This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

We received 3 ways to renew Ambassador

Ambassador is the loyalty program of Intercontinental hotels, not to be confused with the Intercontinental hotel group, whose overall loyalty is IHG rewards club which the Intercontinental brand is a part of. Intercontinental is the 5 star premium brand of IHG, and they’ve made a wholly separate program inside the IHG program that gives specific benefits to its members while staying at Intercontinental hotels. Last year my dad received a great targeted renewal offer, and this year he received something similar. Check out this very attractive IHG Ambassador renewal offer.

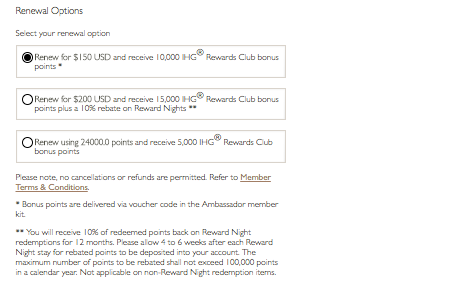

He was given 3 different options.

The typical renewal offer is $150 or 24000 points. Both of these options are listed below, one with a 10k bonus, the other with a 5k bonus. Since IHG points can regularly be purchased for $0.007, and targeted purchases of $0.005, I’d value these offers in the following way.

- $150 plus 10k IHG points = $80-$90

- No brainer as this comes with a free weekend night, room upgrades, etc.

- 24k points get 5k back = 19k points or $95 to ~$140

- not as sweet an offer

The real winner to us…$200 plus 15k points plus 10% back on nights

15k points = $75-$105 which reduces the $200 down to $95 to $125. On this merit alone I’d go with option one above, but we have to look at the 10% back on all stays with Intercontinental up to 100k total points. This is the same deal that IHG credit card holders retain. In fact, this deal is stackable, meaning the top tier Intercontinentals of the world, which usually cost 60k points, net out at 48k with this deal. Since my family stays at a lot of Intercontinental hotels, and we have another big family trip planned next year, this is the deal we will go for.

We have plans right now to redeem in excess of 400k points, that’s worth another 40k points back right there. Conservatively that’s worth $200 – $280, not including upgrades, or free weekend nights. That would put us way ahead, and it’s more than likely we’ll redeem in excess of 500k.

Have you received any attractive renewal offers?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.