This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I was contacted by Emirates with the following statement on the devaluation mentioned in the post below. Devaluations are a bitter pill to swallow no matter how they are implemented, but it would have been much better to notify the loyalty base of the the planned devaluation instead of doing it randomly over the holidays in the middle of the night. With that said, it appears that earning on Emirates will increase the rate of return you will earn miles on some of their routes which is at least a bit of positive news.

“In line with current market conditions, Emirates Skywards is introducing an increase on Skywards Miles required for Upgrade Rewards and Classic Rewards booked in Business Class and First Class. The increase will be gradually introduced on reward tickets across the Emirates network between 22 December 2022 and 31 January 2023.

To reduce the impact of this change on our most loyal customers, we will be increasing the bonus Skywards Miles earning opportunities for all Platinum, Gold and Silver members travelling with Emirates.

On all Emirates flights booked from 31 January 2023 onwards, Skywards Platinum members will earn a further 100% of the Economy Flex+ Miles earned on a given route (increasing from 75%); Skywards Gold members will earn 75% of the Economy Flex+ Miles earned on a given route (increasing from 50%); and Skywards Silver Members will earn 30% of the Economy Flex+ Miles earned on a given route (increasing from 25%).

For more information on earning and spending Skywards Miles and to view the Miles calculator, please visit emirates.com/skywards.”

(Original post is below:)

