This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

According to a post on Reddit, Citi Prestige has tightened up their policy when it comes to trip delay compensation. Apparently, people, who miss connections due to delay, have been getting their claims denied unless their first flight was delayed more than three hours. Additionally, travel claims were only being honored if it was part of a roundtrip itinerary.

Citi has consistently devalued the Prestige benefits amidst the war of premium cards. While the benefits have been eroded I still find plenty of value in paying the fee and keeping the card…for now. The main reason that I carry the card is the 4th night free benefit, and my grandfathered Citi Gold status which drops my fee to $350 ( effectively just $100 after the $250 airline fee credit).

When it comes to making travel reservations, I typically stick them on my Reserve or Biz Preferred.

Here’s a link to Citi Prestige Benefits:

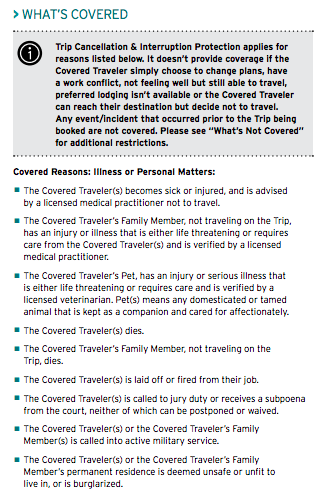

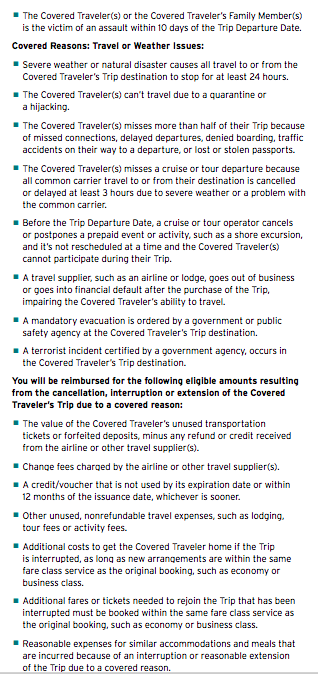

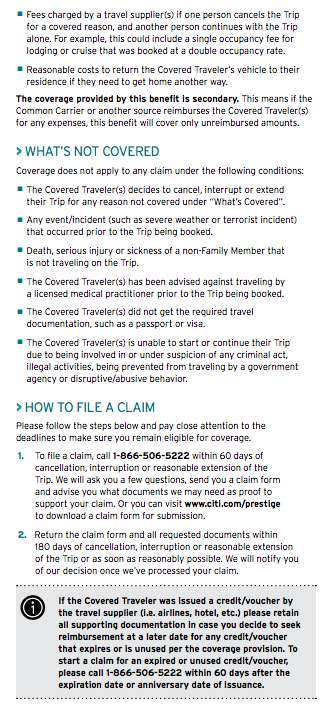

Screencaps of their Trip Delay/Cancellation coverage

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.