This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

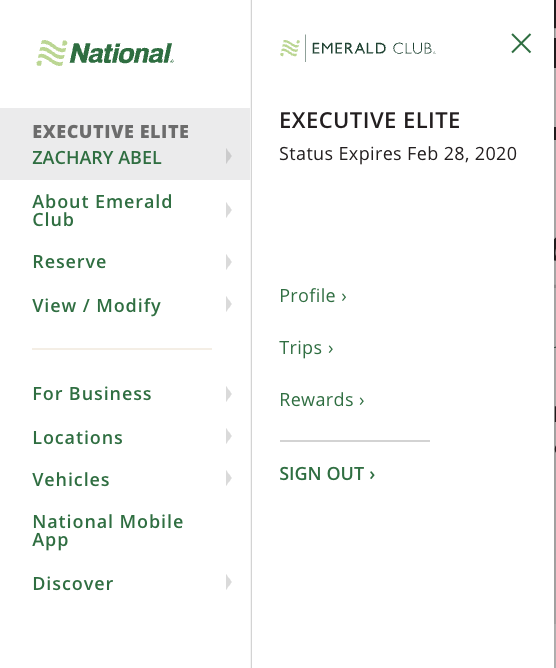

At the end of 2017, National offered an incredible opportunity to status match Hilton Gold/Marriott Gold to their top tier, Executive Elite, status as noted by DW at ACYP. Since both of these statuses can be acquired via an American Express Platinum Card, and I carry one, I matched and received National’s top tier. For whatever reason that status hasn’t changed since, and even though I rent 20+ times a year, and I have to say, National’s Executive Elite is pretty awesome, they don’t have any branches near where I traditionally rent. Hertz does. So…I did a bit of research and found that you can request a match through hertzstatusmatch@hertz.com. My go-to site for all things status matching is www.statusmatcher.com.

You can also pick up National Executive status just by having an American Express Platinum, but also Sixt’s Platinum status via Mastercard Elite benefits. Just an FYI 🙂 I would think Sixt’s Platinum should match to Hertz’s President Club whereas National Executive, more than likely, will match into Hertz Five Star. Lemme know if you’ve experienced something different.