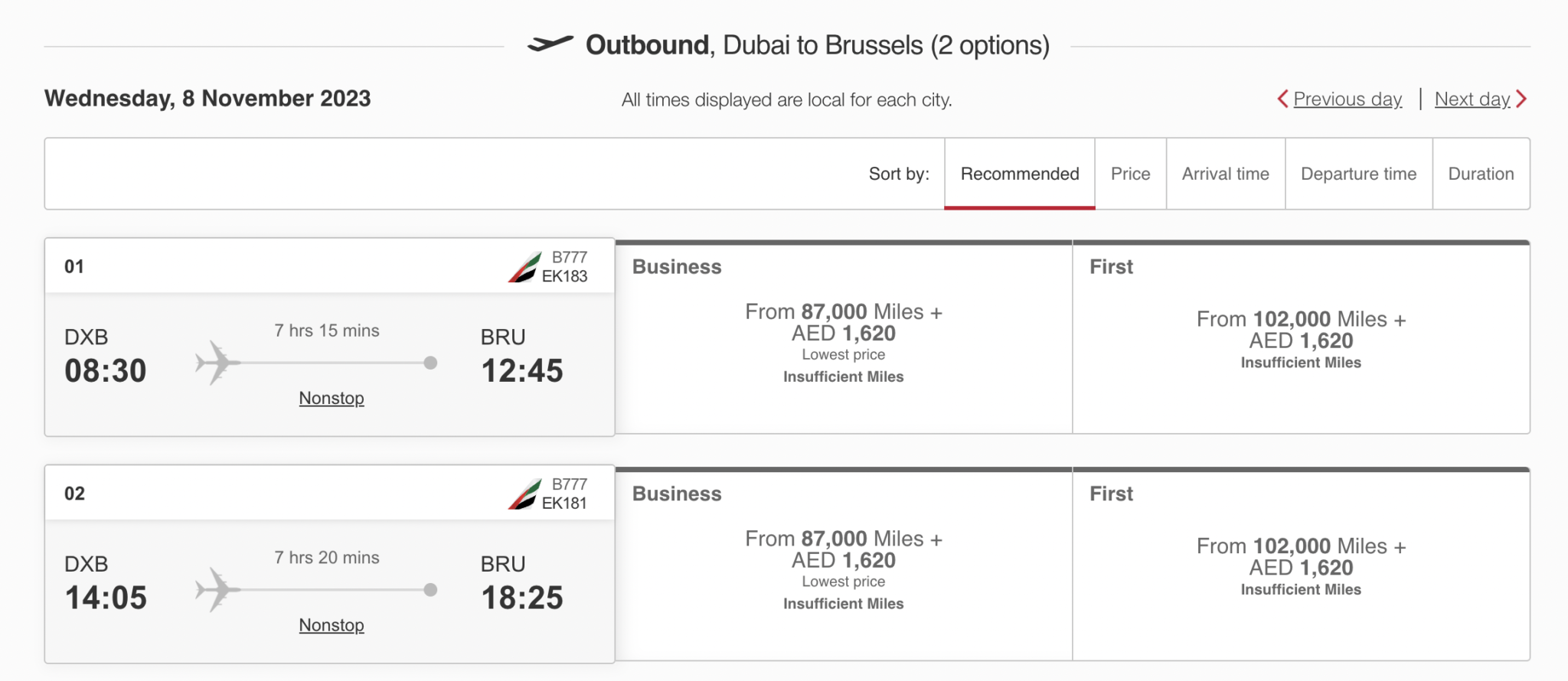

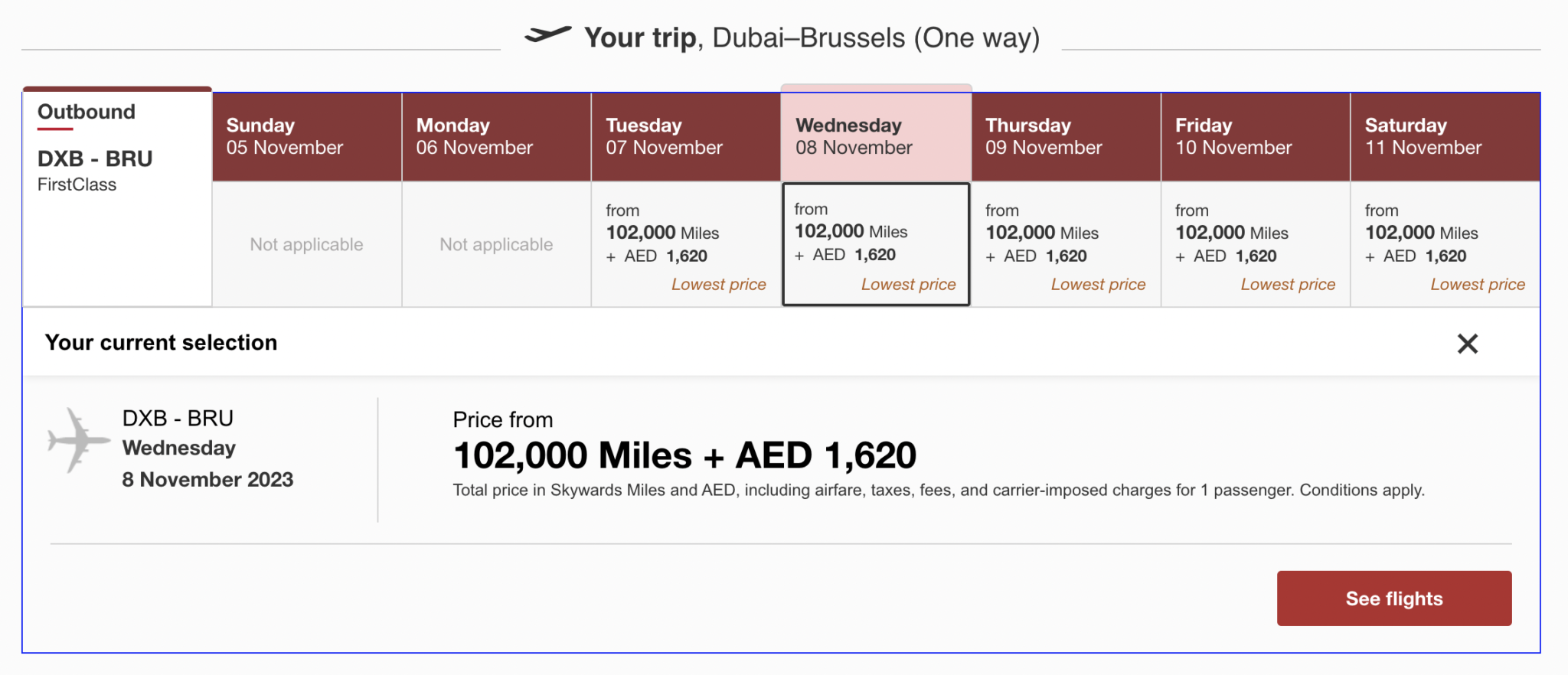

UGH! One of the best ways to fly Emirates first class, including their game changer, is now more expensive. I’ve been tracking flights pretty closely the past few days trying to get a ride in the game changer first class with my buddy and suddenly all of the first class seats are pricing at 102k whereas before they were 85k, and business has popped from 72.5k to 87k.

It looks like the new structure has increased most rates across the network by 20%

