This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Frontier Instant Gold Statusish Match

Frontier Airlines is offering a Gold “status match” for all Southwest members. The poaching of Southwest’s loyalists continue and Frontier will give every single member of Southwest Gold status if they pay $40. Note that Gold status doesn’t include a free checked bag, but does include preferred seat assignments and a free carry-on. I rarely check a bag domestically and the seats on Frontier are the big issue… being able to select a nicer one free of charge easily recoups the $40 in a flight or two.

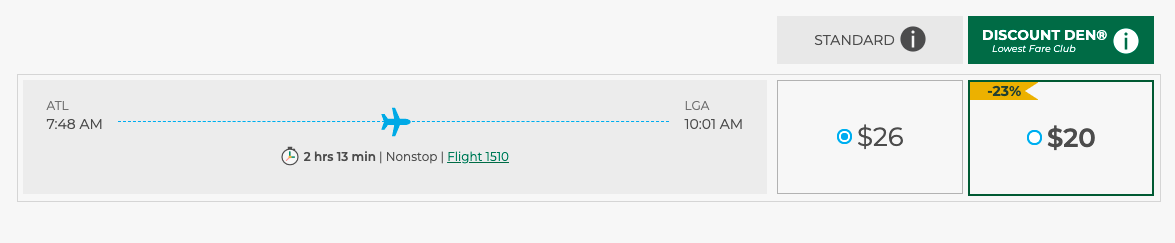

Will I do it? I’m heavily considering it. I status matched to Spirit Airlines 2 years ago, a no brainer and easily recouped the price, and I think I will match yet again to Frontier. I’m not an airline snob when it comes to domestic travel and Frontier, as well as Spirit, is perfectly adequate for me on shorter flights ( sub 3 hours ).You may hem and haw at the seat pitch, lack of recline, but when you can fly Frontier for $50, heck sometimes $20, and the Big 3 are selling for $250, I’m booking Frontier.

Let’s take a look at the latest Frontier Status Match www.frontierstatusmatch.com

Highlights of the status match offer:

Note that You will have to pay a $40 application fee

You can go here to get gold Status

What are the benefits of Frontier Airlines elite status?

The biggest advantage is all of the nickel and dime-ing gets folded in the higher your status.

Frontier seating is tight but status helps

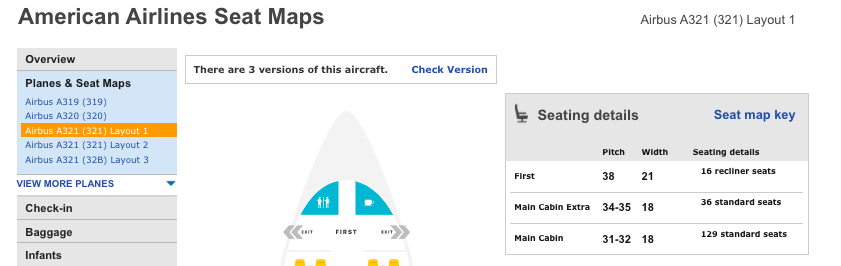

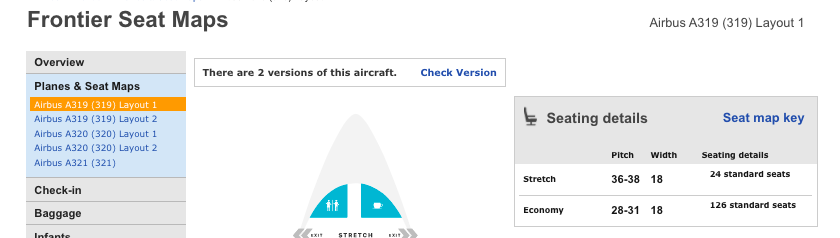

It seems every airline nickels and dimes these days and Frontier is certainly no exception, in fact I’d say they are quite creative in ways of adding cost to a base fare. But the biggest issue I have after all of those nickels and dimes is space. Often times, Frontier will price out marginally cheaper but the seats are so close to one another. Look at the pitch on this Frontier A321 vs American 28 to 31 vs 31/32 in econ.

BUT… the stretch seats, which are complimentary for some elite status members is much roomier and can be selected when booking free of charge. The pitch is the same or more than on AA first class. Note the width is the same so it’s more like Main Cabin Extra with more leg room.

Why I may go for it

I flew Frontier Airlines earlier this year and it was completely fine. We left on time and arrived early. I’ve flown them other times and been woefully delayed. But, honestly, isn’t that kinda every airline these days?

There are enough times that I’m faced with the proposition on very short flights to fly Frontier. I usually decide against it so I don’t have to pay all the fees for seat selection, bag fees, etc. With the status, I don’t have to think about those things, and can even pop into a stretch seat…I’ll take it.

I don’t really care about flying first class domestically unless it’s on a transcon flight of more than 5 hours. Otherwise…it’s nice, but I’m perfectly happy in economy.

Why not go for it?

You hate Frontier and don’t want to part with $40. But, honestly, if you fly them once you’ll likely recoup the fee.

Cheap flights may put me in Frontier more often…

Airlines are moving aggressively to pure revenue

American set a new stage with its recent revamp, and Delta just followed in their footsteps. The most profitable arms of airline are now watering down the programs that make them the most money. When it comes to flying domestic, I’m a free agent.

As a result, I’ll hunt even more for cheap domestic economy seats and use flexible currencies like Amex, Chase, Bilt, Cap1, and Citi to fly flat when going abroad.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.