This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Super Quick head’s up to all of you honeymooning, uber luxury hunting, gimme a villa in French Polynesia or death crowd – the Conrad Hilton Bora Bora has very good, and highly unusual award availability from January through March of 2024. One thing to keep in mind, almost all of the rooms do not have a view of the mountain, which may or may not be a big deal, but worth noting, and only some are overwater. Hattip to Loyalty Lobby for spotting this, let’s take a look!

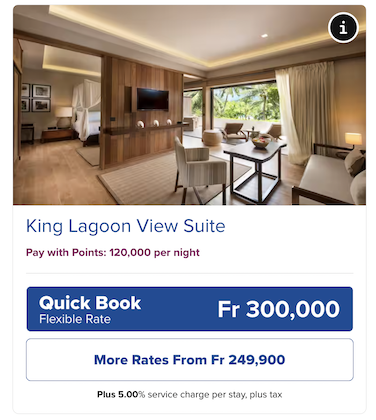

The Conrad Bora Bora base room isn’t over water

Most of the pictures you’ll see look like the resort is entirely over water…it’s not. The base room is a lagoon view suite which faces the lagoon but is on the island, a part of a building, and not overwater. These now start at 120k points per night or about $1250 per night.

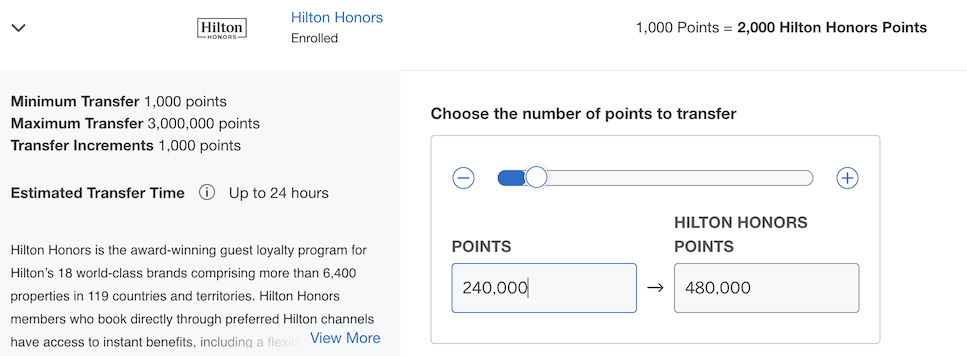

5 nights would cost you 480k points…

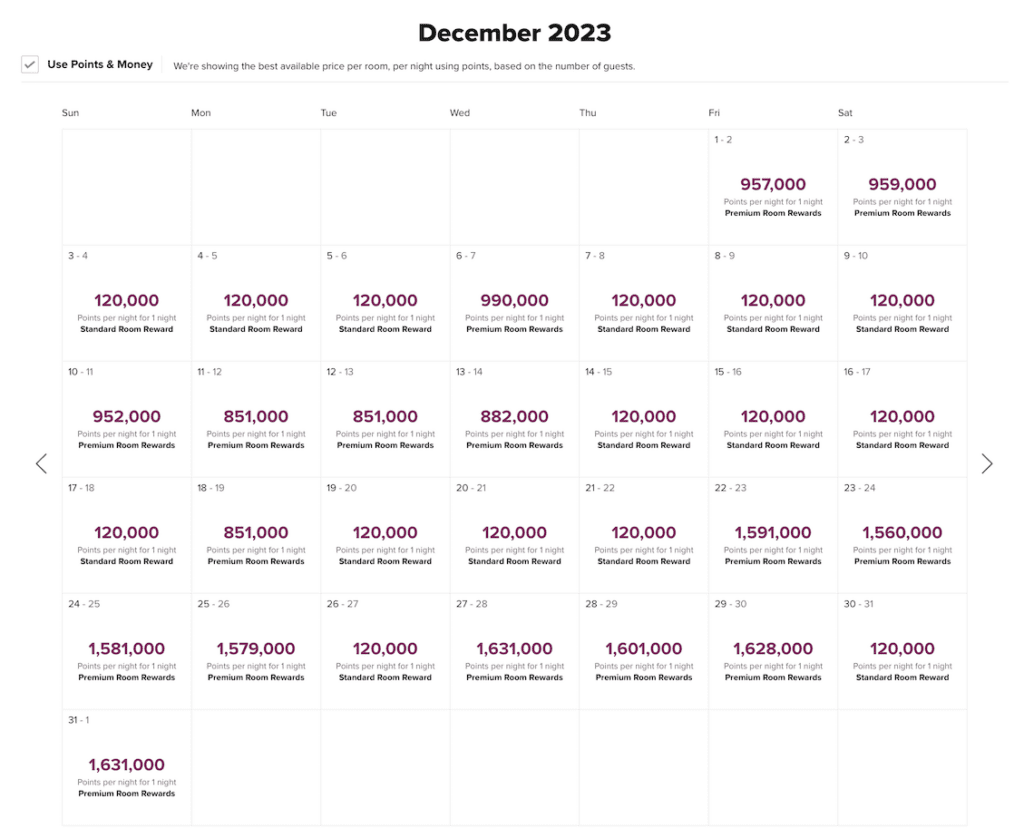

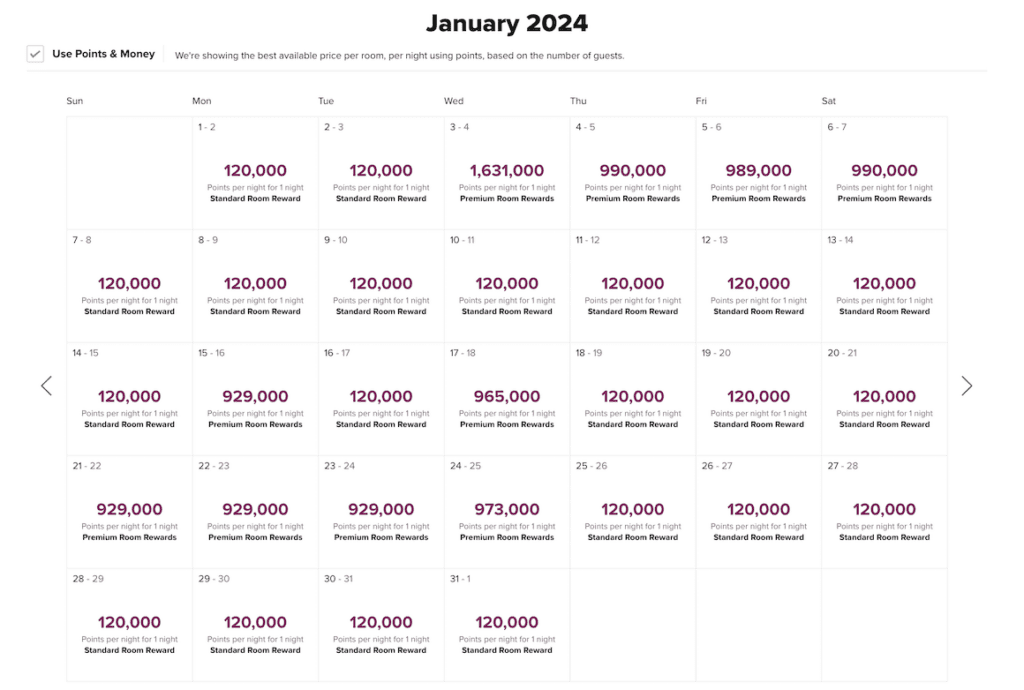

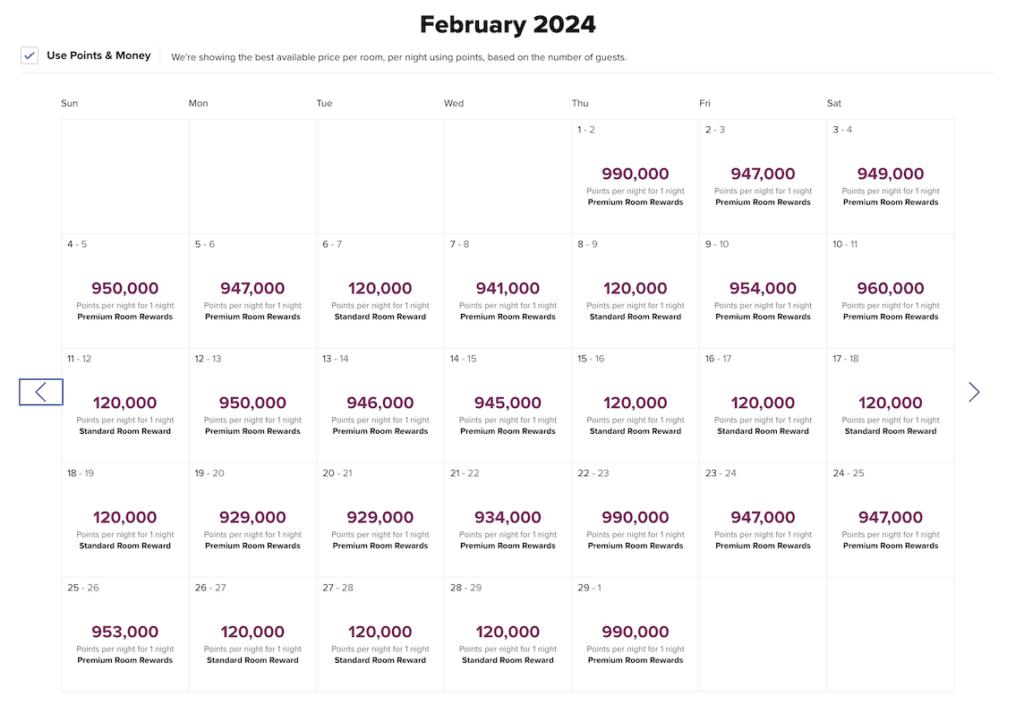

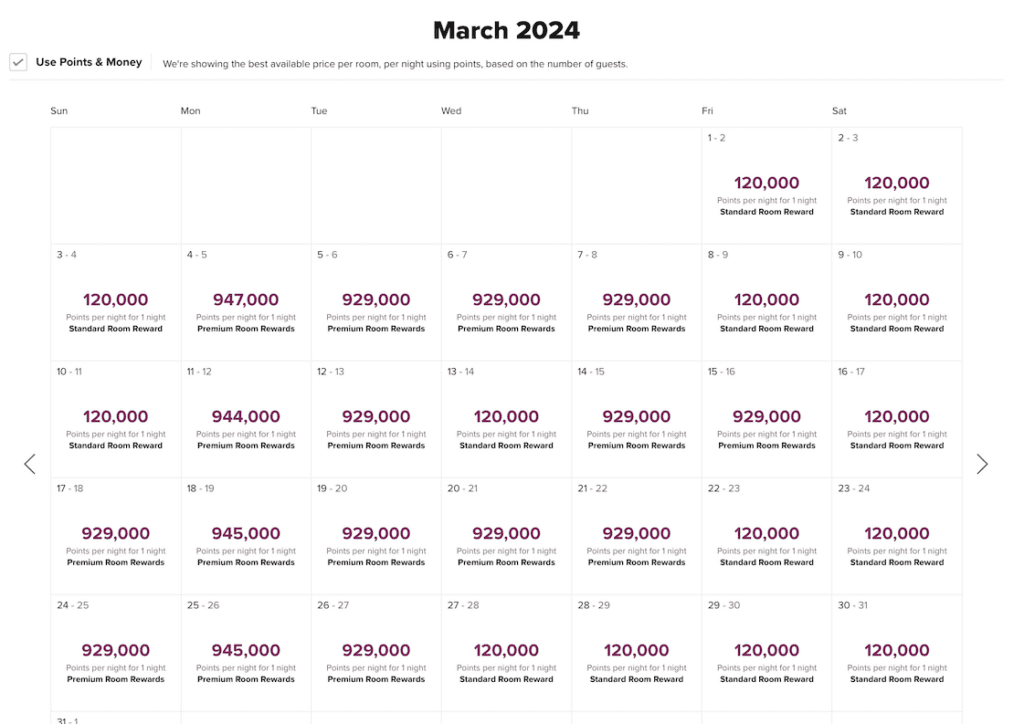

Conrad Bora Bora Award Availability using Hilton Points

Here is a look at several months of space. The very best being in January

How do I find award space at a Hilton Property?

