This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Check your credit score and 5/24 with Credit Karma

Like many, I use CreditKarma to keep an eye on my credit score, fraud, etc. But, I also use Creditkarma for a quick and free way to keep tabs on my 5/24 number ( Chase’s rule on applications). I thought I’d give a refresher so you can quickly and easily find your 5/24 number.

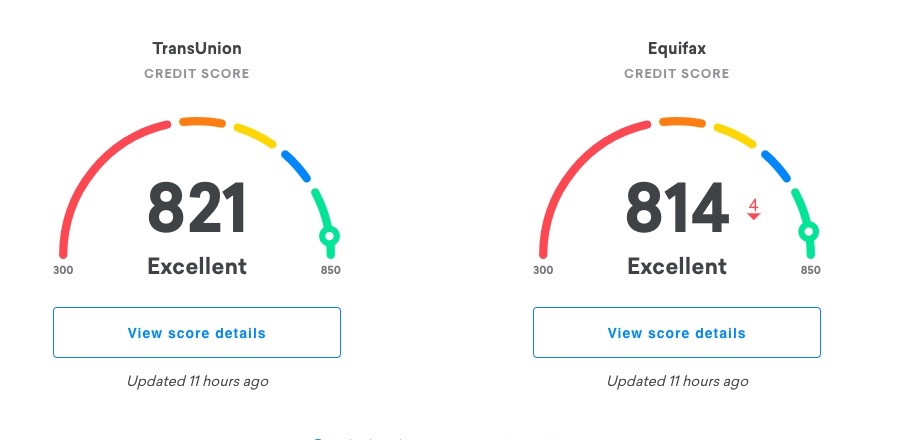

Log in and see your TransUnion or your Equifax scores

The Easiest: The Old Credit Karma Website

This is, by far, the easiest way to access your 5/24 number. After you’ve logged in to the current version of Credit Karma you’ll want to Go here to populate the old credit karma which allows you to organize both your old and new accounts by age. A big thanks for Frequent Miler for discovering a while back and CreditKarma for keeping it active.

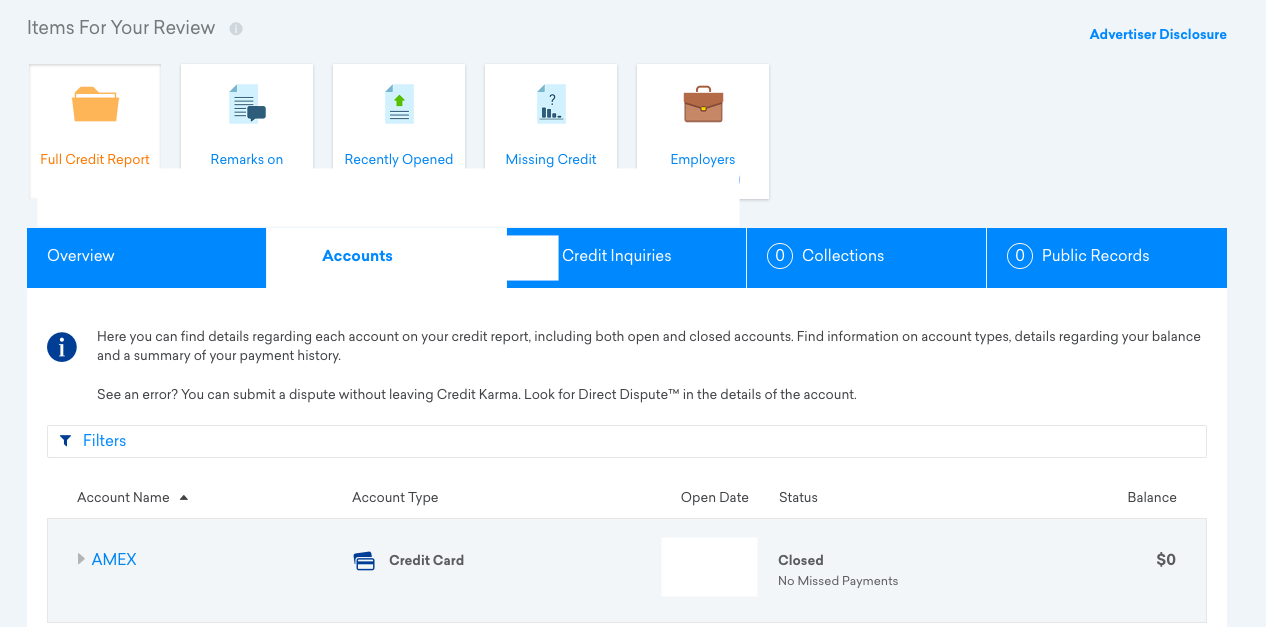

You’ll see the site now look like this:

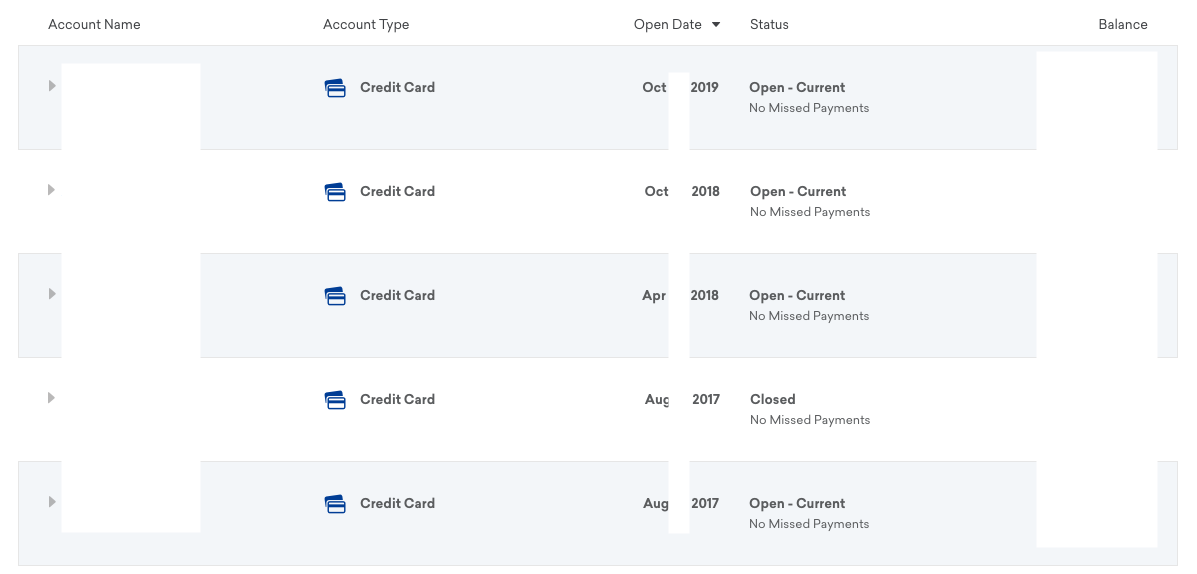

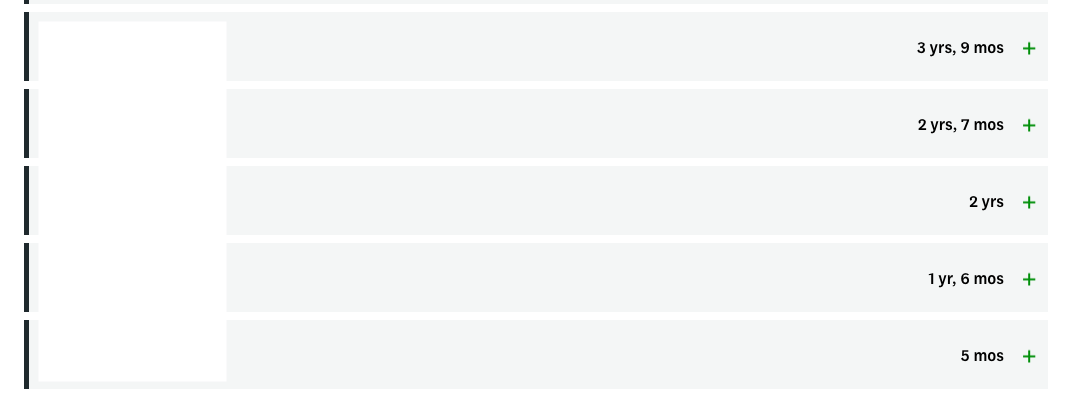

Click on “Open Date” which will organize it by ascending or descending dates. Here’s a look at my redacted info. You can see that my newest account was in October 2019 and my 5th oldest was August 2017. You can also see that my 5/24 is 2.

If that doesn’t work…go back to the new version and follow these steps.

