This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Freedom Flex® 2025 category bonuses

Q4 must be activated by 12/15/25

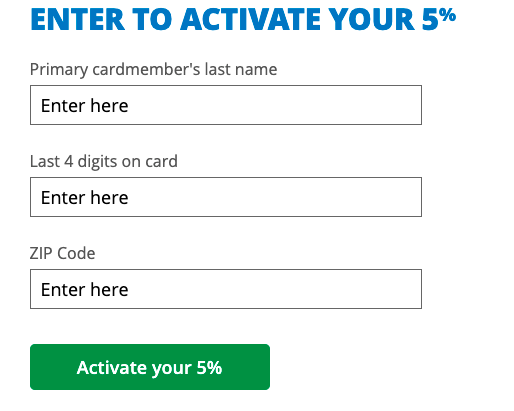

We love the Chase Freedom Flex® for this exact perk: rotating, quarterly 5x bonus categories. Activate here

What does that mean?

It means that every 3 months Chase Freedom Flex® releases a new list of bonus categories that earn 5x throughout the quarter. It’s an incredible way to multiply the number points you make on purchases, or strategize for the future. Here are the upcoming Q1 2026 categories

-

- Norwegian Cruise Line, Dining, and American Heart Association

- Dining will be normal 3x + 4x bonus

I would definitely consider getting a Chase Freedom Flex® in order to enjoy the native category bonuses the card offers in addition to these quarterly, rotating category bonuses.

What are the new Chase Freedom Flex® 5x rotating, quarterly categories?

Q4 is running until the end of Sept. You needed to activate by Dec 15th in order to receive 5% or 5x on all of the purchases made in the bonus categories for that quarter.

- You must activate by 12/15/25

- The spending is capped at $1500

- This means that your earning potential is maxed at out 7500 points or $75 cashback

- You must activate this perk each quarter, starting the 15th of the month prior ( September ), up until the 14th of the last quarterly month ( December ).

- If you have a Chase Freedom Flex®, you’ll get $1500 per card.

What have the past Chase Freedom Flex® bonus catagories?

Just so you have an idea, here’s a look at what we’ve seen incentivized in the past.

2025

Here’s a look at 2024

Heres’s a look at 2023:

Here’s a look at 2022

Here’s a look at the 2021 calendar

And the 2020 categories

When Do the new bonus Categories start? The 1st of every quarter

You’ll need to register for these bonus categories by March 14th, 2023. As long as you register by that date, all of the purchases made in these categories will earn 5%/5x points.

Where Do I go to Register? Click here – available starting 12/15/23

How we use Chase Freedom Flex® to get closer to lie-flat seats and 5 star suites.

If you’re like me and carry a Chase Premium credit card like the Chas Sapphire Preferred®, Chase Sapphire Reserve®, or Chase Ink Business Preferred® then you can combine your Chase Freedom Flex® points into those accounts in order to transfer them into valuable partners.

This is by far the most advantageous usage of Ultimate Rewards, but also increases the value when redeemed in the Chase Travel center. For instance, if you move them into a Chase Sapphire Reserve® account, your points will instantly be redeemable for 1.5 cents per point, a 50% increase over redeeming them in the Freedom Chase Travel Center.

Don’t have a Chase premium card?

You should definitely check out our thoughts and the latest offers on:

Combining a Chase Premium card like those above will help you optimize your spend and value of the points you’re earning.

One of the coolest ways to use Chase Ultimate rewards? Emirates First Class. Immerse yourself in the full experience in our YouTube video below!

Take a look at our Best Uses of Chase Points

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.