We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Earlier today one of my instagram followers reached out and told me she was having a lot of problems with the Frontier GoPass she purchased. If you’re unfamiliar this is the unlimited flight pass that Frontier was marketing a couple of months ago…Unfortunately, in true Frontier fashion, it hasn’t been great.

The pass isn’t due to go into effect until next year ( May 3rd ), but after purchasing the pass, it’s not showing up in her account, nor are any options available to cancel. The fine print of the terms and conditions say that it was auto-renew at $1999 a year ( ARE YOU SERIOUS ) which was one of the big reasons I said it was a big fat pass. The pass is still available for purchase and I would seriously advise a deep dive to make sure you are comfortable with the headache that may ensue.

She sent me screenshots of her interactions with Frontier…

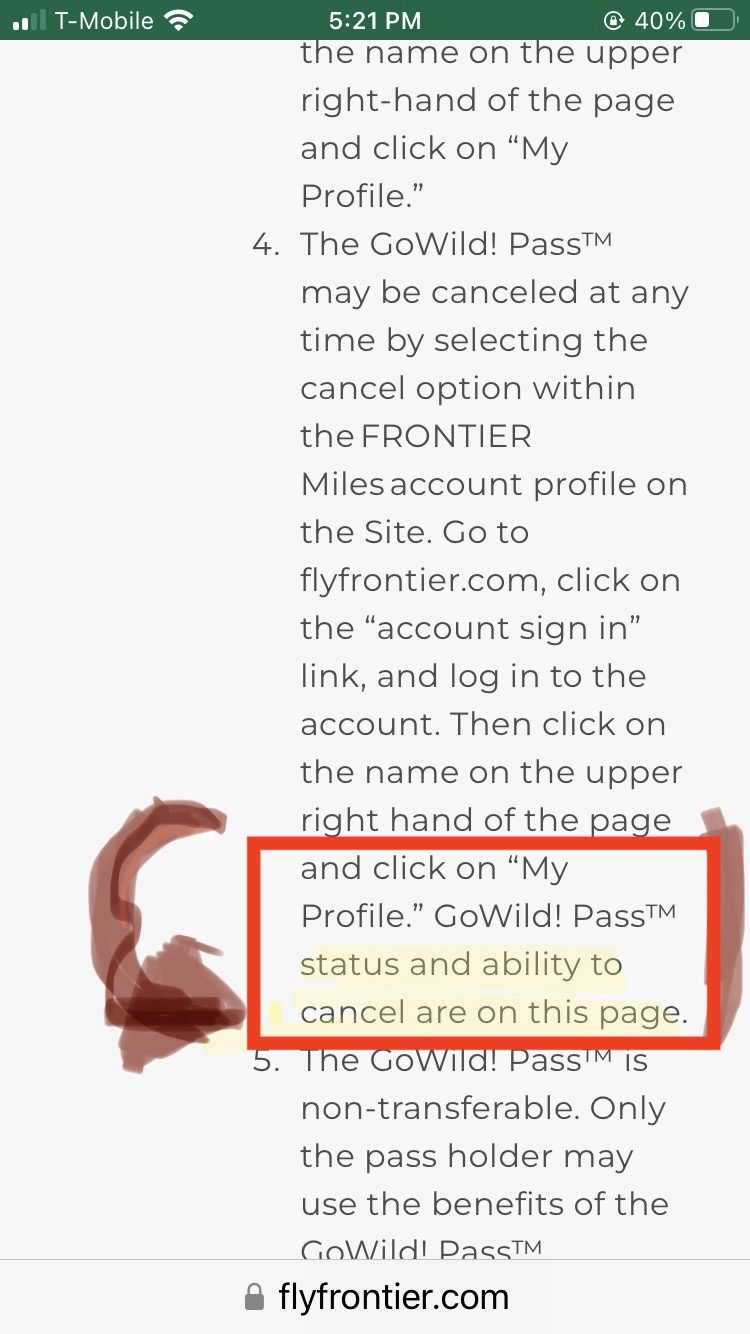

Here is a screenshot saying the Pass and cancellation options should be in her account

