This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

What if you don’t have any credit cards?

Today’s post is in response to an Email I received today from a reader located in Colombia. It’s a great question and I thought I would actually answer the email as a post because I think it could be valuable to a lot of people. I will disclose that I’m not an expert on Colombian credit cards or even the ways that Colombian banks issue cards so I will answer the email as best I can and relate it to the USA. The title of the email is “What if you don’t have any credit cards?”

Here is the body of the email

Hey you! I’m from Colombia and I’m very interested in learning how to travel cheaper. I really haven’t started reading your tips properly but for what I’ve seen credit cards are a big part of it. I don’t have any. I don’t like to be in debt so I got used to just spend what I own (I’m good at saving money). Anyway, when I have to buy tickets I just look for someone with a credit card to do the purchase for me and I pay them right away. Is there a way to get the most of it giving my situation?

3 things I love about your email

- Love that you’re looking for ways to travel cheaper

- You’re right, a lot of my tips relate in some way to credit cards

- Love that you are financially responsible and don’t want to go in debt

But I want to say: Credit Cards aren’t bad, but how you use them could be.

If you have a penchant to spend more than you make, then perhaps this isn’t the right sort of thing for you. However, if you’re responsible like this reader…there isn’t a reason not to get a credit card.

Credit cards are a big way to earn miles, but they don’t mean you have to go into debt. In fact, you shouldn’t ever carry a balance.

Just because a bank will give you a large credit line doesn’t mean you should go out and use it. In fact, you should only spend what you can afford to pay off every single month. A credit card should merely be a different instrument to pay your bills with, not an excuse to live beyond your means. When you do this, you won’t be paying any fees and wouldn’t be in debt to anyone. You could be using your every day purchases to earn points to send you on your next trip!

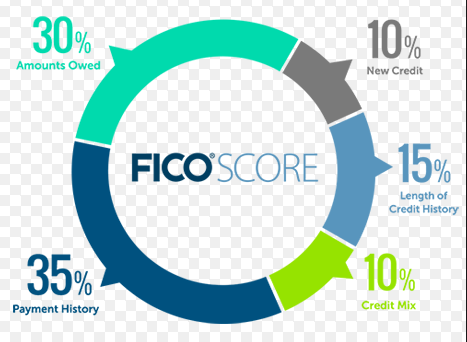

Here in the States your credit score is actually shaped by several factors, and your length of credit history counts for 15% of your score. As you can see in the chart below

The longer you’ve shown yourself a reliable person, the higher your score will be.

At some point you will want to buy a house, lease a car, buy a car, etc, etc. You will need to have a credit history to get the best rates, and credit cards are the perfect way to do this.

My advice to my reader and anyone who asks me, “What do I do if I don’t have any credit cards?” Get one!

Don’t go crazy, but get a card that earns you flexible points and will create a relationship with a bank that has other great products. This way, if you start feeling more comfortable and haven’t built up any debt, you will be in a good position to get another credit card with that bank that offers attractive benefits. It will also position you well when it comes time to take a loan out for something in the future. If you have a proven track record with that bank, it can help you get approved down the road.

The three cards I would recommend:

- American Express Everyday/Everyday Preferred

- Chase Sapphire Preferred

- Citi Thank You Premier

Any of those three cards will give you access to the 3 best transferrable point programs out there.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.