This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

IHG 100k Offer is a total no brainer.

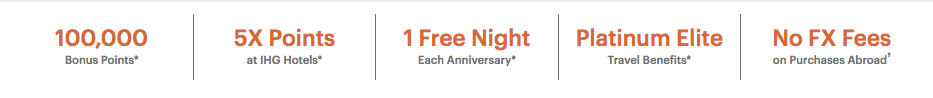

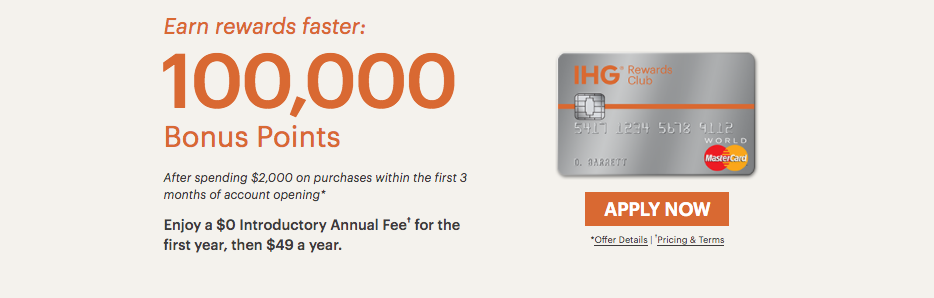

Just to be completely upfront, as of the writing of this article, I make no commission, referral bonus, etc off you signing up for a Chase IHG credit card. I wish I did, lol, because it’s truly a card that I love to promote and one that I happily pay the $49 annual fee. Why? Did you see the hotel my family stayed at in Cannes, France?!? The legendary Intercontinental Carlton? You get a free night every single year you keep the card AT ANY IHG PROPERTY IN THE WORLD. Add a few other perks, and a mega 100k sign up bonus and the Chase IHG card is a total no brainer.

UPDATE: NOT EVERYONE IS TARGETED via the link. Also, there as been success applying for the 80k offer ( which is public) and matching to the 100k (frequent miler). My apologies for the confusion

This card isn’t under the Chase 5/24 rule.

According to DOC, the IHG card isn’t regulated by Chase’s 5 new account openings in the past 24 month rule. So even if you’re a mega churner, you won’t have to worry about 5/24 disqualifying you. However, if you currently hold the card, or if you don’t, but you’ve received a signup bonus in the past 24 months you aren’t eligible for the 100k signup bonus.

The Biggest perks to me…

- 1 Free Night ANYWHERE, annually

- It usually loads 30 days before the annual fee hits.

- 10% back on redeemed points, up to 100k a year.

I’ve used a free night to stay at the Intercontinental Austin.

I have the card, but would love another 100k. Should I cancel and sign up again?

- One, I love where your head’s at.

- Two, Are you worried about 5/24 at all

- It will add to this number

- Three, You could buy the points for $500-600 when IHG puts their points on sale

- is the added number to your 5/24 worth more than $500?

- is it worth the extra hard pull, effect on your credit?

- Four, If you do so, realize that you should wait 30 days before signup back up.

- Chase has been known to reinstate closed accounts in that time period. Meaning…you’re SOL and lost out

- DW at AYP had a different experience, so it’s not steadfast…

Miles I don’t need all the Fancy Schmancy stuff like you

You may love this card even more. Awards start at 10,000 points and go up to 60k for hotels like the Intercontinental Park Lane.

IHG also releases PointBreaks where awards start at just 5k per night. That means the sign up bonus could earn you up to 20 nights.

Having this card saved my family over 180k points on our $125k Surprise Trip Around the World celebrating my Mom’s 75th birthday.

All three of us carry the card. We used two free credit card nights for the Intercontinental Carlton which normally goes for 60k a night. We also redeemed 670k points – 67k were refunded back because of the IHG credit card. That’s 187k IHG points in value. Not to shabby for a $49 annual fee.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.