This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

We’ve been hearing a lot about retention offers, but it seems the offers may be fluid. A couple of weeks ago I phoned Amex after a chat with an online rep regarding a potential retention offer on the account. At the time, my $550 annual hadn’t hit, and they offered me 30k points after $4k spend in 3 months. I didn’t take the offer at the time because, honestly, I wasn’t convinced I wanted to keep the card and rumors had been circulating that new benefits were coming. I wanted to see what those were, and make a more informed decision after announcement. Well, we learned, at least for the time being, that I could earn up to $320 statement credit by putting streaming and wireless services on the card. Great, that certainly helps. So I phoned Amex to see if the retention offer was still on the table. I learned a couple of things…

A little history on the account. I acquired this Amex Platinum in 2018 as an Amex Platinum Mercedes and it converted to a regular Amex Platinum in 2019. However, I was told that my account actually extended back to 2012. Interesting…I did have an Amex Platinum that I had acquired in 2012, but cancelled two years later because I didn’t think it was worth paying the fee. It seems, anecdotally, that the records somehow merged? This would be an interesting development into the lifetime rule…anyways back to the retention offer

When I asked the phone rep about any retention offers on my account he went into a fairly long explanation of benefits and the newly announced statement credits. I inquired about my chat session specifically indicating retention offers…he said that there wasn’t anything to do, aside from downgrading, to lower my annual fee. I said that I valued points a lot. Nothing.

At that point, I thought…well this is a sign I shouldn’t keep the card and maybe down the road I’ll receive an upgrade offer on my green or gold, but for the time being…I’ll just cancel my Amex Platinum. So I told him I think it’d be best to cancel

Put on hold

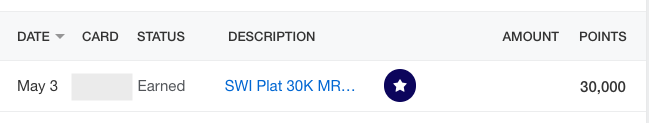

Came back…new offer: Spend $2k in 90 days and get 30k Membership Rewards.

Done deal, and even better than my first offer. I suspect I’ll be able to take advantage of some of the statement credits, but I push my mobile phone bill to my Ink Business Preferred, so I’d really be looking to get the statement credits off of streaming services I use.

The main point of the story is, I was prepared to cancel, and only then was I given the offer to keep. If they hadn’t given another safety net, I was fully prepared to allow it to fade off my credit card portfolio. Keep that in mind.

Note…as of this morning – the bonus had already appeared and I haven’t spent the $2k yet

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.