We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Who doesn’t love a transfer bonus?! We keep a dedicated page to transfer bonuses that you can peruse, but the latest is a 15% transfer bonus from Citi Thank You to Cathay Pacific Asia Miles. Until July 22nd, you will enjoy a 15% bonus when transferring your hard earned Citi Thank You points to Cathay Pacific’s loyalty program: Asia Miles. Unfamiliar with Asia Miles? Let’s take a look…

The Transfer bonus:

Asia Miles has a lot of value – don’t discount it.

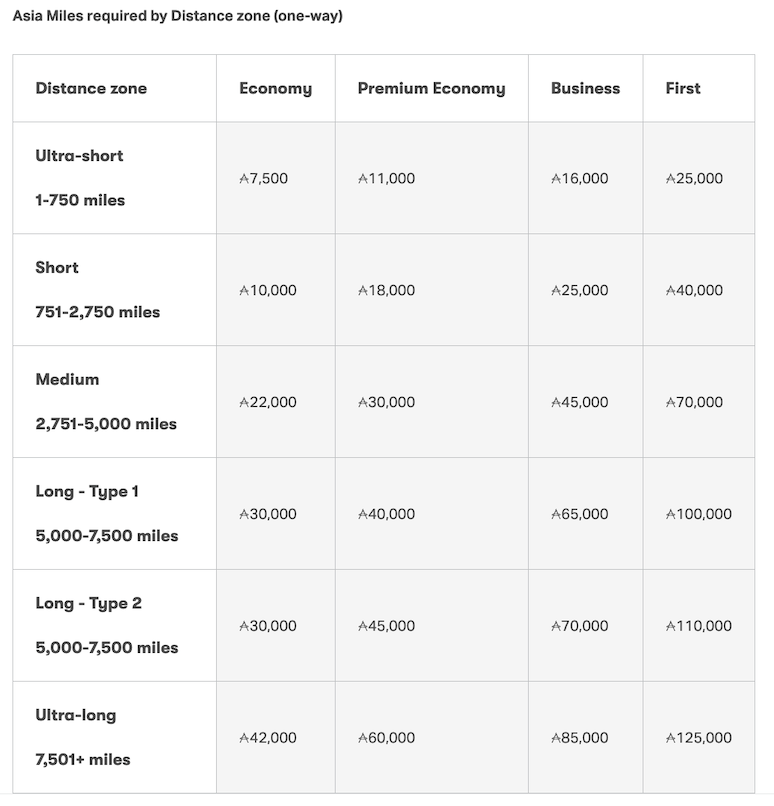

Asia Miles is a transfer partner of not only Citi, but also Capital One, Amex, and Bilt Rewards. You can also access more award inventory utilizing Asia Miles vs a partner since they do release more award tickets to their own loyalists than partners. I have the A350 highlighted, which is currently flying to to multiple US cities. You could do east coast to Hong Kong for 70k Asia Miles…or 61k Citi Thank You points.

I’d highly recommend flying their A350 from San Fran to Hong Kong if you get a chance. Awesome product.

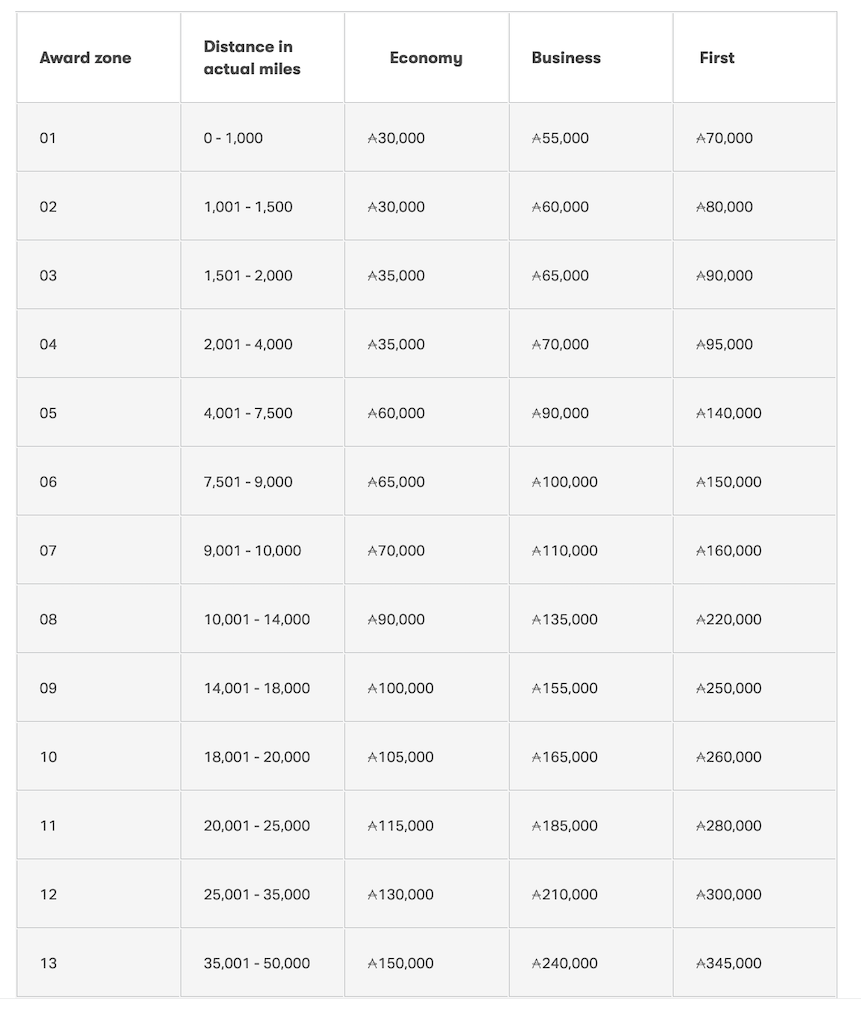

The Asia Miles sweet spot: The One World multi partner award chart

You need 2 airlines that aren’t Cathay to qualify, or 2 plus Cathay. If you can fly on two carriers to South America for instance…if you flew from Seattle to Dallas on Alaska, then Dallas to Buenos Aires and back, you could do that for 135k Asia miles in business class. Or… about 118k miles with this bonus

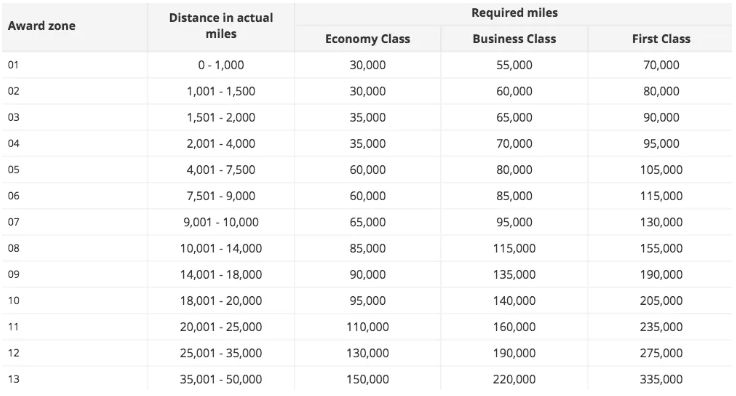

Here is an old chart from years back…not too much deval here

The long/short of it.

Programs like Asia Miles are often overlooked, but if you have a bit of time to investigate, you’ll find there is a lot of value especially when combined with transfer bonuses like these.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.