We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Beginner’s Guide: What is a retention offer?

Simply…a retention offer is an offer that is given by the bank to retain you as a customer. Keeping a credit card, or charge card, in your wallet is an investment, and with any investment you’re looking for some return. If the underlying points you earn or the benefits provided by the card aren’t giving you that return, you may be thinking about cancelling that card.

Anytime one of my cards is hit with an annual fee, I do an analysis to determine whether the fees I’m paying are worth the benefits I extract. Whenever I’m on the fence as to whether I will keep it or not, I always investigate retention offers that the bank may give me to keep that card another year. I’d strongly suggest you do the same.

Here’s how I approach it

When your cardmember year has expired you’re gonna get hit with an annual fee. You want to pre-emp this fee and call in the month or so ahead to see if there are any offers.

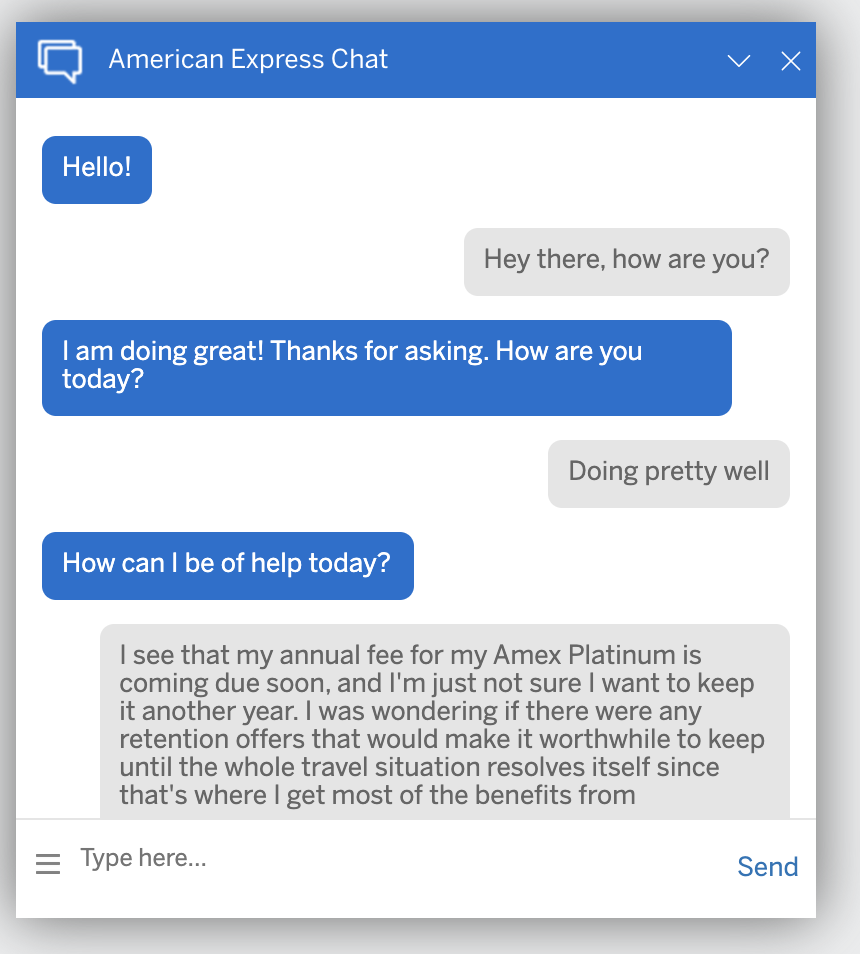

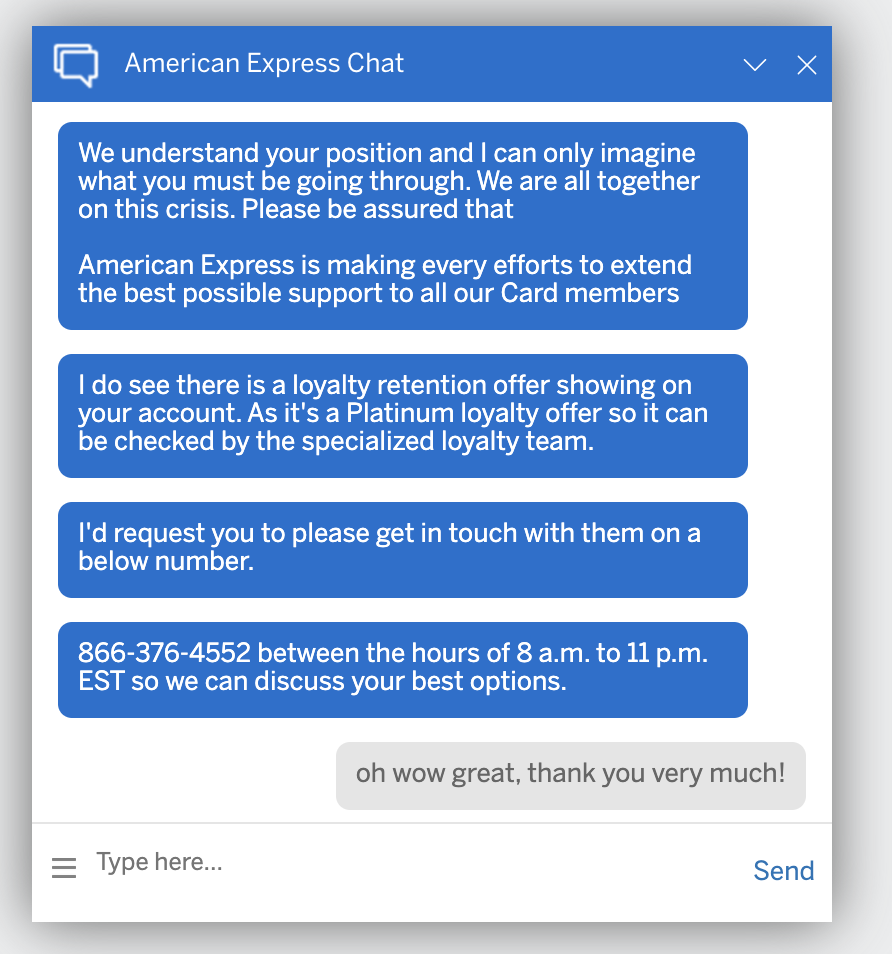

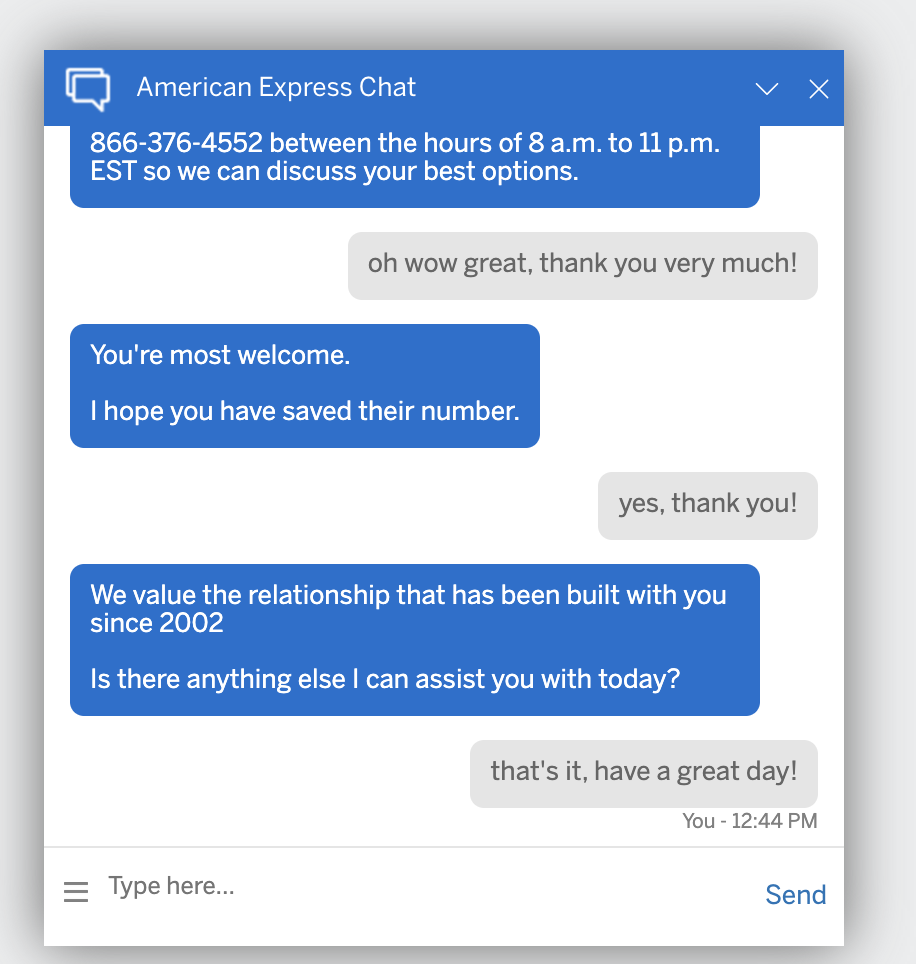

Chat:

First off…ask via chat. Most likely they won’t be able to give you your offer, but they will tell you if they see an offer on your account. If they don’t…it doesn’t necessarily mean there isn’t one available.

A look at how I’ve handled it in the chat earlier in the pandemic

Phone

Get on the phone and call up an agent. Ask if there are any retention offers available. If they say no, and you’re willing to give up the card…tell them you want to cancel. I’m seriously considering dumping the card. The annual fee is high and I’m not taking advantage of most of the benefits I’d usually get outsized value from…uber, incidental airline fee credits, lounge access, etc.

