This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Update: 10/12/18:

I picked up an American Express Gold, selected Alaska Airlines as my airline of choice and booked two tickets to Las Vegas for $48 a piece. Both qualified towards the $100 incidental fee credit and I was able to deposit them into my wallet.

Update May 2018: Alaska has changed their 60 day + free cancellation since writing this article. Only applies to Gold and G75 now.

A quick tip.

One of the benefits that’s great, but also frustrating, about the American Express Platinum ( any version ) is the annual $200 airline fee credit. The frustrating part is, unlike the Chase Reserve or Citi Prestige, the credit can’t be applied directly to purchased airfare, but rather to incidental fees like change and baggage fees. On top of that, you have to select a specific airline and up until this year I had selected American. That’s pretty limiting, but hadn’t really affected my ability to use up the credit because I purchased gift cards that triggered the fee credit.

This year, I’ve switched to Alaska, and as of last summer, Alaska Airlines gift card purchases don’t trigger the incidental fee credit. The solution? For the time being, it seems as though purchasing low fare tickets actually triggers the fee credit. I recently purchased a ~$40 ticket to Vegas, set a pending alert on my Amex, and waited to see if it was refunded. A day after it posted, wham, bam, it was refunded on my account.

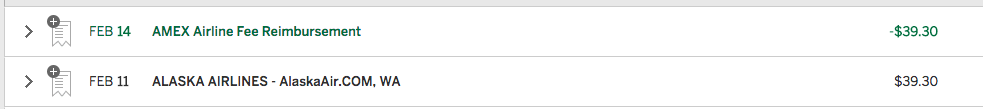

I purchased a one way ticket on Feb 11th from AlaskaAir.com

It went pending on the 11th, and 72 hours later, on the 14th, it posted to my account. The 15th, the Airline Fee Reimbursement was triggered and reversed the charge. It doesn’t reflect the 15th below, but it turned negative a day after the initial posting.

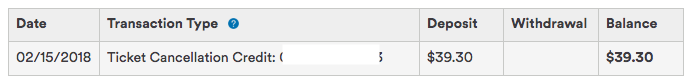

Make sure you wait 24 hours for the ticket to actually process before canceling. After that point, simply cancel and deposit into your Alaska Wallet.

If you don’t carry MVP Gold or G75 then you’ll want to purchase tickets that are more than 62 days out so that you can deposit them without penalty. 62 because Alaska allows free cancellation if you do so 60 days out. This will give you a bit of buffer for the ticket to process with Amex and to cancel. The cost of the ticket is then deposited into your Wallet. You have a year from the date of purchase to then use those funds.

Hope this helps!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.