This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

This is a lesson in stacking. If you’re unfamiliar with stacking, it’s the technique whereby you enjoy the benefits of several promotions or perks simultaneously. What I’m going to explain in the post is how my family is able to enjoy 6 nights at Intercontinental hotels worldwide, but pay for only 4 nights. It won’t work for everyone as you need to have Ambassador status and both IHG credit cards, and one is no longer offered. However, TONS of people still hold the old one and this could be incentive to keep it rather than product change or cancel. In fact, once a year you can actually stay 8 nights and pay for only 4. Don’t mind paying a little cash…we even show you how you can get super crazy and do 10 nights: cash for 1, points for 4, and the rest free of charge.

In order for this to work, this is what you need:

As I mentioned in the opening paragraph, the IHG Rewards Select card is no longer offered.

- IHG Rewards Select Credit Card

- IHG Rewards Premier Credit Card

- Renewal Ambassador Status with a 10% back renewal offer

Widget not in any sidebars

Lemme walk you through how this works.

Each of the 3 things I mentioned above comes with certain perks that can be stacked on each and every stay you enjoy. Here’s the perks that we will be specifically utilizing:

- IHG Rewards Select Credit Card

- 10% back on points used towards stays, up to 100k a year

- IHG Rewards Premier Credit Card

- 4th night free when using points

- Ambassador Status renewal with a 10% back offer ( up to 100k a year )

- This applies specifically to IHG’s Intercontinental branded properties

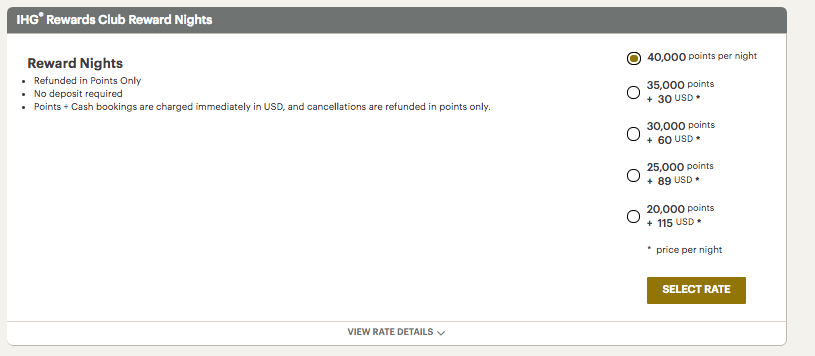

Applying it to a single stay: Let’s take a 50k per night property, the Intercontinental Singapore

Applying the IHG Rewards Premier 4th night free benefit

For this example, let’s use the Intercontinental Singapore, a property I’ve stayed at and enjoyed. Here’s a booking for 6 nights. As you can see, the IHG Rewards Premier Credit Card 4th night free perk kicks in during booking. Instead of charging 300k points for a 6 night stay, only 250k would be withdrawn.

Applying and accounting for the two 10% back opportunities.

Each of these perks are mutually exclusive, and each carry their own 100k point cap. This means if you stay at an Intercontinental property that would ordinarily cost 50k, you will see a refund ( after the stay is completed ) of 5k points, two times, per night. Once for having the IHG Rewards Select Credit Card, and once for renewing your Ambassador Status and selecting the 10% back offer on Intercontinental properties.

Since this stay is charging us for 5 nights, we’ll receive 10% back on the 250k points, two times. Or, in other words, 50k points refunded.

Our grand total for 6 nights will end up being 200k points, or the equivalent of 4 nights. A savings of 100k points.

I chose a property that is 50k a night for the simplicity of the math, but I also mentioned how ( if you meet the pre-reqs) you could do 8 nights…scroll down

Widget not in any sidebars

How you could do 8 nights and pay for only 4…shoot for properties under 40k a night.

In addition to the perks I laid out above, both of the credit cards come with annual free nights at properties 40k and below… This means, if you were to choose a property that qualifies, and apply the technique above, you could in fact apply two more free night certificates and enjoy 8 nights for the price of just 4.

Here’s a look at the Intercontinental Budapest: 35k a night, or 140k for 8 nights

Intercontinental Bali: 40k a night, or 160k for 8 nights.

Don’t forget…there are opportunities to buy points for as little as 1/2 a cent – up to 100k a year.

Periodically, throughout the year, IHG will put their points on sale – we’ve seen a 100% bonus offered which, when maxed out, drops the price down to just 1/2 a cent a point. When you utilize these point buying bonus opportunities you’re not only getting a great deal on the points, but you’re also increasing your max purchase. IHG limits buying to just 100k a year. But…bonus points don’t count.

This means that you could buy enough points to stay 8 nights at the Intercontinental Bali ( assuming you meet the pre-reqs ) for just $700…140k * $0.005. That is an insane deal.

Wanna get even crazier? You could add on a buy one get one free night included with Ambassador and do 10 nights. Cash for 1 night, points for 4 nights. 5 nights free.

Ambassador comes with a Buy one Get One weekend night certificate. If you could work out the dates, you could actually start your trip off by paying for the first night and getting the second night free. Then commence your 8 night award stay utilizing points and free night certs we discussed above.

It’d look something like this

- Night 1 – Cash Rate

- Night 2 – Free night BOGO Ambassador

- Nights 3,4,5 – Points

- Night 6 – Free with IHG Rewards Premier

- Night 7 – points

- Night 8 – free ( 20% refund on nights, 3,4,5,7,8)

- Night 9 – IHG Rewards Select Free night cert

- Night 10 – IHG Rewards Premier Free night cert.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.