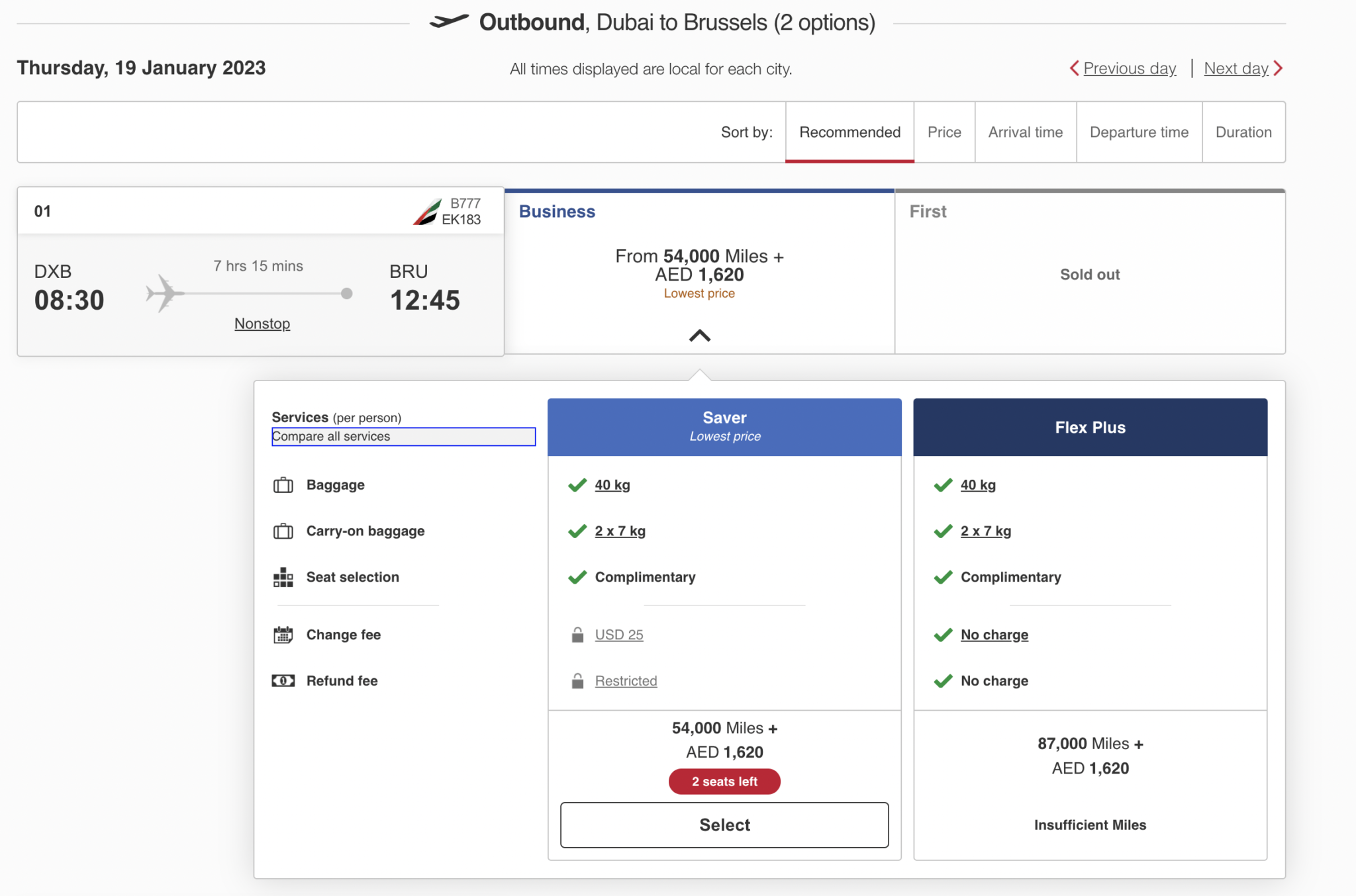

- Business Saver – 54k but needs to be booked roundtrip at 108k

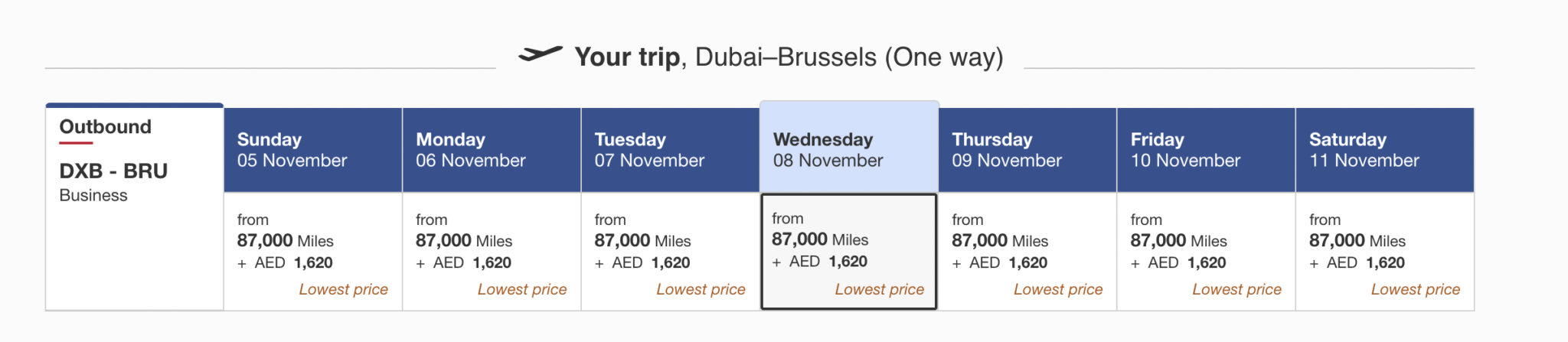

- Business Flex – 87k now up from 72.5k

