This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How to extend the expiration of your

Singapore Airlines miles

Singapore Airlines miles ( Krisflyer miles ) are some of the easiest miles to populate since the program is a transfer partner of all 5 transferrable currencies: Amex, Chase, Citi, Capital One, and Marriott. We’ve used Singapore miles many times in the past for various redemptions including Singapore Suites, Lufthansa First Class, and business class between the US and Europe. One thing to keep in mind is that Singapore miles expire 3 years after they’re issued. You can, however, pay to extend them for an additional 6 to 12 months – here’s how we did it.

We used Singapore miles to fly Suites between Beijing and Singapore

Extending your Singapore Airlines Krisflyer Miles

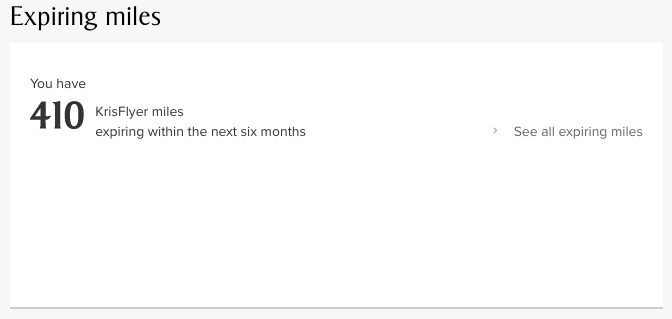

Unfortunately, due to Covid, we had some miles expiring this year that needed to be extended beyond the typical 3 year expiration. Singapore did extend miles for many people, but ours were issued prior to Covid and for whatever reason were’t eligible for extension. If you have miles expiring in the next 6 months, you’ll see a notice that indicates how many are expiring when you check your account summary.

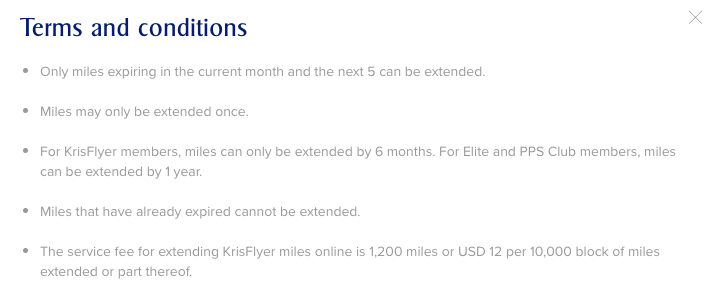

Terms for extending your Singapore miles

- Miles must be expiring in the next 6 months

- Can only extend 1 time

- Base members can extend for an additional 6 months vs Elite and PPS member can extend for one year

- Fee is 1200 miles or 12USD per 10k miles

Click “See All Expiring Miles”

Click “See All Expiring Miles”

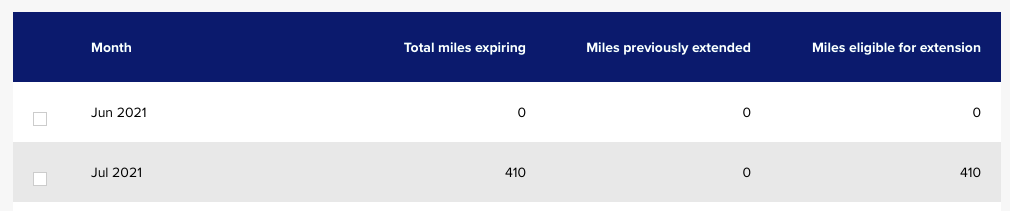

After you click on “see all expiring miles” you’ll get a calendar function to peruse. This is a new image our my account that reflects just 410 miles expiring vs the nearly 150k miles we extended. This is important since you can only extend one time, so if you have miles expiring in 5 months, you may not want to extend those now and wait until you get closer to their expiration date.

At the very bottom you’ll see a button “extend miles”

Calculating how much you’ll pay

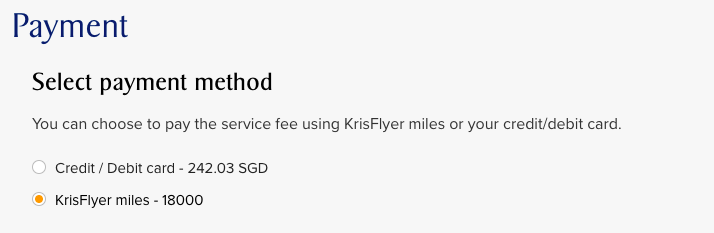

After you press it, you’ll get a calculator that allows you to choose how many miles you wish to extend. We had nearly 150k miles that were due to expire and inputted that number. It’s preloaded with the minimum charge for 10k miles to extend.

Choosing miles vs cash rate

Choosing miles vs cash rate

As I mentioned we had nearly 150k miles which priced in at either 242 SGD or 18k miles. I chose to pay it vs spend another 18k miles – which equals roughly a penny a point.

After you’ve paid, they will extend for either 6 months or 12 months depending on your status.

Overall

It’s fairly straight forward and easy to extend the life of your Singapore miles, but I’d advise keeping an on them and avoid the situation we got ourselves into. Unfortunately, we ended up having to pay to avoid losing them, and will hopefully find a good use for them as the world reopens. Odds are we will use them to fly from the US to Europe for 72k miles a piece in business class ( I think this is one of the better uses) since we have a few trips planned back and forth before year’s end.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.