This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Rakuten has become one of my absolute favorite portals ever since it allowed members the option to earn Amex Membership Rewards instead of cashback. If you’re unfamiliar with this feature, read this article where we show you how to choose that option, but essentially every 1% you see as cashback = 1x Amex points.

In the case of this Expedia Hotels example, the cashback rate has been bumped up to 8%, so we’d be earning 8x on qualifying Expedia Hotels purchases.

![]()

If you don’t have a Rakuten account, use our referral. We’ll get a referral bonus and you’ll get $10. Join here

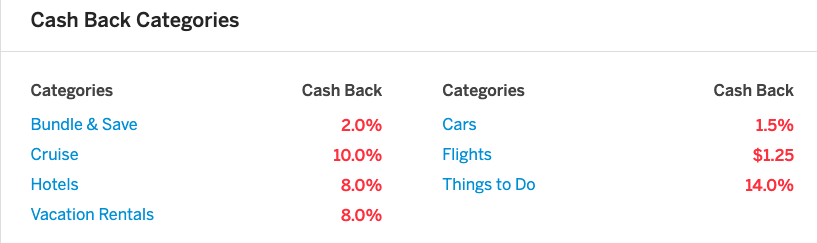

Here’s a breakdown of the categories offering increased cashback

Non-chain affiliated hotels are your best bet

Each person needs to make their own judgement as to how much they use, enjoy, and benefit from hotel elite status. If you’re top tier with Hilton, Hyatt, or Marriott, you’ll have access to lounges and free breakfast that may outweigh earning 8x on your stay.

However, if you’re staying at a non-chain boutique or luxury hotel – this could be a fantastic way to earn extra points. We stayed a fantastic boutique hotel in Paris as part of a hotel and train package called the Marignan. We enjoyed a stunning Eiffel Tower view room, and I’d stay there again in a heartbeat. It’s be a prime candidate for a deal like this + I could end up earning 10x points on the booking.

Yes, I said 10x points

Since you’re using the portal to earn 7x we don’t need to go into detail there, but you can stack that deal with your credit card. There are several cards that earn 3x points on nearly all travel purchases. Two of my favorites are the new Amex Green and the Chase Ink Business Preferred. If you had to pick between the two…I’d go Ink Business Preferred. The $95 annual fee is unbeatable, and gives you free mobile phone insurance.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.