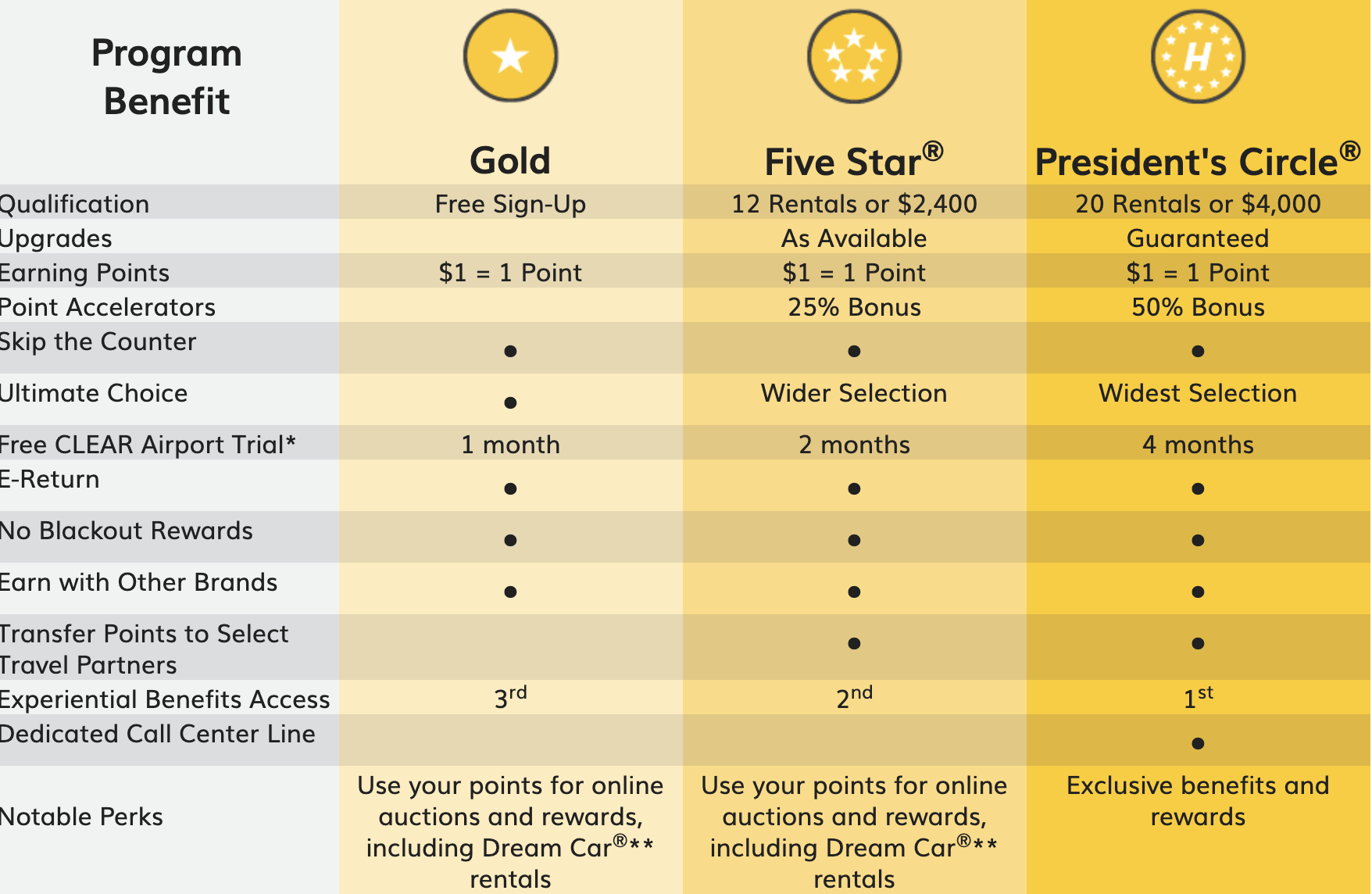

Here’s a quick look at what Hertz status provides:

I sent off an email:

Hello there –

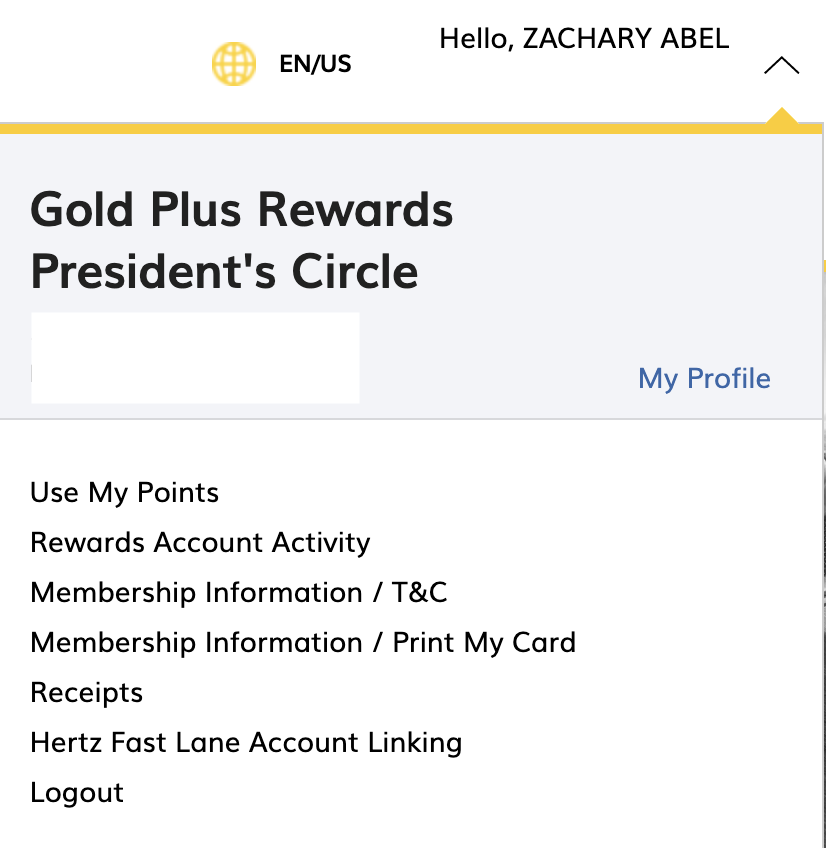

I’ve recently started renting more with Hertz and would love to match my National Emerald Elite status to President’s Circle. Here’s a screen cap of my National account. Hertz has been offering better rates and is a bit more central to my main rental location and would love to enjoy similar elite benefits as I rent more consistently with Hertz.

Today I received a response showing my Hertz status had been upgraded:

Hello Zachary Abel,

Thank you for your email. This is confirmation that your Gold account has been upgraded to President’s Circle status.

If you have any pending reservations please call 1-888-444-8600 and an agent can assist you with updating them to ensure you receive the President’s Circle benefits.

Your membership is valid until June 30, 2020. Let me know if I can be of further assistance.

Have a great day!

Hertz Corporation | 5601 NW Expressway | Oklahoma City, OK 73132

Hertz Status Match | Fax: 405 290 2200

Here’s a screen-shot of my updated account with top tier Hertz status. Let the increased earning and upgrades begin 🙂

Other ways to match into status? Airline and Hotel programs.

Delta:

- Gold to Five Star

- Platinum to President’s Circle

- Diamond to President’s Circle

United

- Silver to Five Star

- Gold to Five Star

- Platinum to President’s Circle

Marriott

- Titanium to Five Star

- Ambassador to President’s Circle

IHG

- Spire to Five Star

How did my first rental experience as a President’s Circle member pan out? Pretty well. For $26 I ended up in that Infiniti Q60 you see in the feature image

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.