Details on GoWild Pass location in profile

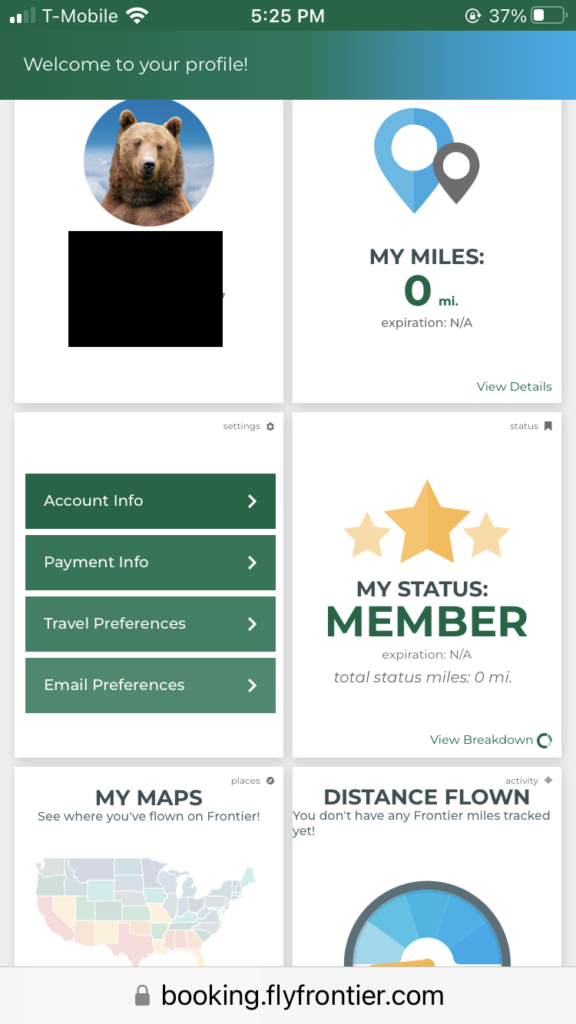

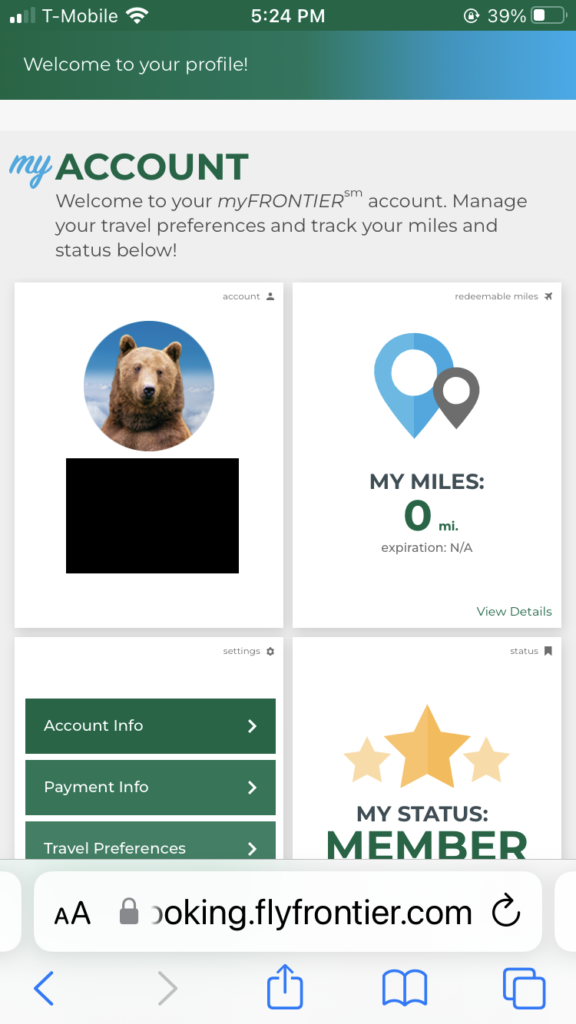

Here are screenshots of her profile and her GoWild Pass isn’t there

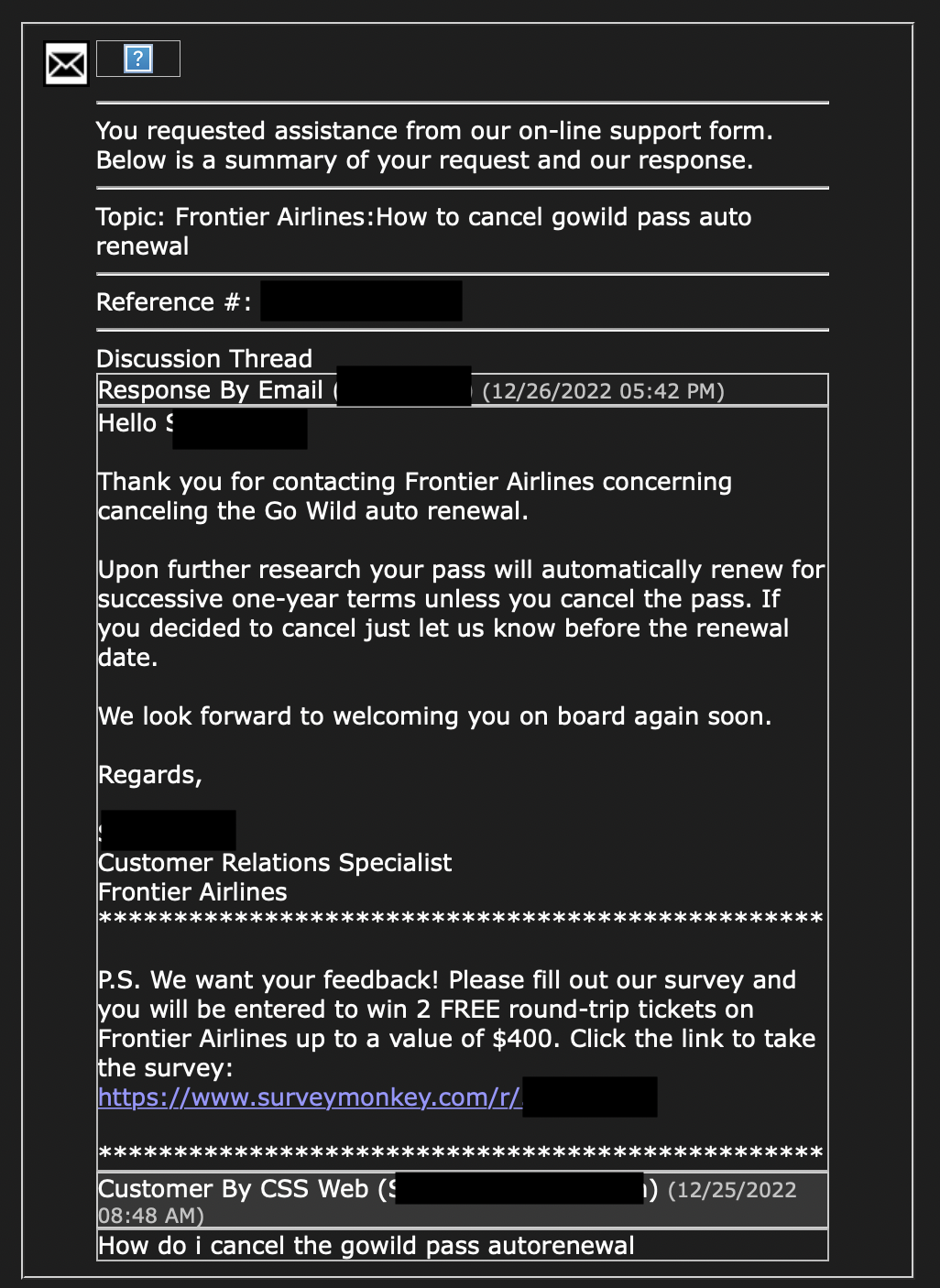

She couldn’t find any mention of the GoWild Pass and nothing about cancelling so reached out to customer service

No help from Customer Service

When asking how to cancel the pass… they say, just cancel the pass before it auto renews. Uhhhhh what?

My Thoughts

Frontier still has a few months before the pass officially begins in May, but for anyone that has purchased it already they’re basically hanging in the dark. Hopefully they can get accounts updated including the option to cancel online otherwise I have a bad feeling a lot of people are going to get stuck with a major auto renewal bill if they aren’t on top of it.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.