We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Tis the season to transfer!

First things first…I don’t advise speculatively transferring, but if you’re planning to take a trip, and could use these points to make it happen, this is exactly the time to make your transfer. A 40% transfer bonus is one of the best you are going to get, bar none, and it’s valid on transfers from Amex to BA, Iberia, and Aer Lingus until 11/15/18

Transfer bonus is offered until 11/15/18

Quick example of putting it to use on Iberia

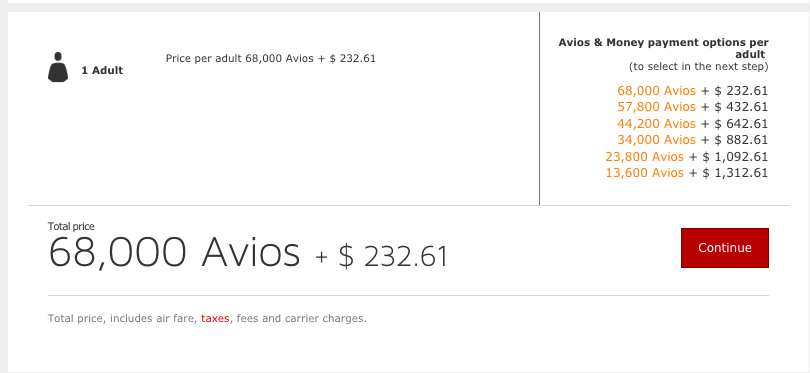

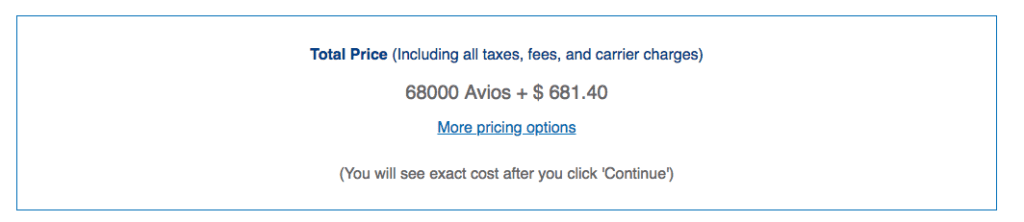

I recently wrote a post illustrating a considerable amount of dates showing Iberia biz avail from NYC and Chicago to Madrid in the beginning of next year. All of these programs operate peak and off peak pricing, but I was able to snag a roundtrip flight from Chicago to Madrid for just 68k Avios. Insane deal. I used Avios I had effectively purchased from the Iberia promo earlier this year, but had a transfer bonus been in effect, it would have only cost me 49k Amex to fly roundtrip. WHAT?!?!?! That’s just nuts.

A couple of things to consider:

- BA transfers are instant and I’ve done it many times

- Iberia transfer aren’t always

- I’ve read reports of a couple days to even a week – keep that in mind with fluctuating avail

- I’ve had them instantly go over, but clearly this isn’t always the case

- Aer Lingus – Would love some data…I’ve personally not done this, nor know anyone personally who has…

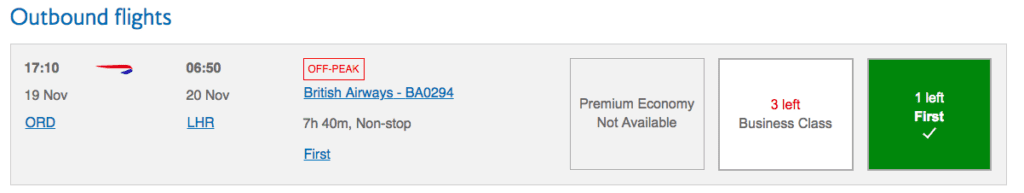

Or…You could nab a BA First Class flight like the feature image for 49k Amex during off peak from ORD to LHR – those fees tho…

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.