This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Earlier in the year we learned that Chase had negotiated to add Air Canada Aeroplan as a transfer partner at some point in 2021. Well…that point has come. This is a wonderful addition to the Chase program and has loads of a great redemption sweet spots to keep you flying in luxury. Even better yet? It’s a partner of Amex, Cap1 and Marriott Bonvoy as well meaning if you’re a little short on points, you can transfer into Aeroplan from multiple programs.

here’s the new list of Chase Ultimate Reward transfer partners – don’t forget to check out our best uses of Chase points here

Chase cards we recommend

- Chase Sapphire Preferred is offering an incredible all time high time and is a great starter premium card, one that I actually carry, think this is a great card to view as your Chase cornerstone cad.

- Chase Freedom Flex and Chase Freedom Unlimited have amazing offers currently running and I would highly recommend both cards

- They were improved in September of 2020 and at least one should be in your wallet

- Chase Sapphire Reserve It’s also well worth your interest and includes many additional perks, but has a much higher annual fee of $550

- Chase Ink Business Preferred is one of the best business cards you can carry and I actually have two of them in my wallet ( different businesses )

- 3x on a litany of categories and earns transferrable points

- Chase Ink Business Cash

- rotating quartely 5x categories make this a great card to keep in your wallet to maximize spend

- Chase Ink Business Unlimited

- earn 1.5x on every dollar your business spends

How does the Aeroplan program work?

