran and LA: 119.2k Miles, or 100k Amex with the transfer bonus

Cathay Pacific

Another great redemption? 109k Amex for roundtrip Cathay Pacific Business Class between the States and Hong Kong. Read our review of the A350 and 77W.

One of my favorite First Class experiences was on Qantas.

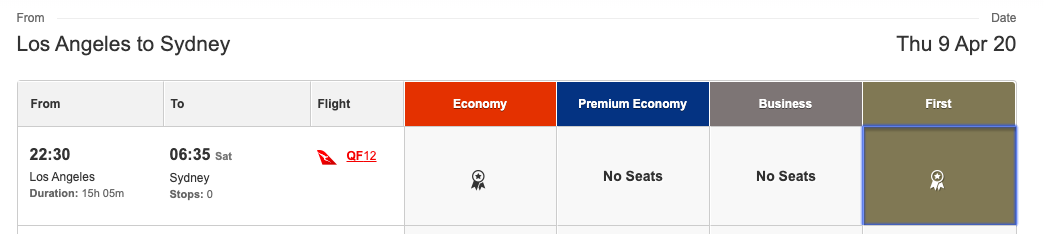

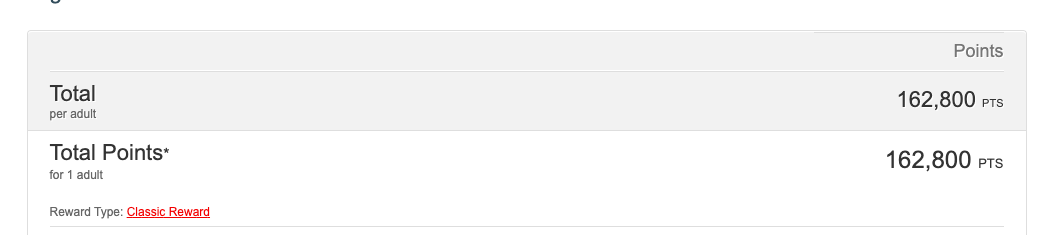

I used Alaska miles for my experience, but if you’re sitting on a pile of Amex points…it’s a fantastic experience and one I would highly recommend. Qantas also releases far more award space to its own members than it does to partners. At 162,800 points needed…it would require 136k Amex points for a one way first class flight.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.