This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

In November of 2022 IHG and Iberostar engaged in a strategic partnership that folded the brand of Iberostra into IHG; however, Iberostar retained 100% ownership. After a little more than a year, it’s now possible to burn some IHG One Rewards at Iberostar properties around the world. Personally, I’m not a huge fan of all-inclusive, but I’m well aware that many people absolutely love them. If I were to check one out, I’d be looking at the Iberostar Grand properties which are more luxury focused and adults only.

A couple of years ago IHG went fully dynamic on pricing which equated into a major devaluation in the redemptive value of points albeit with perhaps more redemption opportunities. I remember the days when 50k was a free night at any IHG property in the world, and in 2021 I stayed at the Six Senses Maldives in 2021 for just 75k points per night…it’s now almost 200k per night.

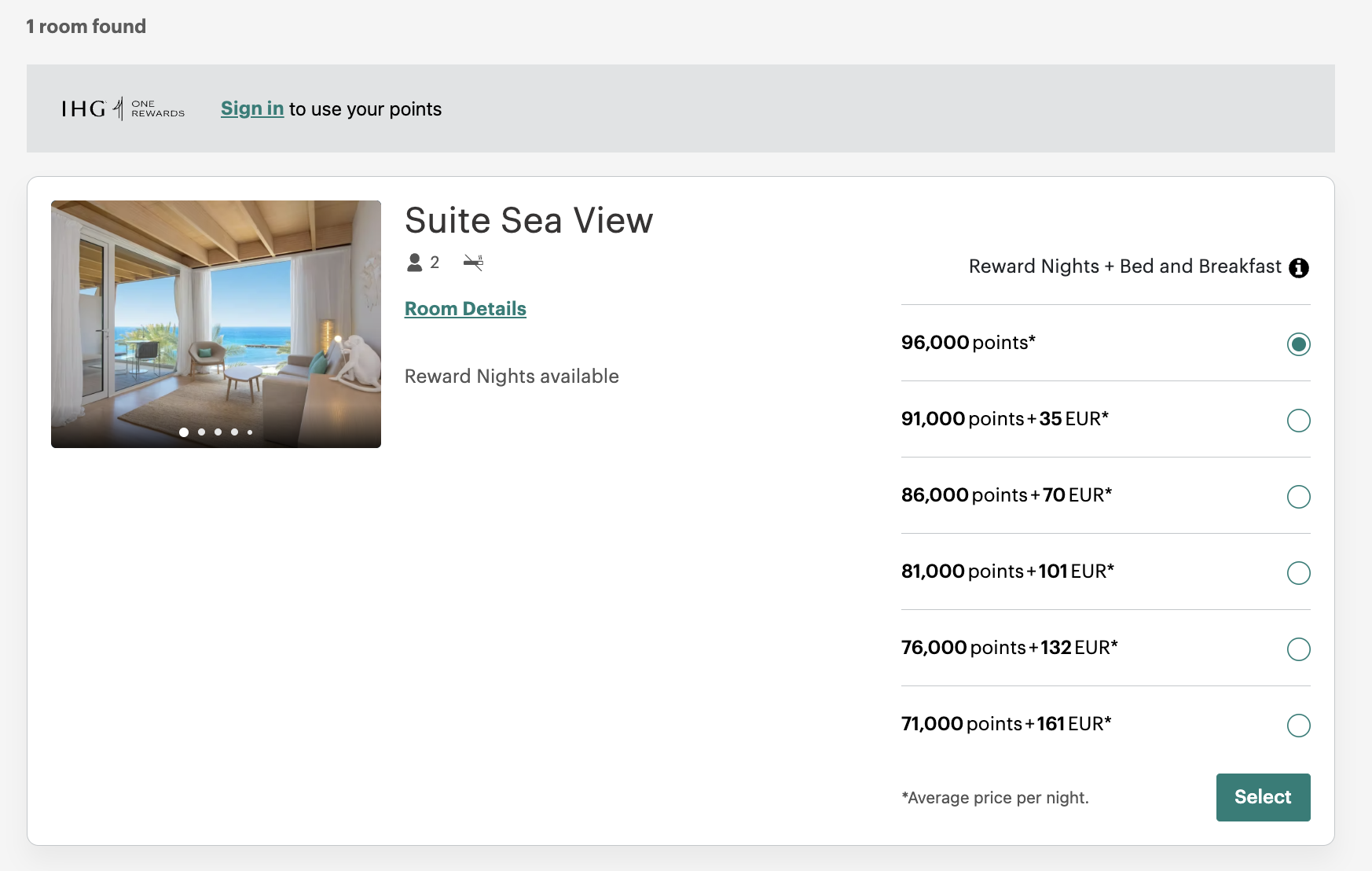

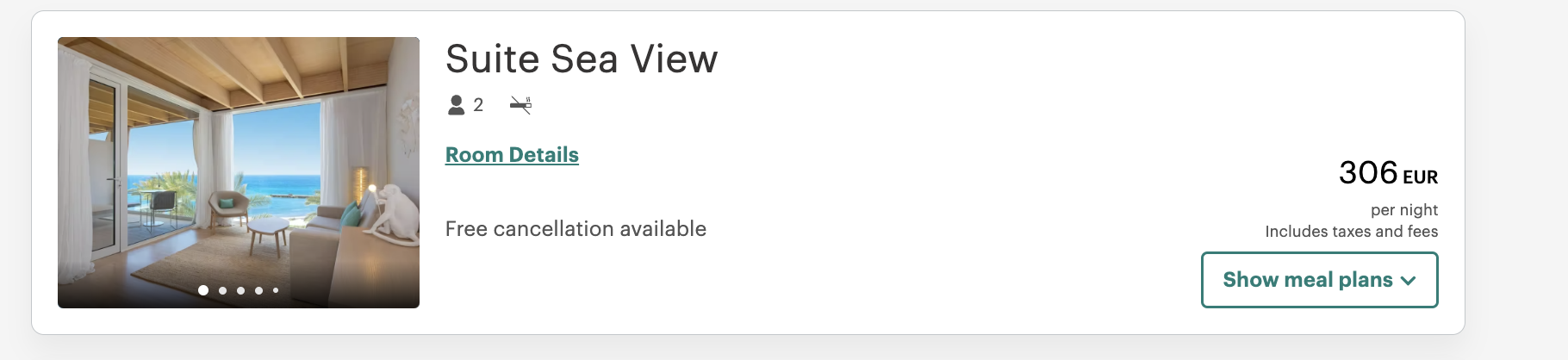

I did a quick search at the Iberostar in Tenerife during both peak and non-peak times and rates were all over the place, but the point redemption values weren’t great. You can almost consistently purchase IHG points for about 1/2 a penny a piece, and even when factoring in a 4th night free which comes as a perk for most IHG branded credit cards, it doesn’t make a lot of sense.

Sept rates: 96k points vs 306 Euros.

It would cost you $480 to purchase those points vs $340 in cash. Pass.

