This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The Capital One Venture X has been my pick for the best super premium credit card since it first debuted a little over a year ago. It has a litany of benefits, but most impressively it’s simple to see how the $395 annual fee is offset: it comes with $300 annual travel credit + 10k anniversary miles = $400 in total credits. Taking all of the other benefits out of the equation, they’re effectively paying you $5 a year to keep the card. But…one of those other benefit is the complimentary Priority Pass lounge access that includes 2 guests, and unfortunately we’ve learned that it is being devalued.

How?

Well, for those of us who have had the card since its inception we’ve been able to use that Priority Pass membership to access the restaurant + spa partners in the Priority Pass network. The restaurant benefit gives cardholders + 2 guests, $28 a piece to eat. That aspect of the Priority Pass membership is unfortunately going away on 1/1/23. You can read more about it here. The membership itself will stay in tact, and this matches what the Amex Platinum/Business Platinum has in terms of Priority Pass access.

Additionally, you won’t be able to visit the spa or retail experiences either…

What lounges do I still have access to?

The good news is you still have Priority Pass access It just doesn’t include the restaurant benefit. I’d guess many of you never even used that benefit since most airports don’t have a participating restaurant and this won’t really affect how you value the card.

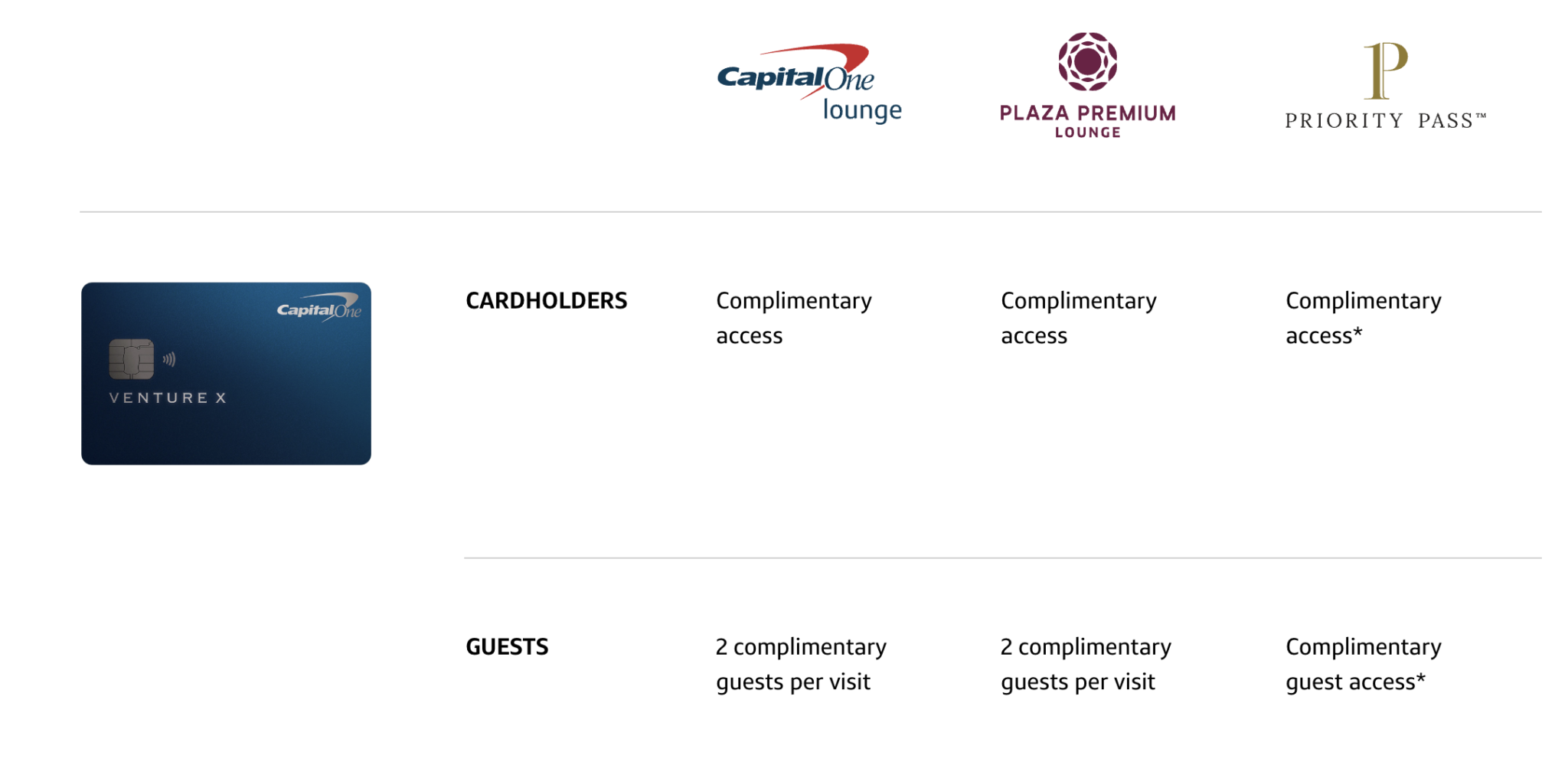

You’ll also continue to have access to the Plaza Premium network and Capital One lounges

Does this change how I value the card

Does this change how I value the card

It’s a minimal hit to the overall value to the card, and continuing to keep in my wallet and my wife’s wallet is a no brainer. If losing the non lounge benefits is a massive value to you, you could look at the Chase Sapphire Reserve, or if you have a personal Marriott card from Chase for over 12 months, you could upgrade to the Ritz card which has a Priority Pass with restaurant/spa benefits.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.