Click on Equifax or TransUnion

You’ll want to go into these microsites rather than looking at accounts on the home page

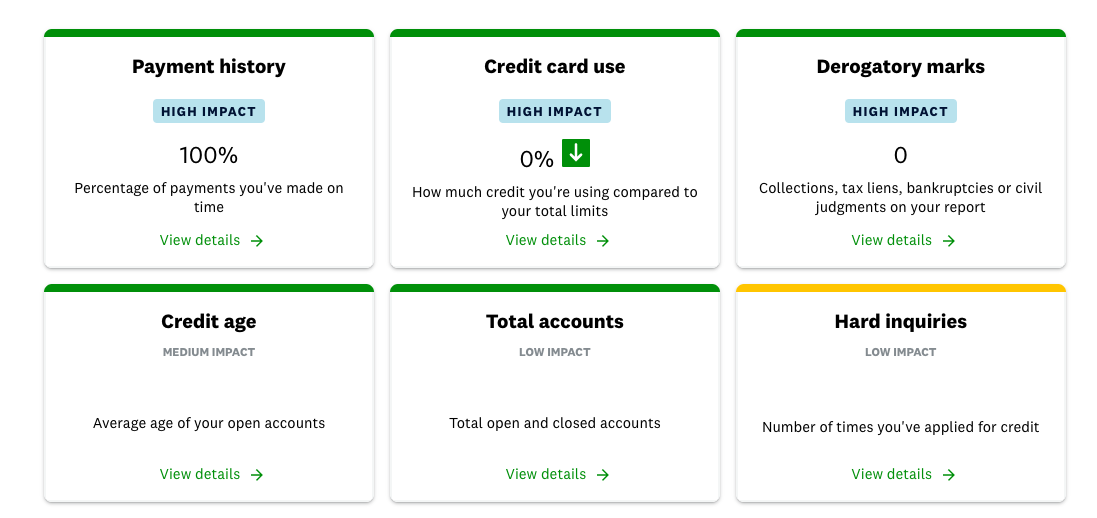

You’ll see your credit factors – find credit age

Open accounts will populate. I had 2 under 24 months. But, remember, both open AND closed accounts affect your 5/24 status.

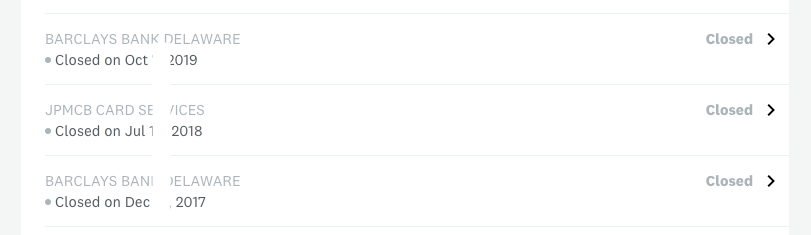

Click on “View All accounts” to see your closed accounts. You want to focus on closed accounts in the last 2 years – starting with the most recent.

The reason I start with the oldest card is because I never keep a card less than 1 year. So if I closed a card in July 2018, the odds are that I opened that card before July of 2017 are almost 100%. So the only closed card that would affect my 5/24 in April of 2020 would be the Barclay’s card closed in Oct of 2019. That could potentially run off in Oct of 2020 if I opened it in September of 2018. If you don’t hold cards for a year ( I’d change that habit ), but I’d do a thorough search of all your closed accounts in the past 2 years.

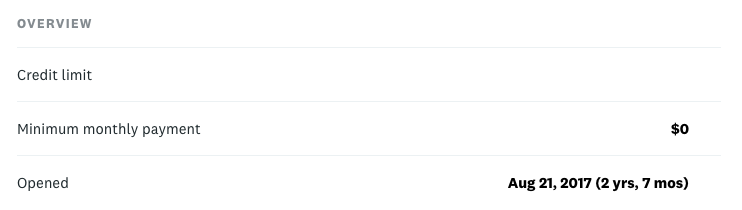

My closed card from Oct 2019.

After expanding it, I can see that the card was opened 8/21/17 – which means I don’t have any closed cards affecting my 5/24. If I did…just repeat the process until you hit the 24 month mark.

As you’ll notice…most business cards you have open do not show up on this list. BONUS!

Additionally, Chase business cards don’t count against your 5/24 number either. Neither do Amex, or Citi.

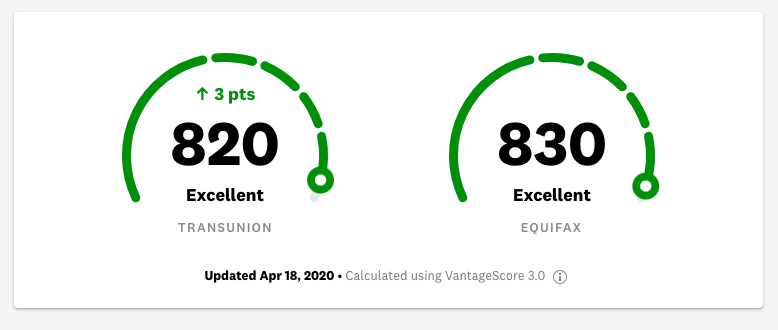

Hope this helps you stack up those points and put you here!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.