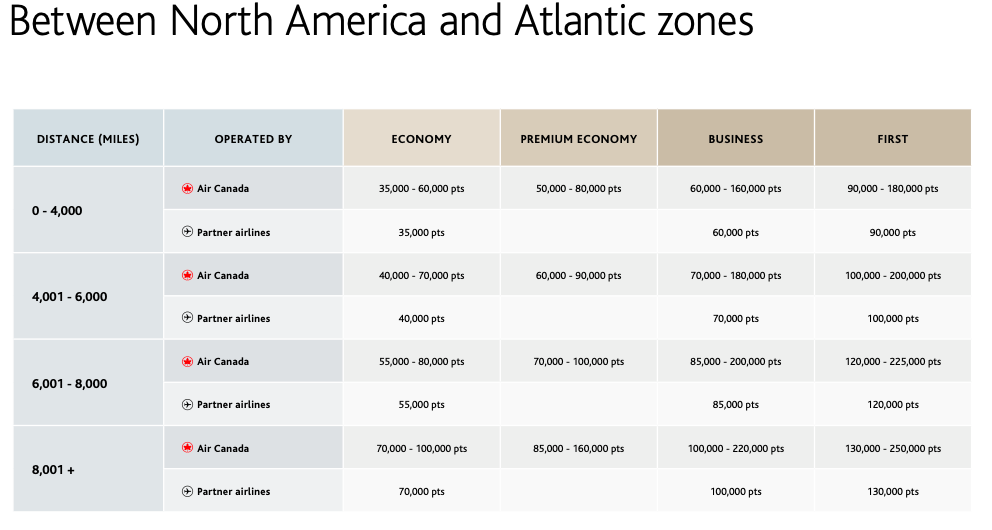

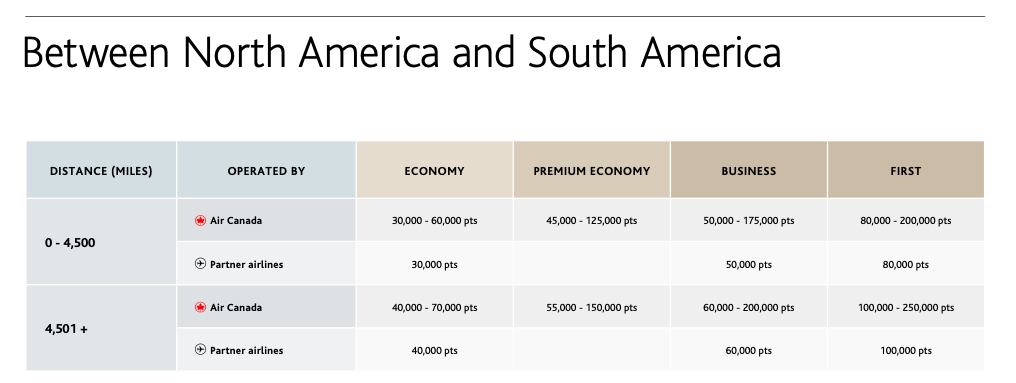

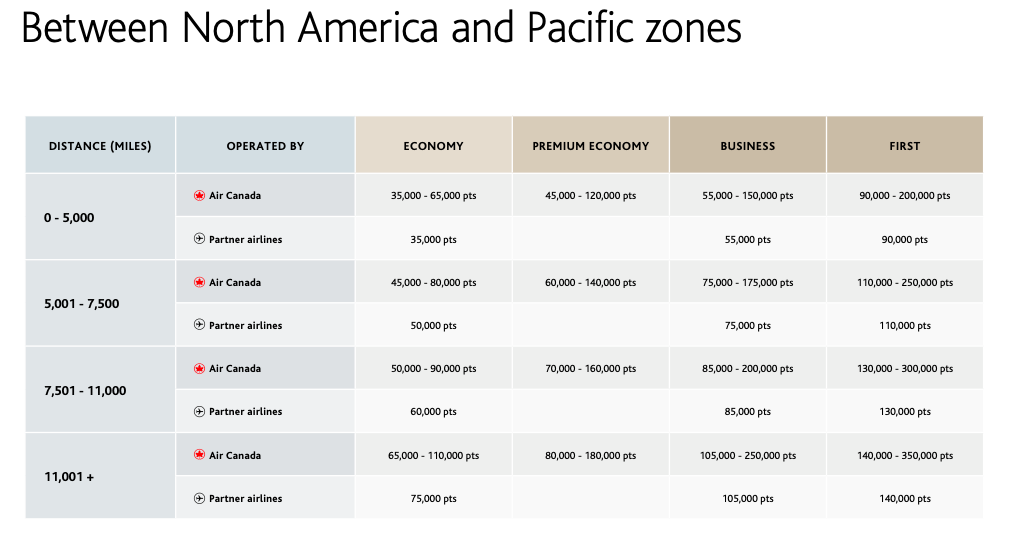

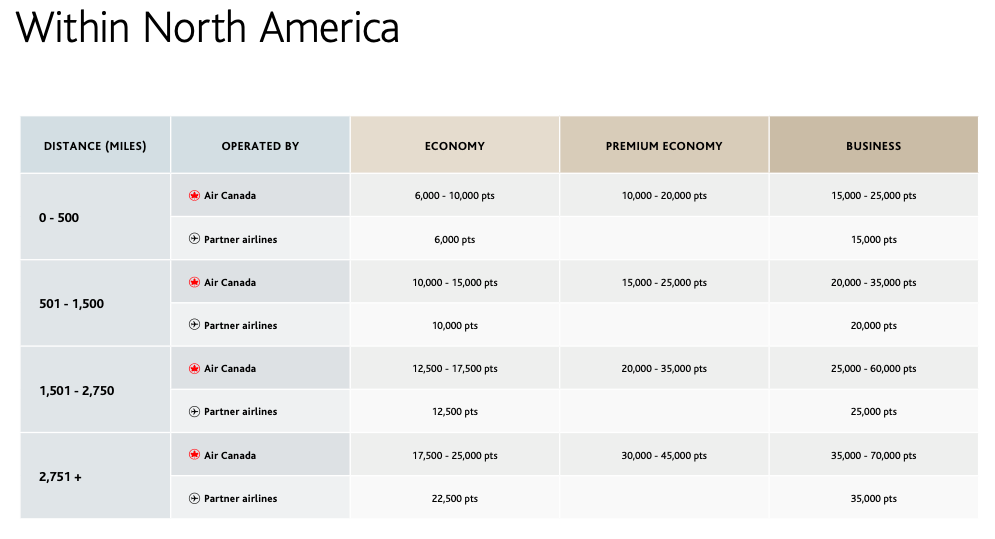

The Aeroplan program is divided into sections around the world and then within those sections there is a mileage based award chart.

Here are the sections around the world: North America, South America, Europe/Africa, and then Asia/South Pacific

Using North America as a base

Here are the 4 charts that would be most useful to you.

Stopovers for just 5k miles

This is a really cool perk…let’s say you want to fly business class from New York to South Africa it would cost you 100k miles ( 9k flown miles). You could fly from NYC to Frankfurt, stopover for a few days, take the Porsche out on the autobahn, come back to the airport, and then resume your trip to South Africa for 105k. That break could even be up to 30 days. Pretty cool.

Keep in mind if you can find a direct routing you could do it for just 85k miles.

What are some cool redemptions

Fly direct to South Africa in business class for 85k miles

US to Asia for 85k in business class – EVA Royal Laurel is fantastic

Fly to the Middle East on Etihad Business Studio for 85k

First Class to the Maldives in Etihad First Class for 130k

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.