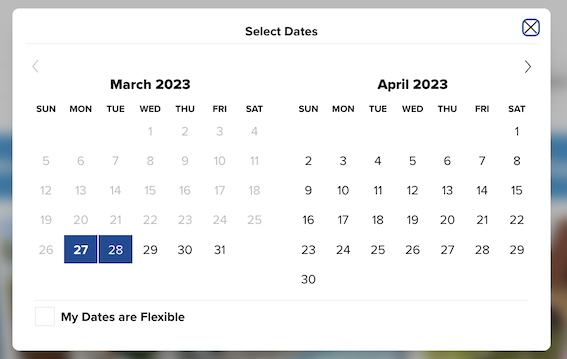

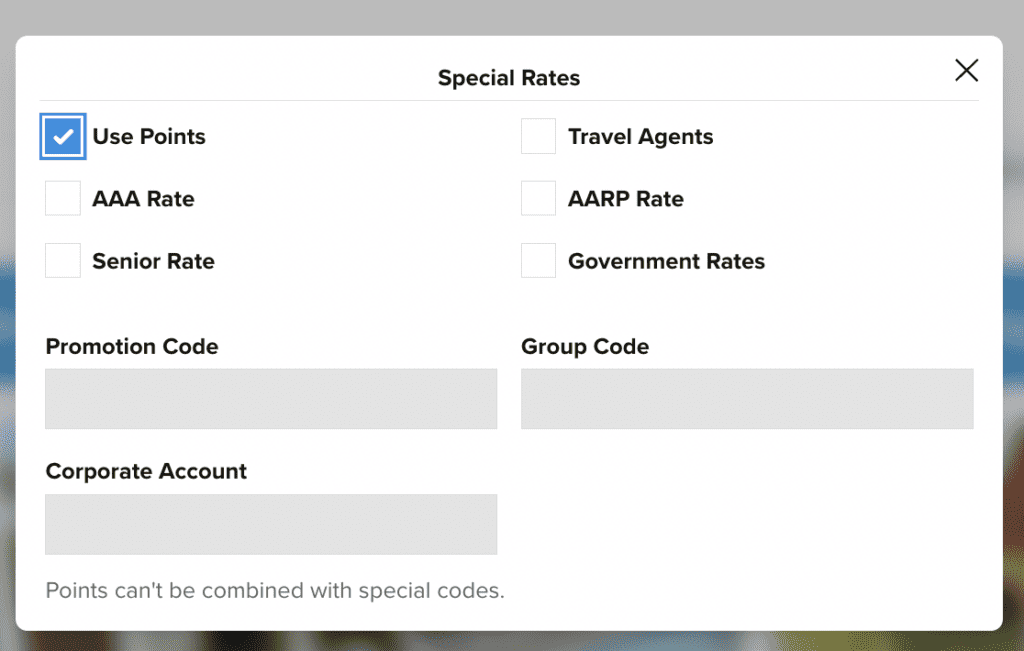

When you enter your location information select these two options: Flexible dates and Use points… this will populate the calendar you see above

Zach, I don’t have any Hilton Points

- You can transfer Amex to Hilton ( although it’s typically not a great deal )

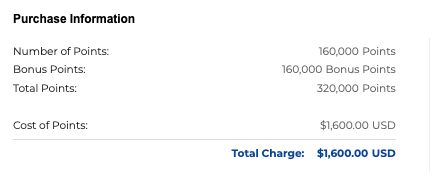

- You can buy them

Transfer Amex to Hilton 1 to 2 ( sometimes there is a bonus that is 1 to 3 )

You can read this article on how to buy them, but as long as you have Hilton Silver status…you get a 5th night free. Currently, Hilton isn’t offering a promo, but when they do, you can expect to buy them for 1/2 a penny

The Amex Hilton Aspire

Hand’s down the best hotel credit card in the market comes with an annual night free each year. You could use it here for a 120k redemption at $1250 value. That’s amazing, as well as the fact that it comes with a $250 hilton resort credit…which you could also use here. This could equate to 6 nights for 480k Hilton Points + $250 credit. Not too shabby

Overall

I’m seriously thinking about this as a fun January trip to Bora Bora…now I just need to find award space for flights!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.