This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase quietly added Emirates as a transfer partner over the weekend. While this may not be a game changer, and doesn’t fill the hole that Korean left in their transfer partner list, it definitely adds value. The biggest downside to Emirates are the fees they tack on to award tickets which can be as much as $800 one way, which is absolutely ridiculous, but they also have some cool routes that you may not know about. Let’s take a look at Chase’s new transfer partner Emirates, also a transfer partner of Amex and Capital One, and how you could fly them on routes outside of Dubai.

Chase’s new transfer partner: Emirates

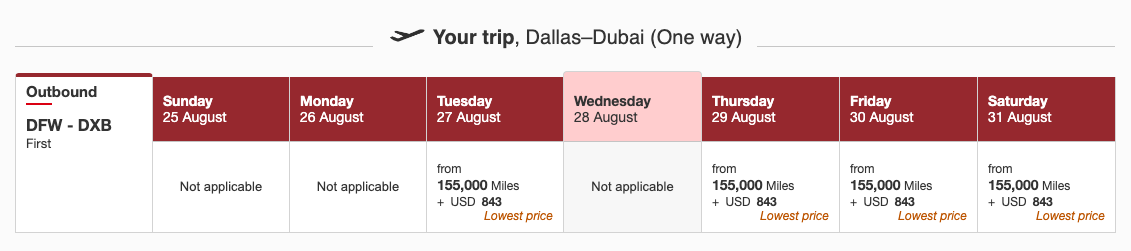

The biggest drawback of Emirates are the taxes and fees they assess on award tickets

155k miles AND over $800 in fees. It’s pricey, but it’s also featured the new First Class suite…so many have splurged to fly it for so long. I have not…yet 😉

Where can you fly Emirates with reduced fees?

Here are 3 places that can heavily reduce your fees..

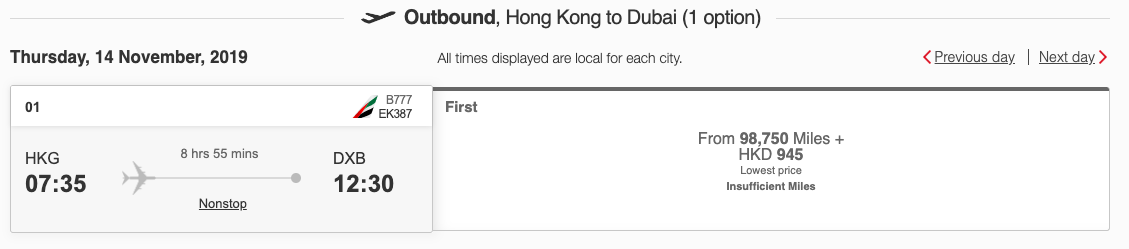

Hong Kong:

Even flying into Dubai will cut your fees down to just $140 ( which is pretty dang low for Emirates )

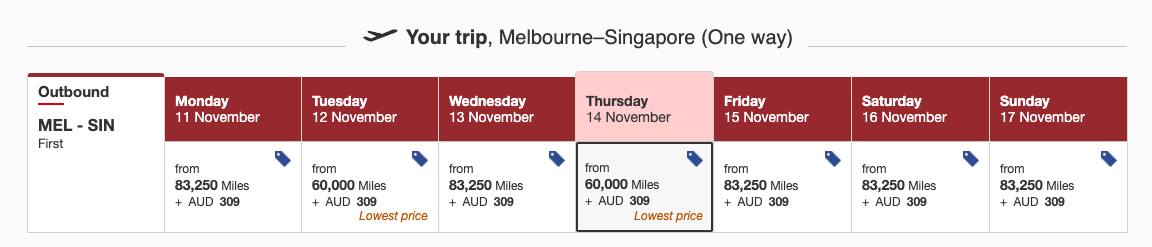

Australia

309 Aussie Dollars is roughly 200 US dollars. A very good deal, and a Melbourne to Singapore is a great way to take advantage of Emirates Fifth Freedom routing

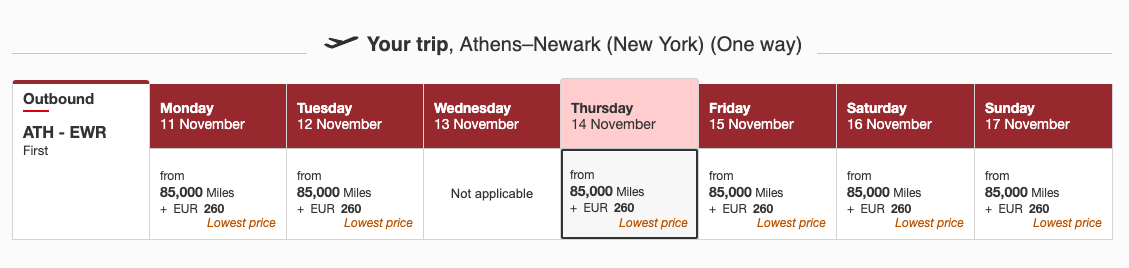

Athens:

You’ll pay hefty fees to fly from Newark to Athens, but on the way back, you’ll score it for loads less in fees. Also 5th Freedom

