This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

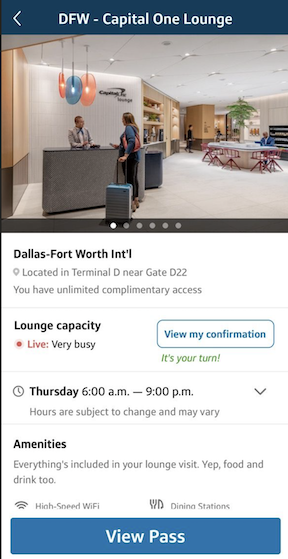

There are currently 3 Capital One Lounges open in the world. They are downright wonderful offering great food, coffee, drinks, and modern, fresh spaces to work and hang out. The first opened in Dallas, and DC and Denver have recently opened up as well. I’m here in Atlanta hoping that we get one soon because, when they aren’t crowded, they’re awesome.

Who can get into the Capital One Lounge Denver?

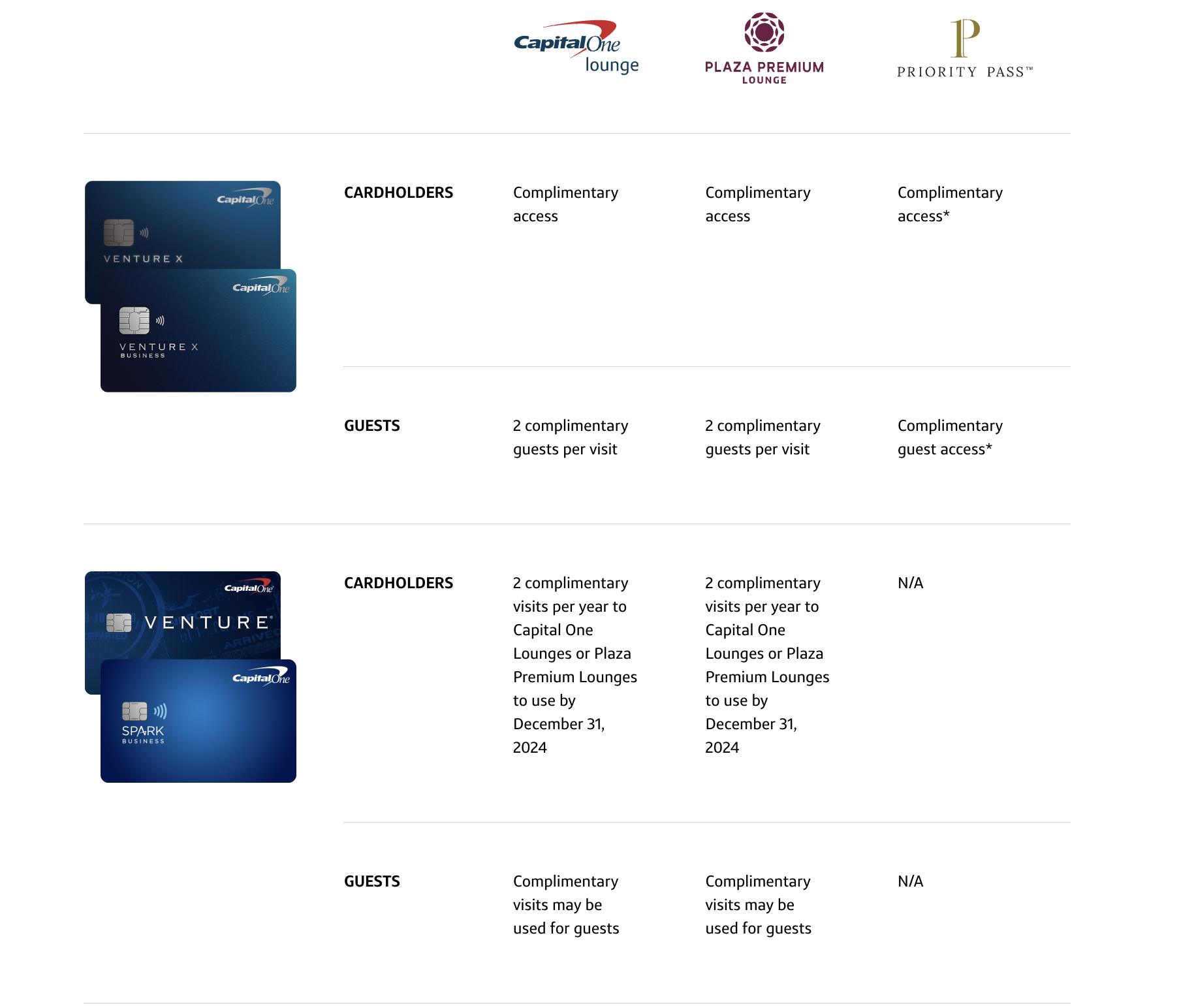

Just remember per the terms: “Effective January 1, 2025, Venture and Spark Miles cardholders will no longer receive complimentary lounge access. You will have 2 complimentary visits to Capital One Lounges or Plaza Premium Lounges to use by December 31, 2024. Venture and Spark Miles cardholders can access Capital One Lounges at a special rate of $45 for themselves and their guests.”

Capital One Lounge Denver Location

It’s located in Councourse A near Gate 34

Capital One Lounge Denver Hours

Daily 5am to 9pm

Crowd control:

It was very crowded, and the new rules that will go into effect Jan 1 2025 are welcomed. Many people were turned away; however, you can now add your name to the waitlist, or reserve a spot online. I’d do this. I didn’t, but in the future I would, but my wife and I were just lucky we got in.

Capital One Lounge Denver Food to go:

Hands down the best part of the lounge is the ability to pop in and out with food. I had multiple items and even took a sandwich to have on the plane ( it was egg salad…sorry I was that guy ).

Capital One Denver Main Area

The lounge has one central area that surrounds a bar…a long the circumference you’ll find drink stations, snacks, and a buffet. As you can see it was quite crowded.

Capital One Lounge Denver – private areas

Opposite the main area you’ll find private work rooms and pods that can be used for a meeting, phone call, work, etc.

Capital One Lounge Denver Restrooms and Shower

The shower was actually occupied, but the restrooms are very clean, large enough to change in, and individual.

Capital One Lounges

I’ve visited all three Capital One Lounges and they are amazing…though starting to get crowded so hopefully this and the restrictions on access will help.

- Denver

- Washington DC Dulles

- Dallas DFW

Overall

Great lounge, but it was VERY crowded.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.