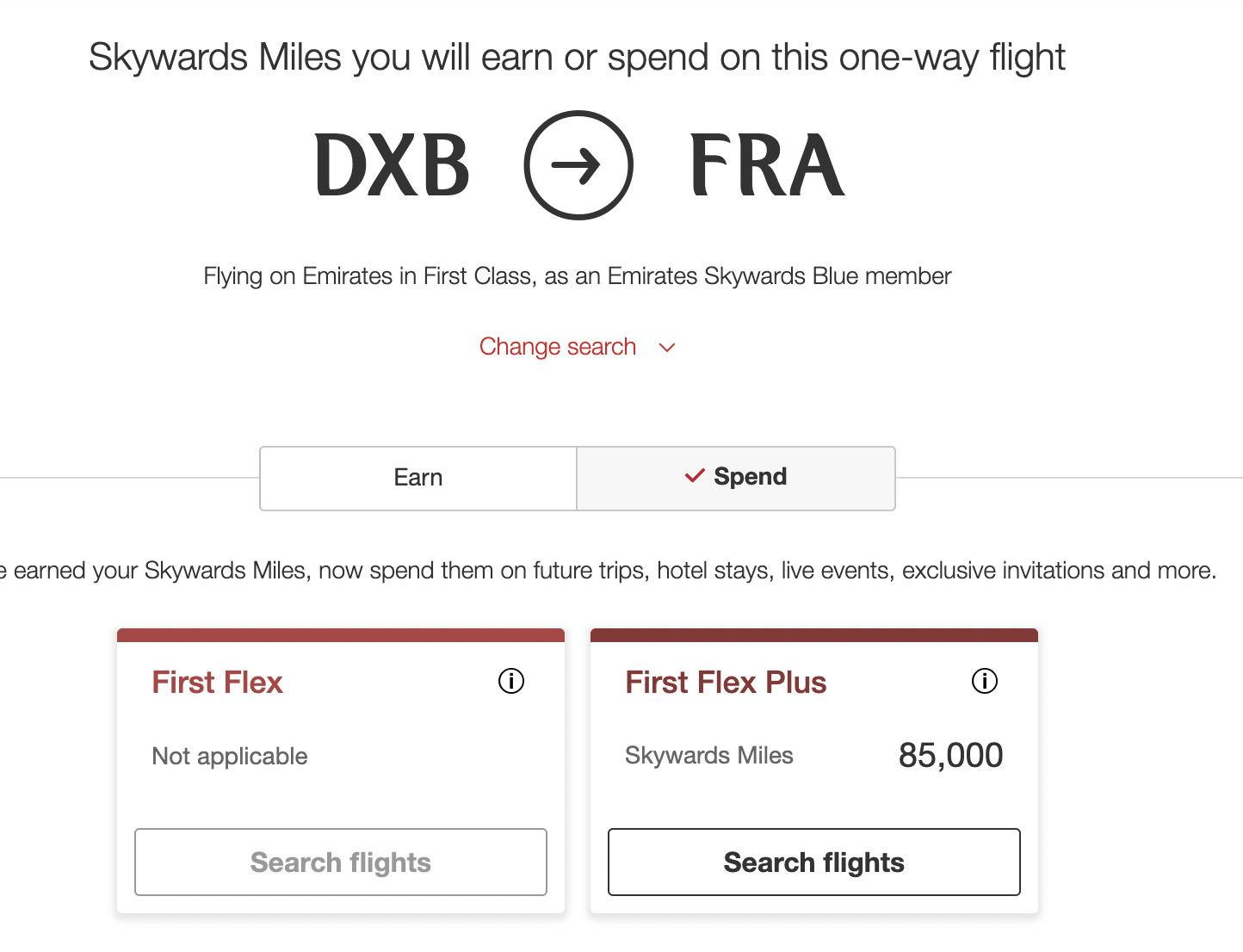

- First Flex is now 102k, up from 85k

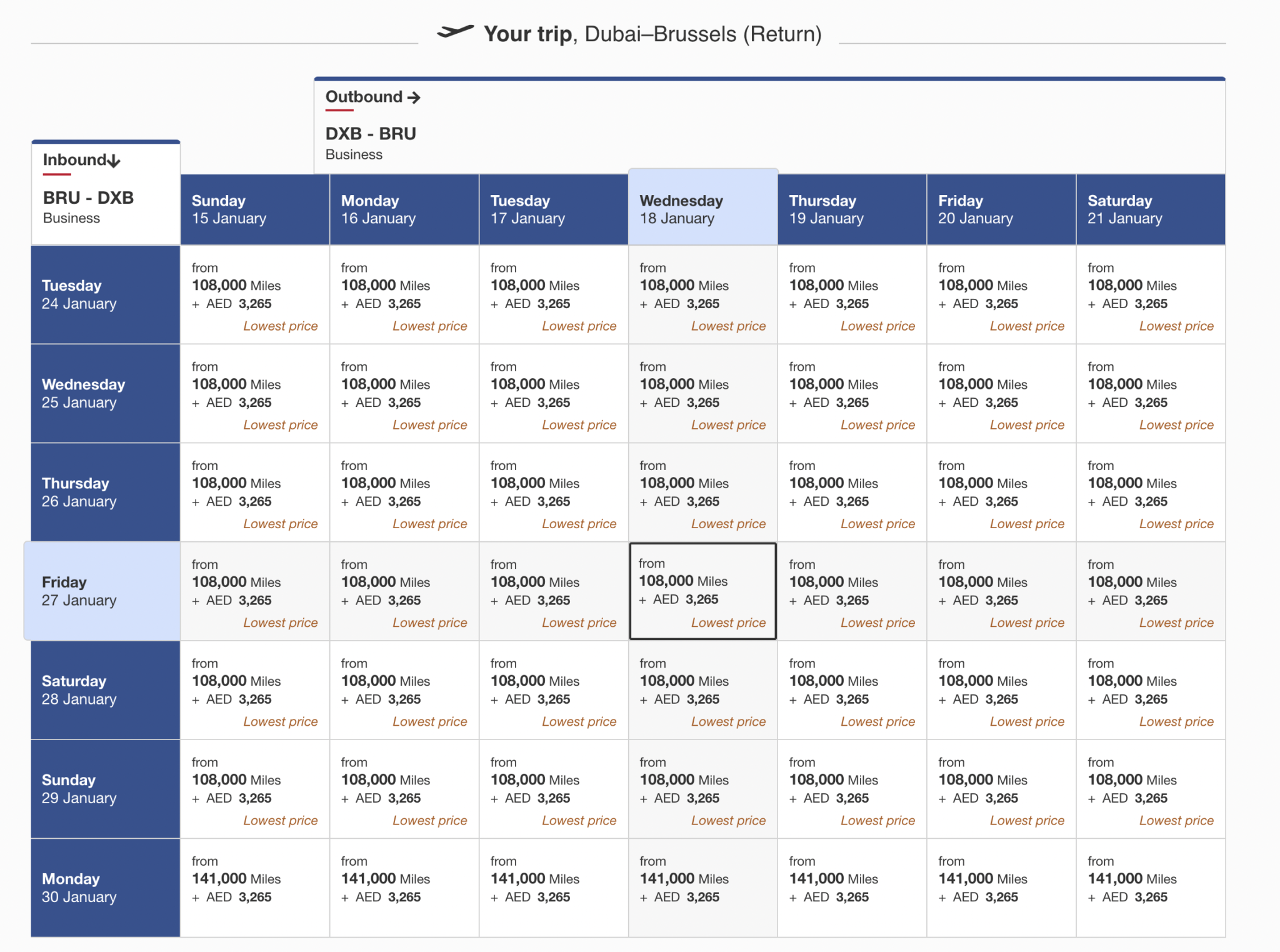

New Dubai to Europe pricing

Yesterday these were 85k, but here’s a look at the pricing from Dubai to Europe now

Here is a flexible search look

And in business class

Emirates calculator hasn’t been updated

It is still showing lower pricing:

