This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

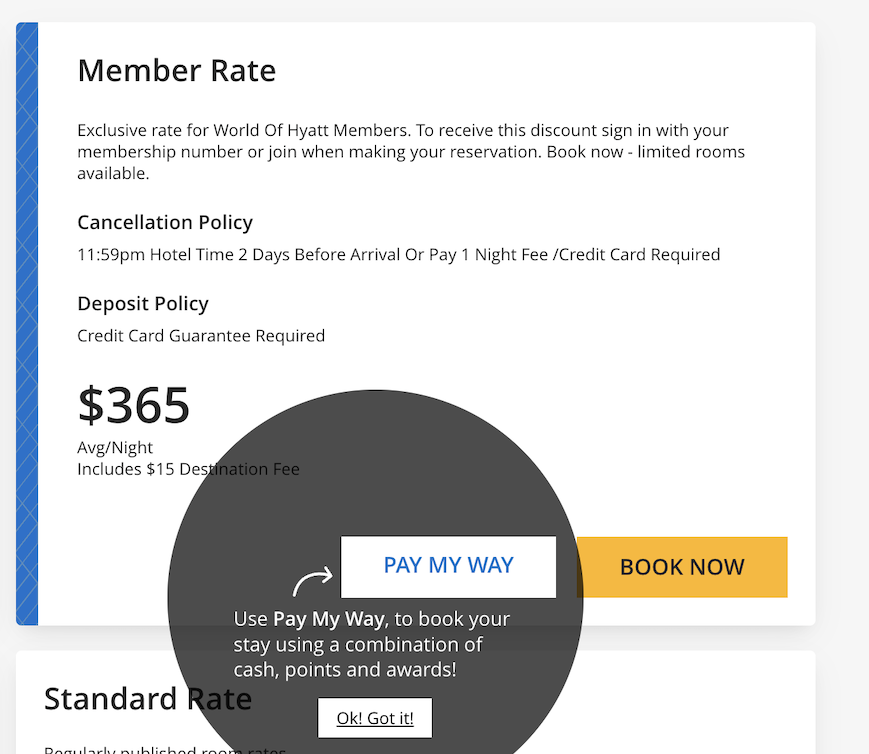

Until this post you may not even be aware that Hyatt has a booking option on multi-night stays to “Pay my Way” which allows guests to choose if they want to pay with points on some nights, cash others, etc. One frustrating aspect of Hyatt’s program, up until this point, was the inability to select the specific award night you’d like to use for a booking if you had more than one in your account.

For instance, when you hit 30 nights, receive a brand explorer award, or get your annual credit card free night, you receive a free category 1-4 night certificate. However, when you hit 60 nights, and hit globalist status, you receive a category 1-7 certificate. Prior to this update, when you’d choose to use one of these certs, unless you called in to specifically choose the award certificate you want, the Hyatt software would choose the cert that expired first.

This was very frustrating and I was one of the sad lot that didn’t pay attention to this issue and ended up using a 1-7 cert on a category 3 property, and no, there wasn’t really a way to “undo” this…

That is all fixed, thankfully!

