This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

New windows were on the home renovation agenda.

Typically you either work directly with the manufacturer, a contractor, or through an authorized retailer. We took several bids and it ended up that Home Depot provided the most competitive price. It also prompted an idea about how some stacking could result in earning loads of Ultimate Rewards.

- As an aside: If you can save considerable money by paying cash then I wouldn’t advise earning points just to earn points

- Unless you have a target in mind – like a biz class ticket worth 1000s – and if there is premium to earning points then the redemption value surpasses the extra cost.

During the bid process I brought up payment of the new windows and intimated that we were interested in using Home Depot gift cards to pay the entire balance. Our sales consultant, Ken, checked with the general manager of the store and confirmed that this was no problem at all. That means that a waterfall of points were headed our way! BYAH BYAH BYAH

How using gift cards earned us 7x Ultimate Rewards on New Windows.

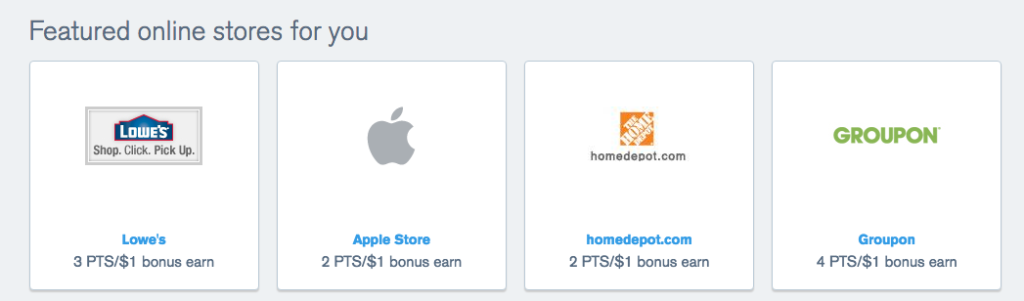

Broken down: I bought the Home Depot gift cards at Staples through the Ultimate Rewards mall with an Chase Ink Plus card. Confused? Let me walk you though the process.

The process was this simple:

- I know that an Chase Ink Plus card gives me 5x at all office supply stores…like Staples, Office Max, etc

- The Chase Ultimate Rewards mall will give me 2x at Staples when linked through their portal

- Staples sells gift cards for a plethora of stores: including….DRUM ROLL please: Home Depot

- By stacking

- 2x just for shopping through the mall

- 5x with the Ink Plus

- I ended up earning 7x points on my order.

- Much better than just paying with my Sapphire card and ultimately took about 30 mins of extra time

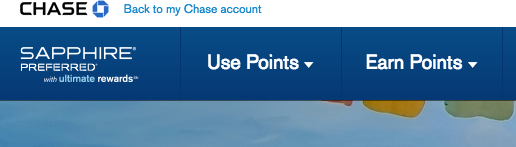

Step 1: Log in to The Chase Ultimate Rewards Mall

It’s amazing to me the number of people I talk to that have a Sapphire Card and are unfamiliar with the Chase Ultimate Rewards mall. It’s the single easiest way to earn loads and loads of points

-

Simple put

- The Chase Ultimate Rewards mall is an online mall that rewards buyers with multiple points per dollar spent at the retailer when linked through the portal

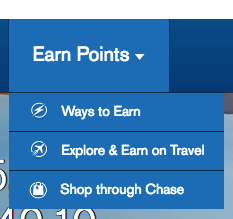

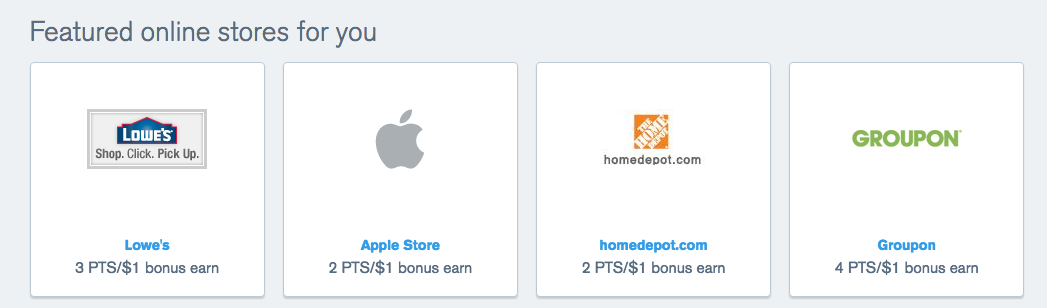

Step 2: Click on Earn : Shop through Chase

- You are now entering the Chase Ultimate Rewards mall.