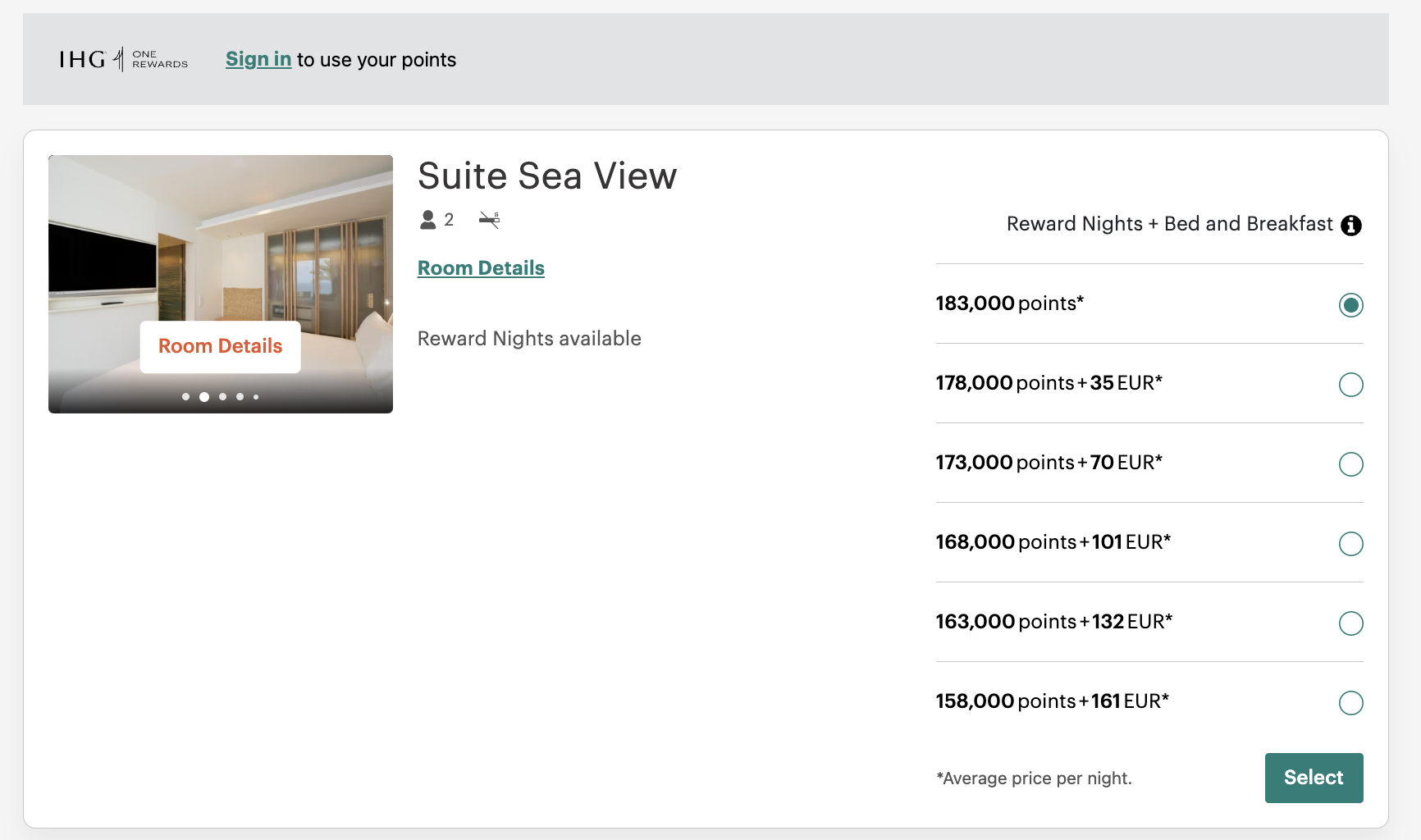

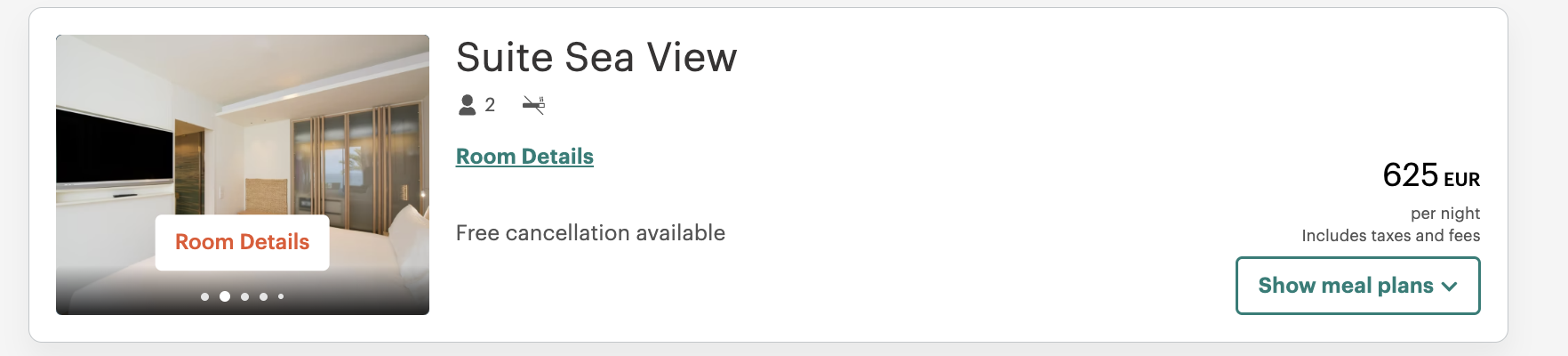

March – 183k points vs 625 Euros

March – 183k points vs 625 Euros

It would cost you a whopping $902 to buy those points vs paying $690 per night…not that I would, but my goodness, that is terrible IHG valuation.

Zach..does IHG ever value better?

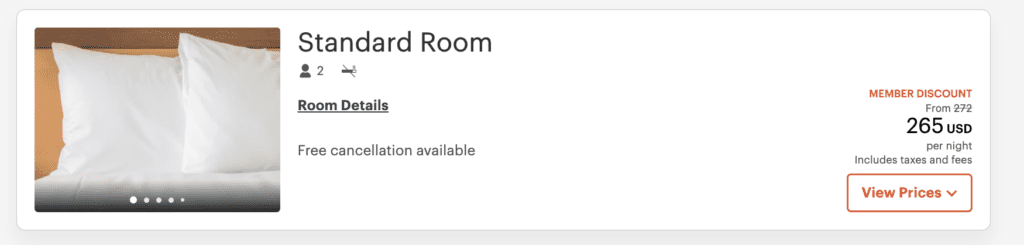

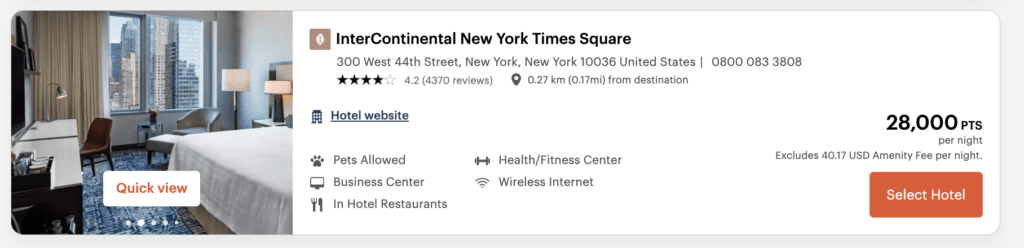

Yes.. here’s a quick example in NYC where a $265 a night hotel could be booked for 28k points, or $140 if you bought them. If you took advantage of a 4th night free, you’d lock it down for 84k points…just $420 for 4 nights in NYC – that’s a steal compared to over $1000.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.