This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

If you hold a Chase Sapphire Reserve® credit card, you can register to get a 5k mile Aeroplan certificate. You could then apply this to a future mileage redemption. Supposedly the Chase Sapphire Reserve for Business® also qualifies ( I just registered mine ) so we will see if I get the deposit, but anecdotally it should work. Since my wife has a CSR this means we will both be able to book tickets and save 5k miles per ticket. That’s a great deal and helps offset the monster $795 annual fees.

Go here to register your card – must do so by August 18th and the cert expires 365 days after it deposits. No brainer to register.

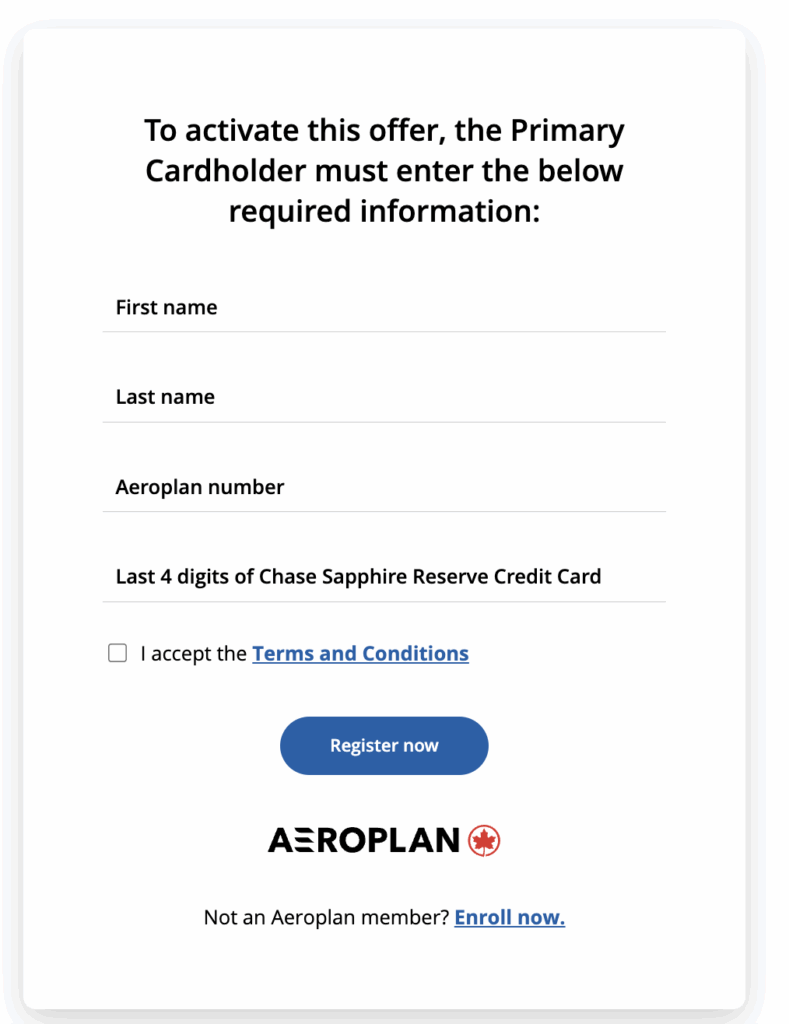

‡ To be eligible for this offer your Chase Sapphire Reserve Credit Card account must be open and not in default and your Aeroplan account must be in good standing at the time of registration and fulfillment. Only members who register between August 5th at 12:01:01 AM EST and 23:59:59 PM EST on August 18th are considered eligible for this offer. Register for the offer by entering your First Name, Last Name, Aeroplan Number, and the last 4 digits of your Chase Sapphire Reserve credit card and click “Register Now”. The offer is only available to the primary cardmember of the Chase Sapphire Reserve Credit Card account and only one 5,000-point flight reward certificate can be earned per Chase Sapphire Reserve Credit Card account. The First Name and Last Name of your Aeroplan account must match the First Name and Last Name of your Chase Sapphire Reserve Credit Card account. Flight reward certificates have no cash value and cannot be exchanged or refunded. For the purposes of this offer, the expiry date of the Flight reward certificate is 365 days after the day that the flight reward certificate is deposited into your Aeroplan account. The flight reward certificate can take up to 14 days to be deposited into your Aeroplan account from the time of registration. For the purposes of this offer, only one Flight Reward Certificate can be earned per Aeroplan account. Chase is not responsible for the provision of, or failure to provide, the stated offer.

A flight reward certificate reduces the base fare in points of a single Aeroplan flight reward ticket for one passenger by up to the specified points value. Flight reward certificates are valid towards a new booking only and are not valid on existing reservations. Bookings must be made directly with Aeroplan, via aircanada.com/aeroplan, the Air Canada Mobile App, or through the Aeroplan call center. Flight reward certificates apply to the base fare in points only. You are responsible for all incidental charges, including any taxes, partner booking fees and 3rd party charges which apply to the Aeroplan flight reward. One flight reward certificate is required per passenger on the reservation, and the value may not be split between multiple passengers.

If a member chooses to use a flight reward certificate for a flight reward worth more than the value of their flight reward certificate, the member will be required to pay the additional points required for the new single flight reward. The flight reward certificate cannot be combined with other flight reward discount certificates, including but not limited to Priority Reward vouchers or other points-based certificates. Flight reward certificates may not be transferred to another Aeroplan account but can be used to book a flight reward for a traveler other than the member. Taxes, government-imposed fees, and any applicable charges may apply on all Aeroplan points redemptions and upgrades, subject to the Aeroplan Program Terms and Conditions. Individual restrictions may apply.

Changes or cancellations are allowed according to the fare rules of the flight reward booked. If during a cancellation the flight reward certificate is to be reinstated in the member’s account and the member’s account is in good standing, the flight reward certificate will be re-deposited into the member’s account, and the original flight reward certificate expiry will apply. In the event of a change or cancellation, travelers are required to pay all applicable fees based on the fare type purchased for each ticket, plus the difference in points, if applicable, taxes, partner booking fees and 3rd party charges which also apply. A partially flown Aeroplan flight reward ticket where a flight reward certificate was used as a form of payment will cause the flight reward certificate to be considered used – in this instance, a change or cancellation will be permitted on the ticket itself, but the flight reward certificate will be considered fully used irrespective of any change between the points total of the ticket in the original reservation and the updated points total in the new reservation. In all scenarios, the points value which a flight reward certificate covered in the original reservation will be carried to the new reservation and no residual value, if applicable, will be applied or credited to the ticket or member’s account.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.