This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

GUYS! GUYS! I like Etihad. I actually love Etihad – oh no here we go again. Well, you can get a 25% bonus when you transfer from Citi Thank You.

If you haven’t read my ‘7 reasons Etihad 787 business studio is the best $7 I’ve ever spent’ then you need to…because it was an amazing experience for less than the cost of a sandwich.

Anyhoo.. A lot of hotels and specifically Citi Thank You are offering a 25% transfer bonus to Etihad until July 31st.

- Etihad has an outstanding product on their own, but it’s the partners that provide unique opportunities for extremely low premium cabin award space.

Let’s look at 2 that provide great opportunities for Premium Class redemption

American Airlines

Miles loved the American Business Class on the 777-300ER

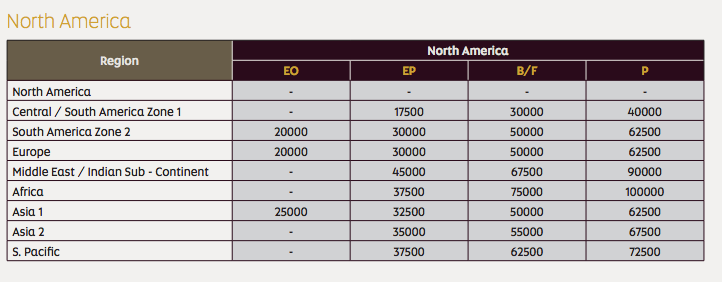

- US-Europe and South America one way

- Business 50k (38.5k with discount)

- First Class 62.5k (48k with discount)

- I recently wrote an article about the volume of space open to South America…this would make those flights significantly cheaper

A lot of people complain that Citi has a cobranded card with American, but hasn’t established AA as a Thank You transfer partner.

This transfer bonus essentially allows that transfer and also at a discount. As you can see above, you can use 38.5k TY for a one-way biz award that would cost you 57.5k with American. That’s over 30% off. It’s only 48K for first class vs 85k with American. An almost 50% discount!

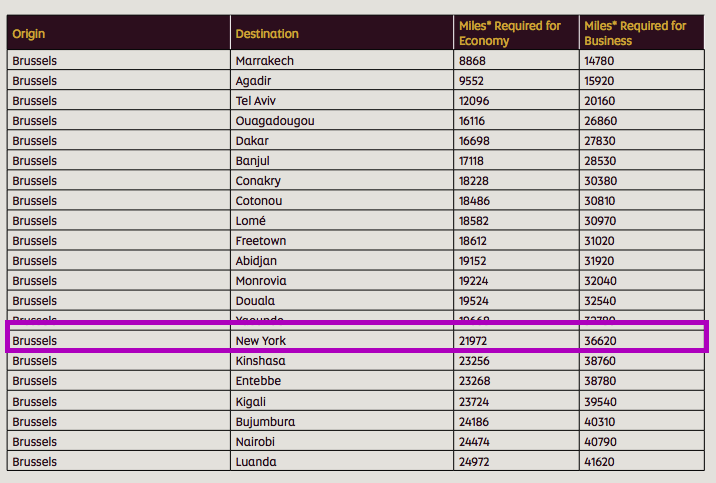

Roundtrip on Brussels airlines

- NYC-Brussels roundtrip

Business class 36620 (29k with discount)

Clearly there is a lot of news surrounding Brussels lately and I’m not commenting or advising travel one way or another. But the option to redeem at a HUGE discount on a lie flat product is there if you wish for it.

Final Word

I’m a big fan of the Citi Thank You reward program. I’d currently rank it 4th among the flexible transfer programs: Starwood, Chase UR, and Amex MR ( in no specific order). Transfer bonuses like this exemplify the reasoning behind holding your points in the flexible currencies until you need to redeem. I wouldn’t advise speculatively transferring points to Etihad and if you see availability on Etihad or a partner, make sure you call in to double check availability. Often times space is available to American Aadvantage members but not to them, so don’t transfer points without having an itinerary you want and Etihad can, in fact, book it.

H/T The Points Guy

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.