This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

ICYMI, Chase announced that Expedia will power Chase Travel. That’s fantastic news for various reasons, but there’s two that really stick out to me. The first is very obvious. The labor of having to go through a portal to find rates, etc is annoying. Once Expedia is fulling integrated into Chase, I won’t have to go to Chase to know the rates the rate I can get. I can go to Expedia to search, and if I like what I’m seeing, I can go to Chase to book.

The second is less obvious, but if you’ve searched for any flights past the 270 day mark, you’ve experienced the same frustrations as I, and those will soon be alleviated.

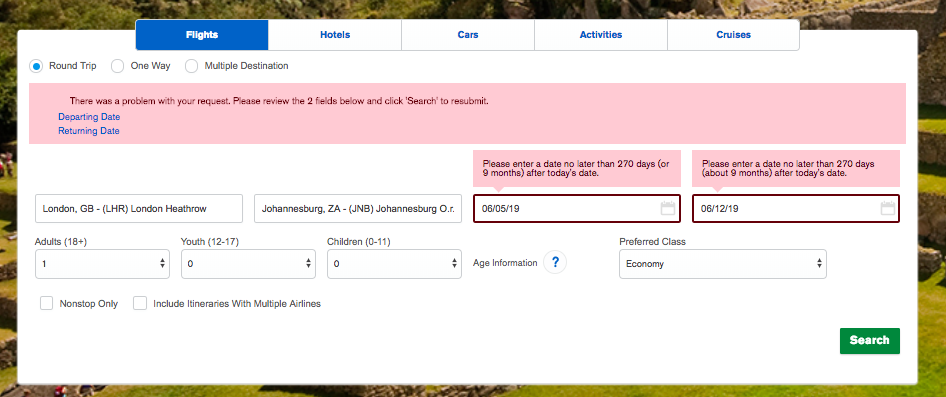

Currently, Chase Travel is powered by Expedia for Freedom cardmembers only. However, if you log into Chase Travel with any card other than the Freedom card, you’ll be accessing Chase Travel powered by Connexions. Not only is the pricing different ,but if you try and search anything further out that 9 months you’ll see this:

Clearly blocking any searches more than 270 days. What an annoyance.

If you want prices after 270 you can get them, but you have to phone in and a rep can facilitate the search, but it’s a real pain as they have to manually search everything.

Not only is this laborious, but as I mentioned above, there is discrepancy between the pricing your Freedom card prices vs any other Chase card.

For instance, Expedia, and thus Freedom, is pricing the current Swiss fare sale the same as the Swiss site ( nearly half off first and business class ticket ex LHR), but Connexions, and therefore Chase Travel logged into with any other card is not. So not only are the flights more expensive, your Ultimate Rewards are worth only 1 penny vs say 1.5 with the Reserve.

That’s a huge disadvantage to Chase’s most premium cardholder.

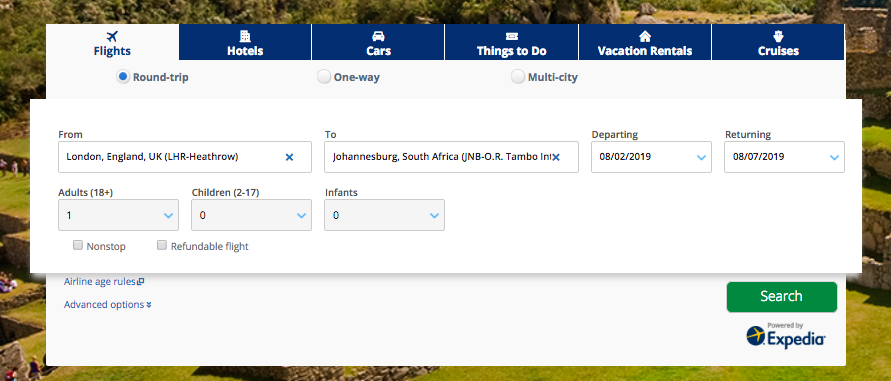

Here’s a look at Chase Travel via Freedom – no problem searching past 270 days.

Personally, I’m excited for Expedia to power all Chase Travel products.

Currently there isn’t any set date as to when this will be finalized, except that it should be done “shortly.”

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.