Hyatt “Pay My Way” options

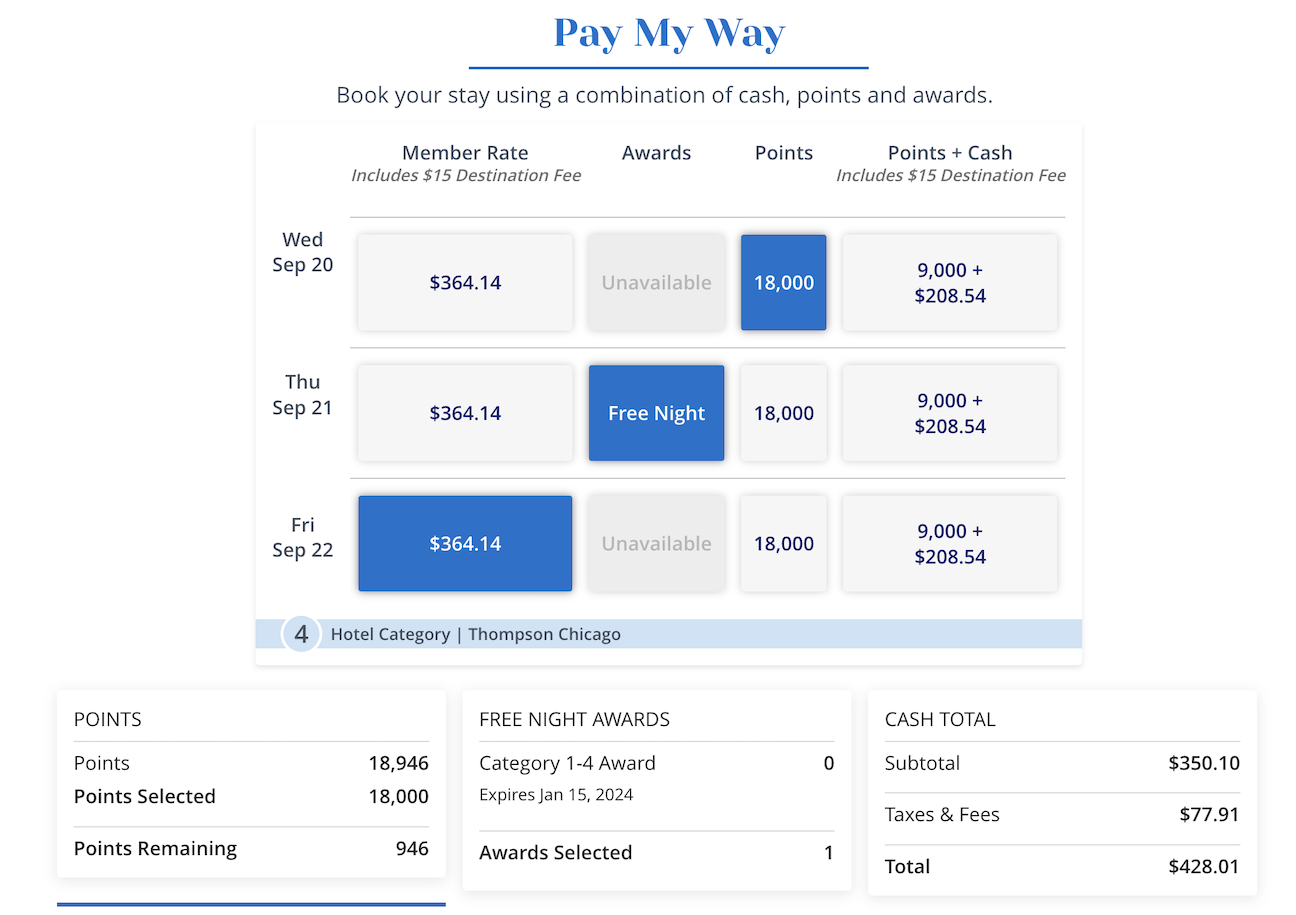

Let’s take a look at how this will work in practice using a faux booking at the Thompson Chicago

Selecting “Pay my Way” options

Selecting “Pay my Way” options

I don’t currently have any category 7 certs so these were my options – you can see I could pay one night with points, another night with a free night cert, and another night with cash + points should I choose.

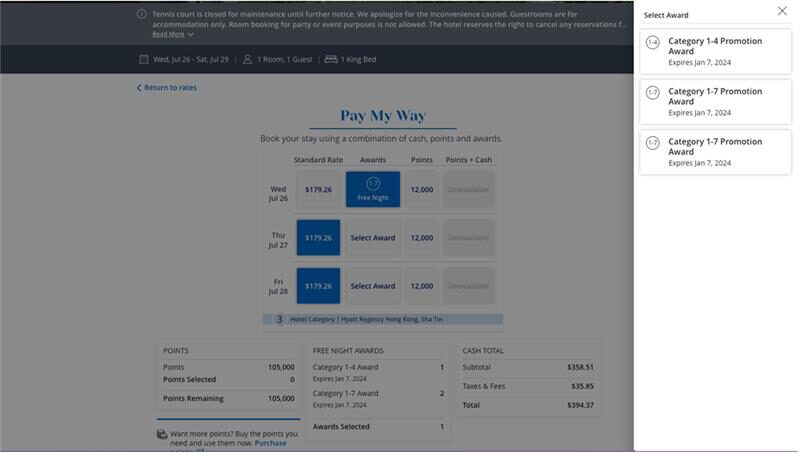

Seeing the different free night certificates in Pay my Way

This is an image sent from Hyatt that illustrates how you can choose which cert you’d like to use. Off to the side you can clearly see the different kinds of awards you could apply when selecting that option. This makes it MUCH MUCH easier to use online.

Overall

Overall

This is a nice improvement to integrate a free night certificate on a multi night stay and choose the exact one you’d like to use.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.