This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How to get a Citi Virtual Credit Card Number

Virtual credit card numbers are random credit numbers you can use online that are associated with a real credit card. So this means, instead of using your real Citi Prestige, you can create a Citi Virtual Credit Card Number that is linked to that card, but doesn’t reveal the real card number. It’s a great way to protect your real credit card number and is specific to one online merchant. Interested? This is how do you get a Citi Virtual Credit Card Number?

Who can get Virtual Account Numbers?

Why would you want one?

How can you get one?

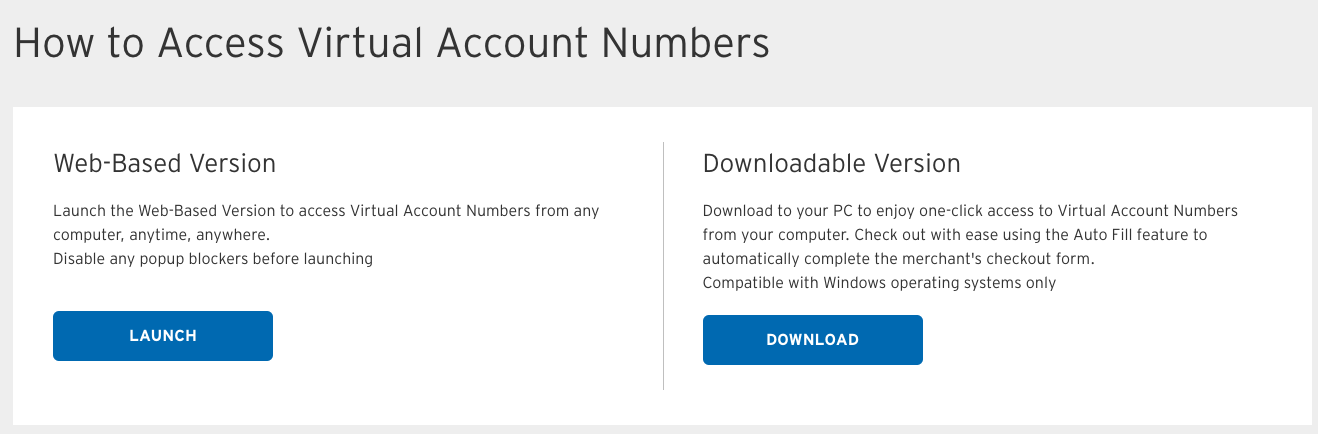

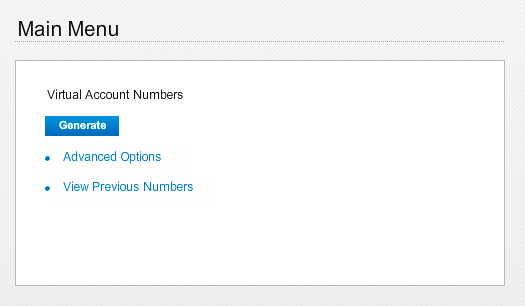

Then you can generate numbers one of two ways, once you register the card

I use a Mac so the downloaded program didn’t work, but the web-based auto generator is super easy. You’ll want to make sure you allow Flash to be run.

You’ll be asked to generate…

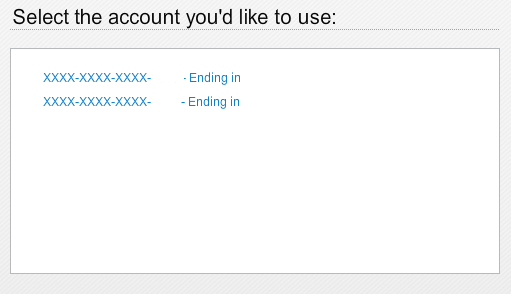

You’ll be prompted to select an account

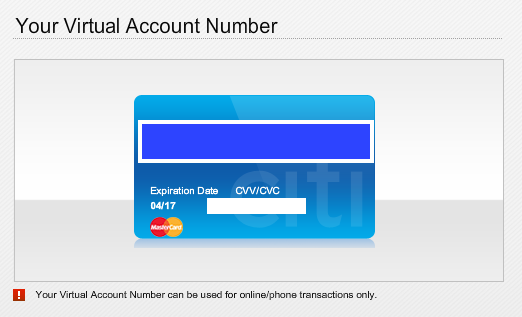

And Voila…Your Citi Virtual Credit Card Account Number

You now have a virtual account number that you can use that will bill your existing card and help protect yourself.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.