This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

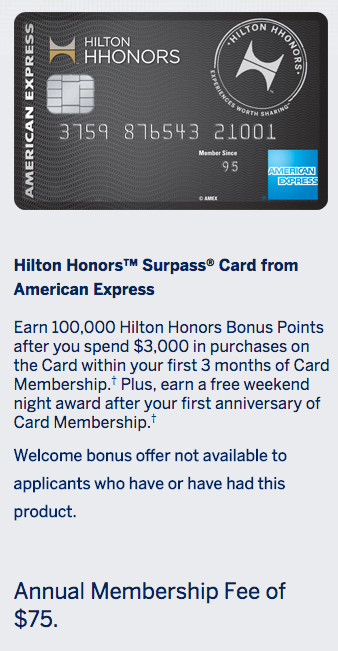

Don’t Forget: BEST EVER Amex Hilton Surpass 100k + Free night ends May 31st. 25k referral bonus too.

An Amex Hilton Surpass 10ok offer lured me into the card last year and I locked down the best ever sign up bonus for the card. I was very happy. WELL, times have changed, and Amex is offering an even better bonus: 100k bonus points + a Free night after your first cardmember anniversary. That’s right, you will earn 100k Hilton Honors points after you spend $3k in 3 months and then a free weekend night after your cardmember 1st year. Let’s take a look at the deal and also where you could spend these points. Oh…and if you already have the card – add your referrals to the bottom of this post and earn 25k per approved applicant.

Amex Hilton Surpass 100k + Free night The annual fee on the card is $75 and as someone who just paid to keep the card for another year…it’s a no brainer. You’re getting a ton of points and for keeping the card a 2nd year you’ll get a free weekend night to use anywhere in the world.

The annual fee on the card is $75 and as someone who just paid to keep the card for another year…it’s a no brainer. You’re getting a ton of points and for keeping the card a 2nd year you’ll get a free weekend night to use anywhere in the world.

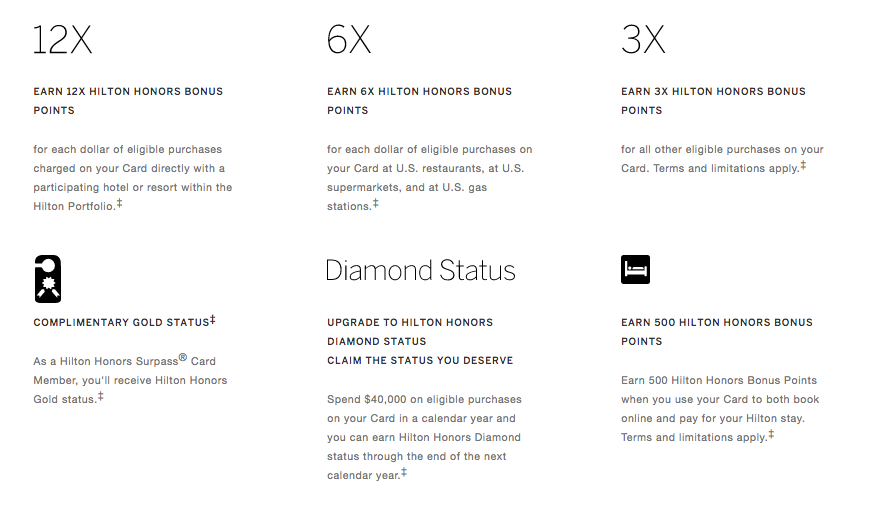

My favorite card benefits…

- 12x at hilton properties

- 6x at grocery stores

- Comped gold status

- after $40k spend – diamond status.

This card falls into the category of ones that I keep and pay the annual fee on, but rarely, if ever, use.

Why do I keep the card? Referral Bonuses. 25k for each referral right now.

I will gladly pay $75 to earn 80k points a year in referral bonuses. Even valuing Hilton points at half a cent means I’m earning $400 a year in referral bonuses. Team that with Gold status and you’ll be enjoying some nice digs when you vacay!

Where could we use these points and Free weekend night?

I just stayed at the Conrad Bali.

It was GORGEOUS and I would highly recommend it if you’re looking for a beach trip.

Or are you more into a city Jaunt? Use your points to stay in London at the Conrad London. We had a great stay there in 2015.

One place I loved visiting was Tokyo. We stayed at the Ritz, but would love to visit again and stay at the Conrad Tokyo. Looks amazing.

Feel free to leave your referrals in the comments section. If you end up booking a Hilton hotel we appreciate you using our affiliate link. Thank you!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.