We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Earlier this year we saw Aeroplan adopt a new 4-zone award chart, and while it was a devaluation, it wasn’t massive and still represents a great way to redeem points for luxury travel. Learning that Chase plans on partnering with Air Canada and implementing Aeroplan not only as a cobranded credit card partner, but also as an Ultimate Rewards transfer partner is fantastic. Chase will debut both a new Aeroplan Mastercard and Aeroplan as a transfer partner later in 2021.

A quick look at Aeroplan’s award map

The key:

The 4 zones:

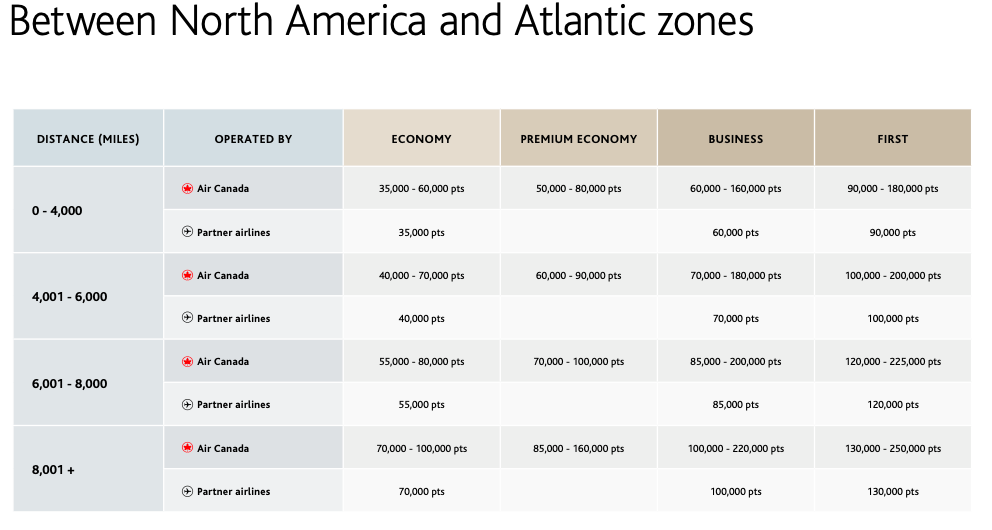

This means most partner flights from the US/Canada to Atlantic ( Europe, Middle East, Africa ) will clock in at:

- 70k for business

- 100k for First Class

If you end up flying longer than 6k miles…it’ll pop up according to the chart below.

With the taxes and fees nearly eliminated, throwing points at Lufthansa could make a lot of sense. Aeroplan will be a transfer partner of Chase, Amex, and Cap1 – lots of earning possibilities

Don’t forget that Air Canada is now partnered with Etihad

The apartment is currently not in operation since Etihad’s A380s are currently grounded, but perhaps by the time Aeroplan is a transfer partner that will change?

My overall take

This is a great pickup for the Chase Ultimate Rewards program, and hopefully is a good omen of value continuing to be added in the future. I’ll eager to know what the welcome offer will be – a nice juicy 100k offer would be fantastic! One can hope 🙂

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.