This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

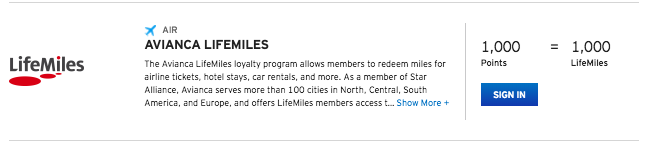

Citi has a list of transfer partners geared for savvier enthusiasts.

This is just my opinion, but I think Thank You points are quite valuable, but they are often under used and overlooked because their use isn’t geared for the casual points user. There’s no United or Delta, but rather Etihad, Singapore, and now Avianca. These programs have tremendous value, but they require a dive further down the rabbit hole than most are comfortable doing. Avianca is a great addition to this flexible points program especially if you’re interested in flying international premium flights, and short haul domestic flights ( which you can now snatch up for just 7500 miles) BYAH!

The Full list of Citi Thank You transfer partners.

Lifemiles can be used to fly on Lufthansa First Class – this is one of the programs sweet spots.

Awards can be searched online: here

- 87k Lifemiles to fly Lufthansa First from North America to Europe.

- This puts a one way ticket in Lufthansa First Class at roughly $1305 + taxes.

- 105k to fly from Europe to South America.

- Lufthansa’s longest flight is from Frankfurt to Buenos Aires on the 747-8i Pictured Below. The 747-8i is truly a fantastic experience that I had the pleasure of flying last year from Frankfurt to LA.

What’s your favorite use of Thank You points?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.