This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Starpoints for 2.3 cents or Airlines Miles for 1.82 cents

There has been much discussion about the new Marriott and Starwood combined program. Let’s not go there. Instead, let’s focus on a great deal to purchase Starpoints to convert into Airline Miles. I’m sure most of already know that 20k SPG = 25k Airline miles, and they have a long list of partners. You can purchase 30k miles per account, per year, and your account has be at least 14 days old. But, remember, if you live in the same household, you can combine your SPG points with another person. So technically, a couple could buy 30k points each, transfer into one account, and convert the 60k SPG into 75k Airline Miles. That’s a spectacular deal. Of course, as I always say, don’t do this speculatively, but if you have a redemption in mind – this is a great offer!

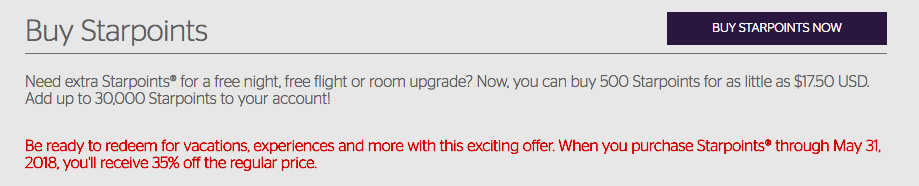

Buy SPG Points with a 35% discount until May 31st.

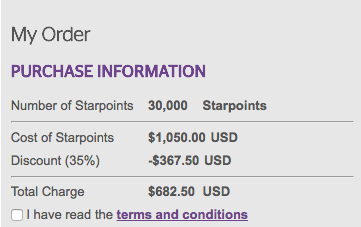

The cost breakdown:

In case you’ve forgotten the transfer partners

We recently wrote an entire article on some of the best uses of SPG points – go here to read.

One of the best uses is to transfer to Alaska. You could redeem it for Cathay Pacific First Class (feature pic) or Qantas First Class for just 70k miles or $1274.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.