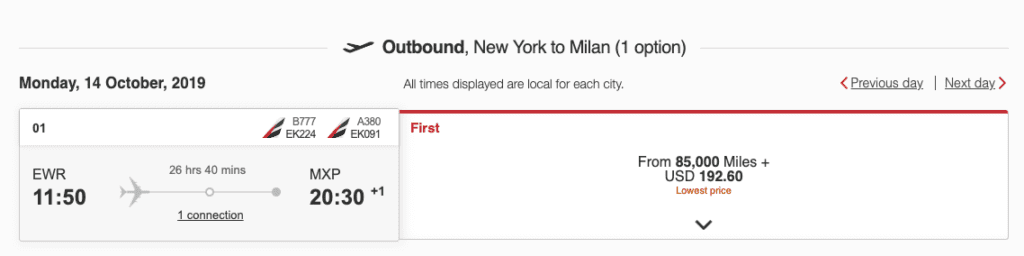

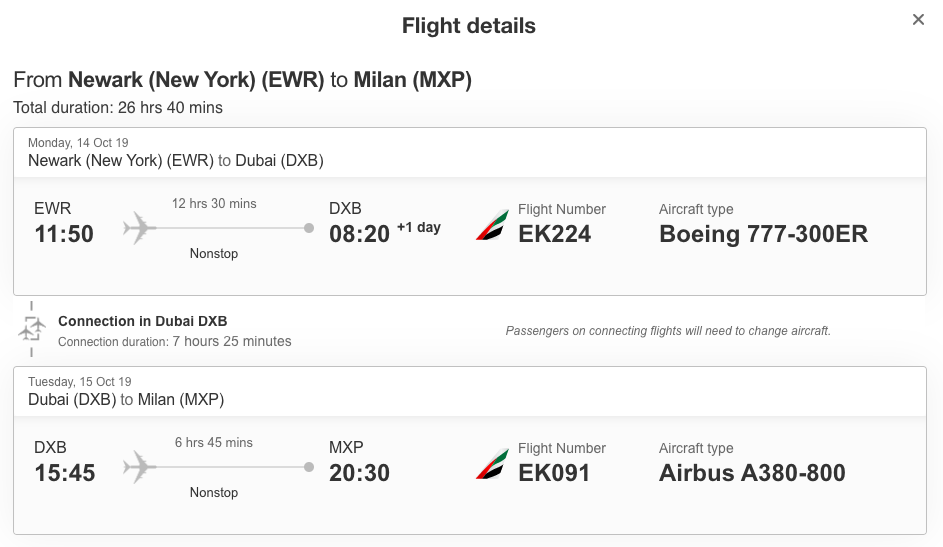

PointMetothePlane noted a great deal if you can get it to price out as well. It’s very hit or miss for me, but doesn’t work, but requires quite a bit of travel, which if you’re like me, AMAZING, if you’re a normal human being…it may be too long. That’s NYC to Milan, but routing via Dubai…sometimes this prices out under $200 in taxes and fees

List of most of their Fifth Freedom Routes, or where you can fly Emirates and not go to Dubai

If you’re unfamiliar with a Fifth Freedom Routing, it’s where you can fly an airline between two destinations outside of the airline’s home country. Now, not all fifth freedom routes can be booked on their own, for instance, Qantas operates a fifth freedom route between JFK and LAX, but you must book that flight to originate from, or continue on to, Australia. Most of the flights listed below, if not all, can be booked on their own, however.

All of the routes listed below are part of larger itineraries that connect them to Dubai, Emirates home city in the UAE. For instance, MEX to BCN, continues on BCN to DXB, if it didn’t, it would be considered a 7th freedom routing, solely operating between two countries without continuing service to the home country of the airline.

- MEX to BCN

- EWR to ATH

- JFK to MXP

- SCL to EZE

- GIG to EZE

- BKK to HKG

- BKK to PNH

- BKK to SYD

- DPS to AKL

- MEL to SIN

- BNE to SIN

- CMB to MLE

I have plans to take advantage of, not only an Emirates fifth freedom routing, but also one with lower fees, later this year: Athens to Newark. I’m hoping to fly it back from a trip I have scheduled in November. Over 11 hours of first class for 85k points and under $300 in taxes and fees.

Keep an eye out for routes that offer their newest First Class, aboard the 777-300ERs…it is arguably the best way for a single traveler to fly.

You can help us earn points and miles by using our Refer a Friend links. We appreciate it!

| Chase Sapphire Preferred | 100k after $4k spend 5x Chase Travel 3x dining + select streaming 3x groceries |

|---|---|---|

| Chase Ink Business Preferred | 100k after $15k spend 3x Travel/Internet/Cable Free Cell phone insurance $95 Annual Fee |

| Chase Freedom Flex | $200 after $500 spend 5x rotating categories No Annual Fee |

| Chase Ink Business Unlimited | Earn $750 after $7500 spend in 3 months. Earn 1.5x on every purchase |

| Chase Freedom Unlimited | Earn $200 after $500 spend in 3 months |

*feature image courtesy of Emirates

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.