This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Yep, it’s possible with a simple change to your checking account.

I wrote a post last week that gave 3 simple options to earning a lot of AA miles. It was pretty popular, and there was one technique mentioned that I felt could use more visibility: 60k AA miles for $144 a year. To be completely honest, this offer isn’t for everyone, but if you have a healthy amount of cash you could easily swing it with very little effort. Willing to do a bit more work? You could earn another 20k that would total 80k AA miles!

That’s enough to sip $400 champagne while flying Japan Airlines First Class from the States to Tokyo.

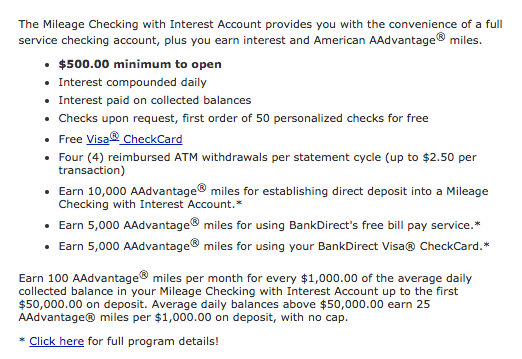

BankDirect has a checking account option that earns you AA miles. Let’s take a look

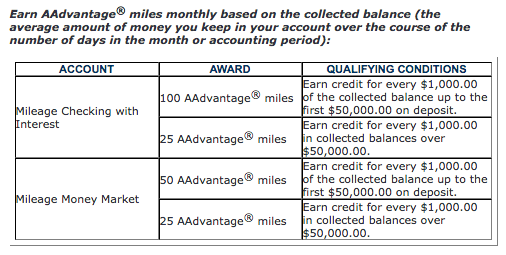

Here is the overview of the program

- Notice the bottom 3 bullet points ( those are one time offers that total 20k points)

- Look at the footnote – 100 miles for every $1k in your account up to 50k, then 25 miles/$1k over $50k in deposits.

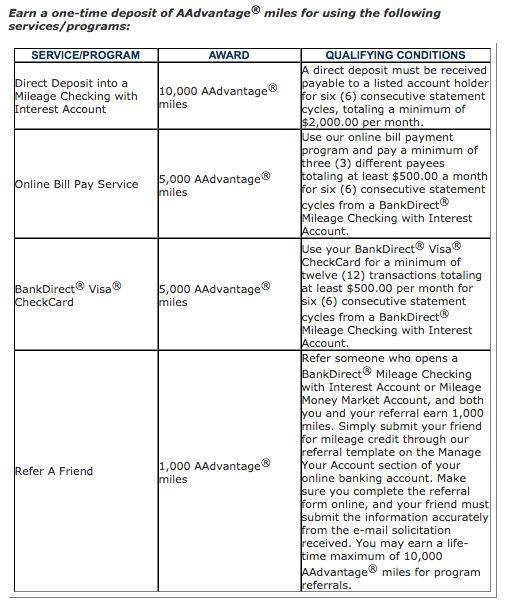

Let’s take a deeper look at the program starting with the one time bonuses.

This is what I was referring to that would be extra work, and honestly, may not be worth it to many people. Then again, who are we to judge? Miles are miles.

- 10k points after 6 consecutive statement cycles of $2k or more in direct deposits

- 5k points after paying 3 different payees totaling $500 a month for 6 consecutive cycles

- 5k points using your check card to make 12 transactions that total $500/month for 6 consecutive cycles

Too much work? I feel ya. You just wanna deposit the cash and watch the miles pile up?

- You’ll earn 100 AA miles for every $1,000 you keep in your Checking Account up to $50k.

- At a $50,000 balance, you’ll earn 5,000 AA miles every month, or 60k a year ( That’s enough to fly in Business from the States to Europe or South America.)

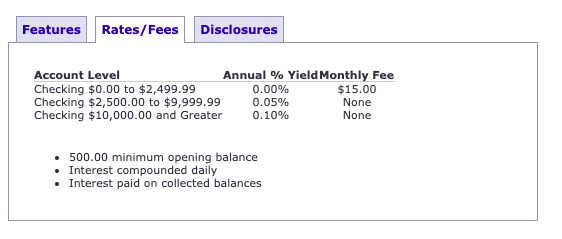

It’s worth noting that there are some fees associated with the accounts: $12/month or $144 a year.

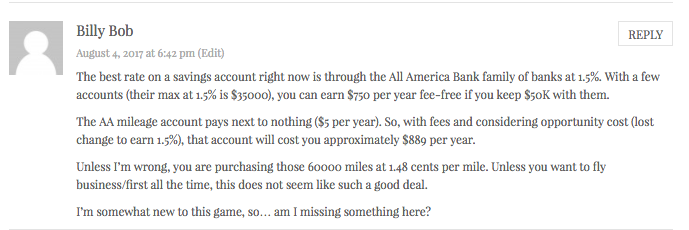

A reader, Billy Bob, brought up opportunity cost

Or in other words, what value are you losing in other opportunities by taking this one. It’s a good point, and should be addressed. He found a Savings Account that earns 1.5%. I couldn’t find this specific account, but let’s just use the numbers. Traditionally Savings accounts earn higher interest on deposits than do checking accounts, so while it’s not an apples to apples comparison as the BankDirect deal is for a checking account, it is another option to park your cash and should be examined.

If you were to use Billy Bob’s assertion of opportunity cost you’d be buying the 60k miles for roughly 1.48 cents. A great deal, but definitely not $144. If you were to do the 3 highlighted One-time bonuses mentioned above you’d earn 80k points, or roughly pay 1.11 cents per point. Either way, even accounting for a large opportunity cost, you’re buying miles at a discount to any public offer, ever.

My guess is most people are earning almost nothing in checking account interest, whereas BankDirect will give you enough miles for a business class flight to Europe or South America for $144/year.

Look and see what you’re currently accruing in interest for your checking account and crunch the numbers. Or if you have Private Client, etc that creates perks that the miles aren’t worth foregoing. Maybe it’s worth checking out where Billy Bob is stashing his cash. If the numbers aren’t sweet enough to keep you banking where you are, BankDirect may be a great way to stack up some miles.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.