This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

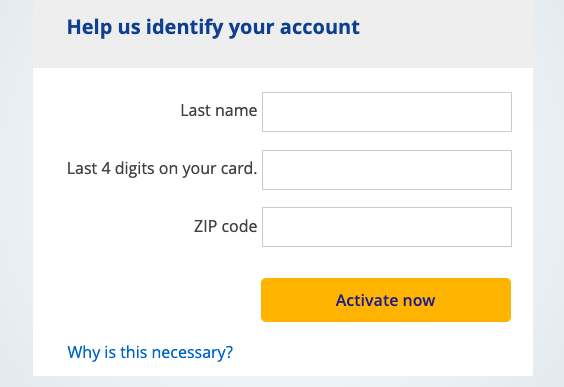

Doctor of Credit uncovered an amazing slew of targeted offers for Chase’s co-branded credit cards. There seems to be a few offers for those who are targeted that can earn them up to 5x on purchases. The most popular two: earn 5x on all purchases, up to $1500, and the other specifically targets 5x on up to $1500 worth of purchases on groceries and restaurants. All of them run from April 1st until the end of June. There is a catchall link you can use to see if your card is targeted which you can just run each of your cards through – personally I think this is easiest vs the Individual links I also Included down below. You can access that catchall link here.

There are also specific links which you can access here.

Neither my IHG nor my Hyatt card was targeted – did you score anything?

Overall

I think this could be a great deal depending on which offer you got, and which cards you currently have. For instance…if you received 5x on dining and groceries on your IHG, but you also carry an Amex Gold…I wouldn’t pivot my spend. I’d rather earn 4x on Amex than 5x on IHG. Same goes if you’re working away on your 10x supermarkets for 6 months that you received with your Amex Platinum welcome offer.

With that said…I would have loved to have received a 5x on all purchases on my Hyatt card. I value those at 1.5 cents+ and have

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.