We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

IHG Accelerate promotion: Fall 2016

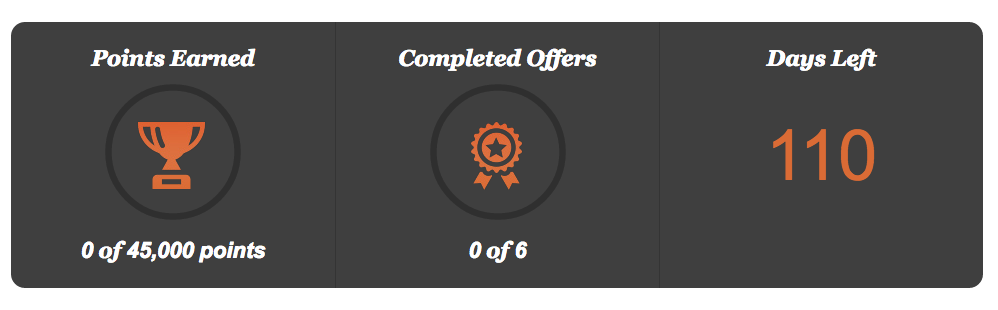

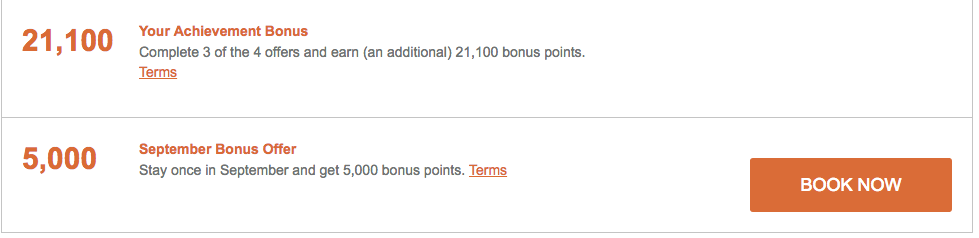

IHG released their Accelerate promotion and I just got around to registering, logging in, and investigating my offer. In case you aren’t familiar with the Accelerate program, it is a challenge and tier based promotion where IHG awards bonuses after you complete each challenge, and then a SUPER bonus if you complete multiple challenges. In the past I haven’t really had that great of offers, but some people get insane deals. For instance, my mom’s IHG Accelerate promotion for Fall 2015 awarded a free night anywhere in the world after just 2 stays with a max of 2 free nights. That’s insane. So let’s take a look at my IHG Accelerate promotion: Fall 2016

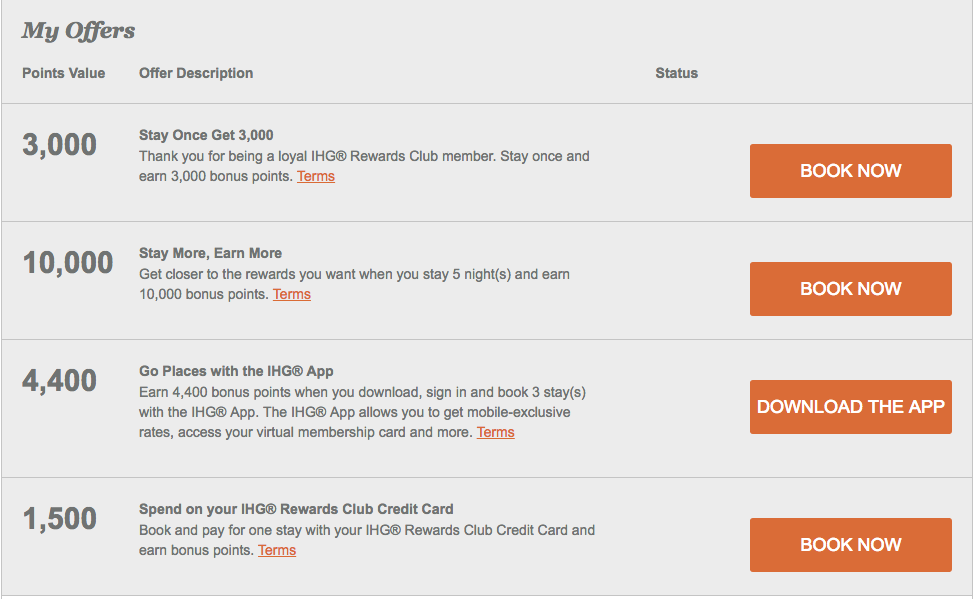

My Offer

The three things that stick out to me are:

- the stay once and get 3000 points

- stay once in September for a 5000 point bonus.

- Use my IHG credit card for a bonus of 1500 points.

I have a couple of trips planned for September and I’ll have to a peek and see if there is a good IHG hotel where I’ll be. One stay at an IHG hotel could net me 9500 bonus points. Typically you have the option to buy points for $0.007 at the time of check out. At this valuation, I’d be receiving just less than $70 but value. Not too shabby really, but not something I’d go out of my way to book.

I manage both of my parents accounts and I’m interested to see if they got any offers as sweet as my mom’s last year. Hope you guys get something amazing!

Check out your IHG Accelerate Promotion offer here

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.