In 2021, I called in and was given an offer for 30k after $4k spend. It was a very solid offer and in fact, many people who did it later in the year got 50k offers!

Either way you’ll usually be transferred to a specialist.

In my experience specialists work on a three tiered retention schedule. YMMV but if you ask for the best available offer they are SUPPOSED to give it to you…skipping the initial two offers.

- First offer: Do you know how amazing your bennies are…lemme tell you

- they’ll prolly ask you why you wanna leave and what you value most

- 2nd offer: okkkkk sir we can give you…a lowball points or statement credit

- 3rd offer: ok sir this is the best we can do

Retention offers I’ve negotiated:

A few of the offers I’ve had the past…

- American Express Platinum: 50k – no spend

- Amex Platinum – 30k with $4k spend in 3 months

- American Express Gold Business: 15k – no spend

- Barclay AA Aviator Red: annual fee waived…no spend

- Amex Platinum: 20k no spend

Be Advised

Retention offers are getting stingier and stingier and vary widely.

In fact, over the last couple of years, on multiple cards I’ve expected to talk to someone…but the reality was different. When I told the automated agent I wanted to cancel, I was prompted that if I pressed a button they would go ahead and do it. I never spoke to a real person. They went ahead and cancelled the card without ever putting me in contact with retention or even a breathing human.

So if you say you want to cancel, be prepared to give up the card then and there – you may not get transferred to a specialist. Always ask for retention offers, if they say there are none, only say you want to cancel if you are willing to pull the trigger. You may get what you ask for.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.