- You’ll have the option to shop through a bevvy of retailers by clicking on their link.

- Once you do: the retailers own website will populate and

- Your order will be coded with the Ultimate Rewards bonus tag

* A must do – don’t let Chase log you out of your account before executing your order. If you do… You will not receive bonus points as the tether between the retailer and UR mall has been severed.

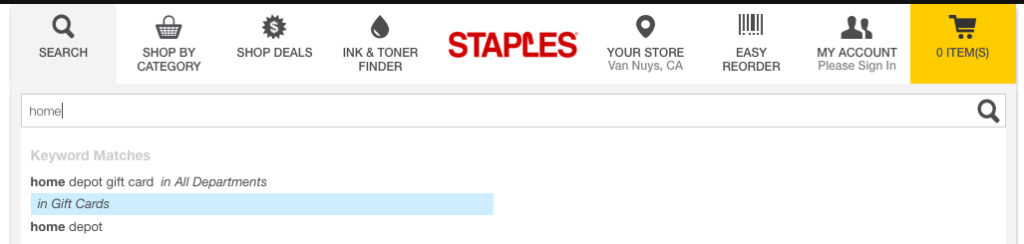

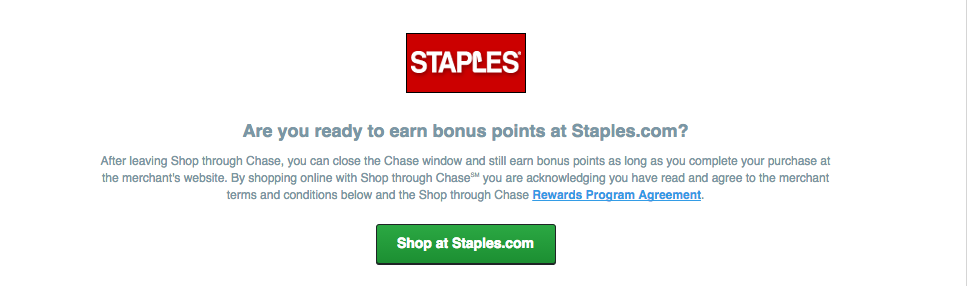

Step 3: Search for Staples

- Shoppers, don’t be fooled by purchasing direct from Home Depot…Although you would earn 2x points

- You want to select Staples instead

Click on through

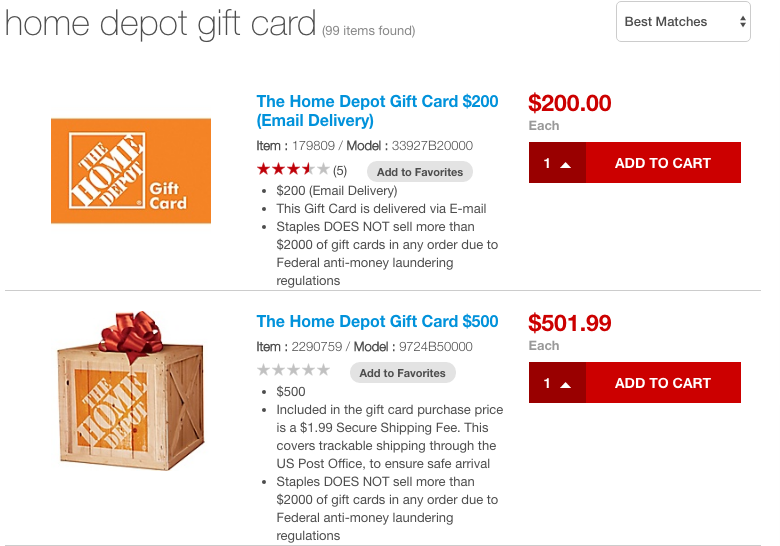

Step 4: Search on Staples.com for Home Depot Gift Cards

Step 5: Buy with your Chase Ink Plus to earn 5x points

Even though you have been linked to Staples from Chase Ultimate Rewards portal – the purchase is still coded from an office supply store. This is where the 5x points come into play. You will then earn an additional 2x points per order via the Ultimate Rewards mall! Amazing.

*Some of you may be wondering how I am putting this on a business card. Well, I’m not going to pay the charges for windows from my business bank account and instead will pay those charges from my personal. At the end of the year I’ll merely note to my accountant that those expenses were not associated with the business and should be exempt from any business related paperwork. I’m not a tax advisor and you should always check with your professional, but this has never created a problem in the past – so long as I make explicit note that the charges have been segregated and paid separately.

What are some of your stacking stories?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.