This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

A quick refresher for those who are tuning in and unfamiliar with the BA program. British Airways utilizes two forms of loyalty: Avios for redemptions and Tier Points for status. When you fly you’ll earn both, but Avios are what you’ll redeem when you want to take a flight and pay for it with points. One great thing about using Avios is you can transfer in Chase or Amex into the program to shore up your balance, but they also have a great policy when it comes to cancellation fees.

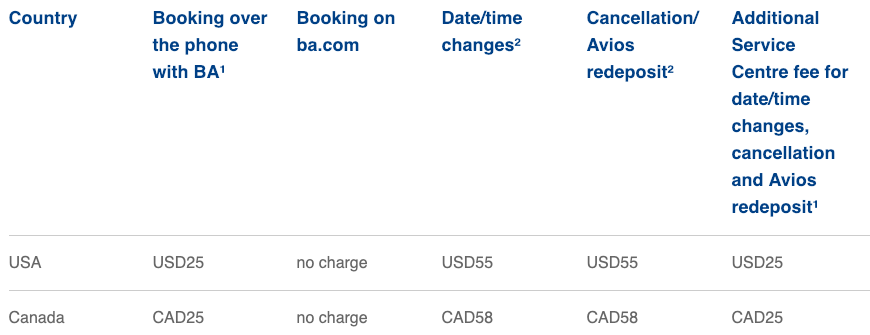

Here’s BA’s chart:

Canceling an Avios booking will set you back $55 as will date/time changes

Comparing this to other airline cancellation fees, you’ll find that this is quite low. However…

If your taxes/fees are less than $55, you’ll only lose the amount already paid when you cancel your ticket.

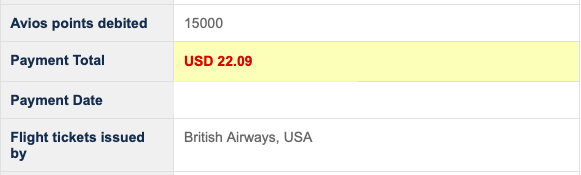

I just made use of this little benefit when I changed a ticket from Madrid to Rome that I’m taking in the next couple of weeks. The fees assessed on the ticket were just $22.09, but when I looked at the cost to change the ticket they wanted $55. Instead I just cancelled the ticket, and booked the new one that I wanted.

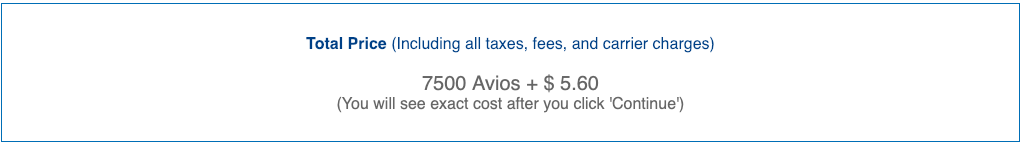

These cancellation fees are even less when booking tickets on American. Just $5.60.

If I needed to cancel the following ticket, I’d only lose the $5.60 fee paid when booking. Even better, I don’t get charged American’s $75 close-in booking fee either.

Before you change/cancel your tickets do a quick check and confirm you’re paying the least possible in fees.

British Airways Avios are best used on partner airlines where taxes and fees are far less than assessed on BA’s own metal. Knowing the most you’ll pay to cancel a ticket is $55 is great, but utilizing the cancellation policy when you need to change your flight is even better, and has saved me hundreds of dollars over the years.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.