New Business Saver rates

New Business Saver rates

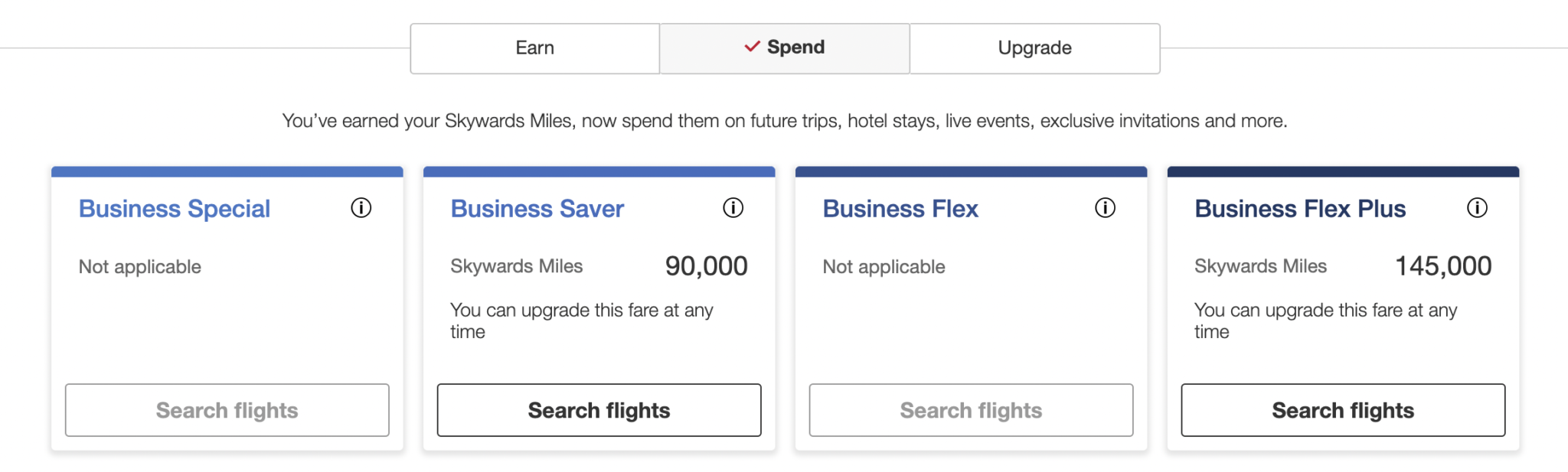

And you can see here in business class there should be business saver at 90k roundtrip

but If we look here it’s actually pricing at 108k roundtrip

Which is confirmed here when you break down

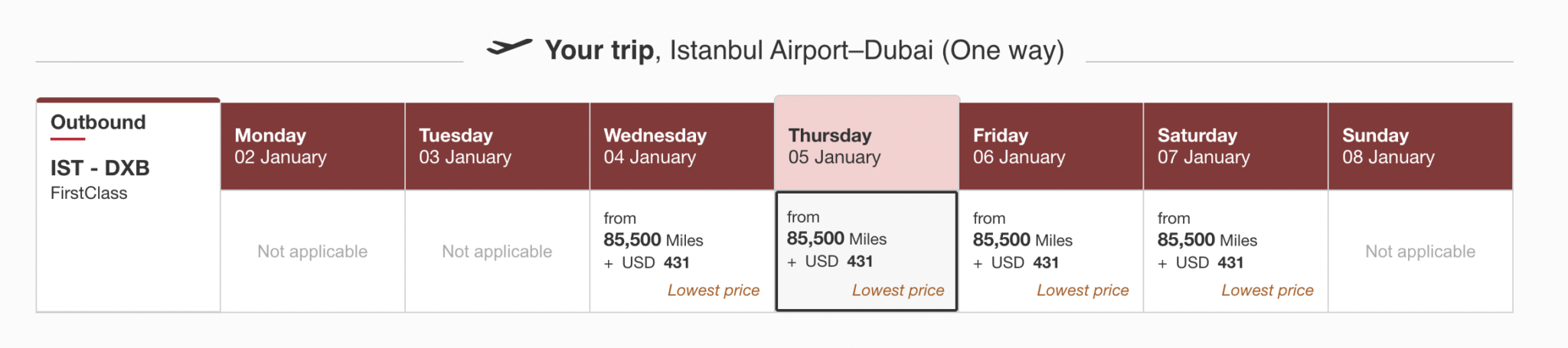

Istanbul to Dubai has changed as well

I just booked this for 71,250 less than a week ago and It has jumped

Overall

The devaluation is one thing, but it’s really a crap thing to do without notification to Emirates loyalists who, like myself, may have been amidst planning a trip and no longer have the miles needed to book all passengers. These fly by night program changes have become far too common and are a reminder to use your points and miles when you see a good deal before they lose value in the long term.

I haven’t done an extensive search to see other routes, so let me know if you see more and I will update

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.