We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

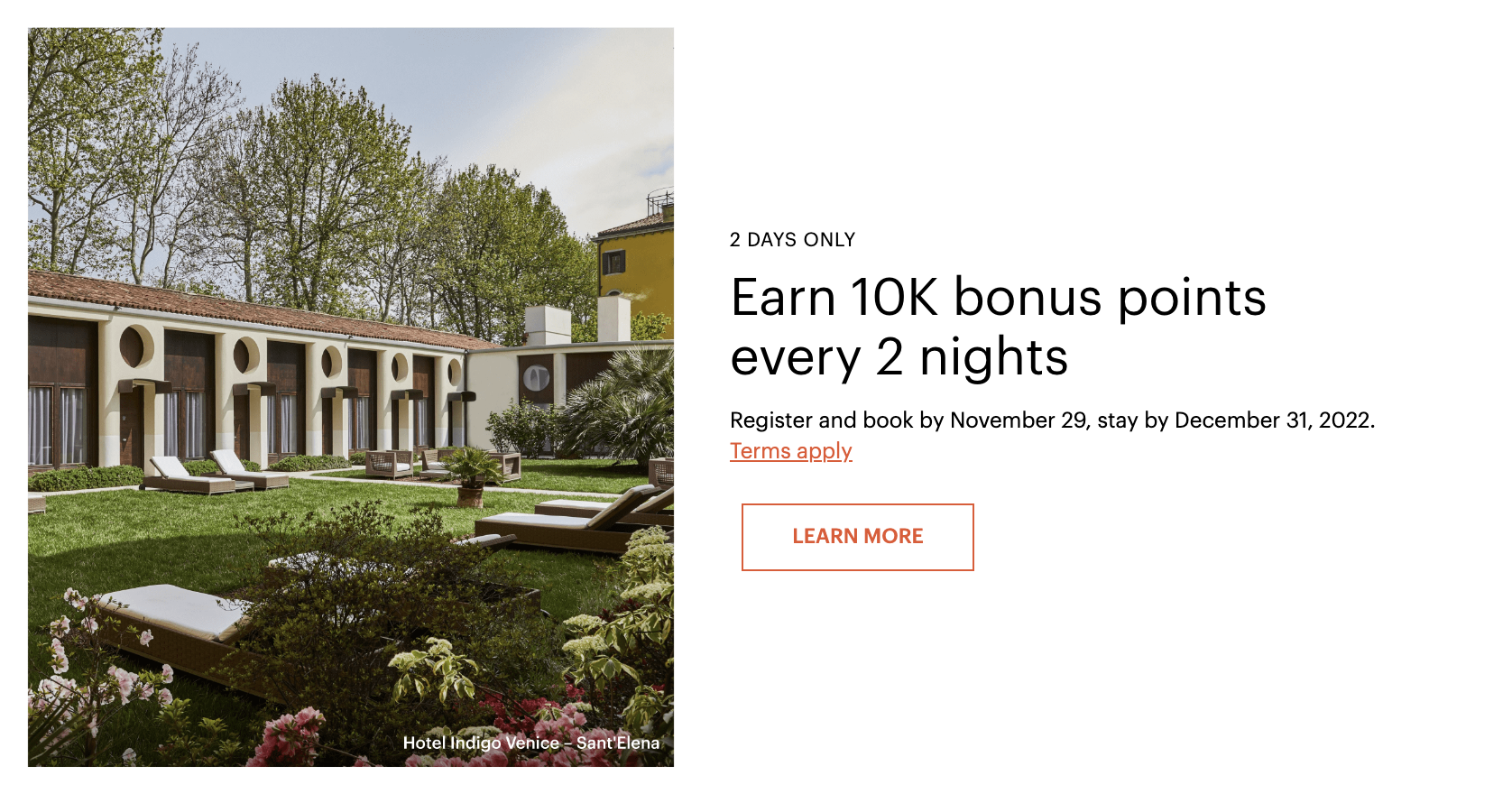

IHG Cyber Monday Promo – 10k points every 2 nights

IHG has a great promo running TODAY ONLY that will yield 10k IHG One Rewards for every 2 nights that you book. They also have two others promotions running: download the app and get 1000 points as well as 25% off cash and points bookings. Let’s take a look at the offers

Table of Contents

Stay 2 nights get 10k points go here to Register

This could be very advantageous if you’ve found a competitive

- Must book in The “Activation Period”

- November 28, 2022 (12:00AM Local Standard Time) through November 29, 2022 (11:59PM Local Standard Time) only

- Must stay by 12/31/22

- Qualifying rates only ( above $30 minimum )

- Point rates don’t count

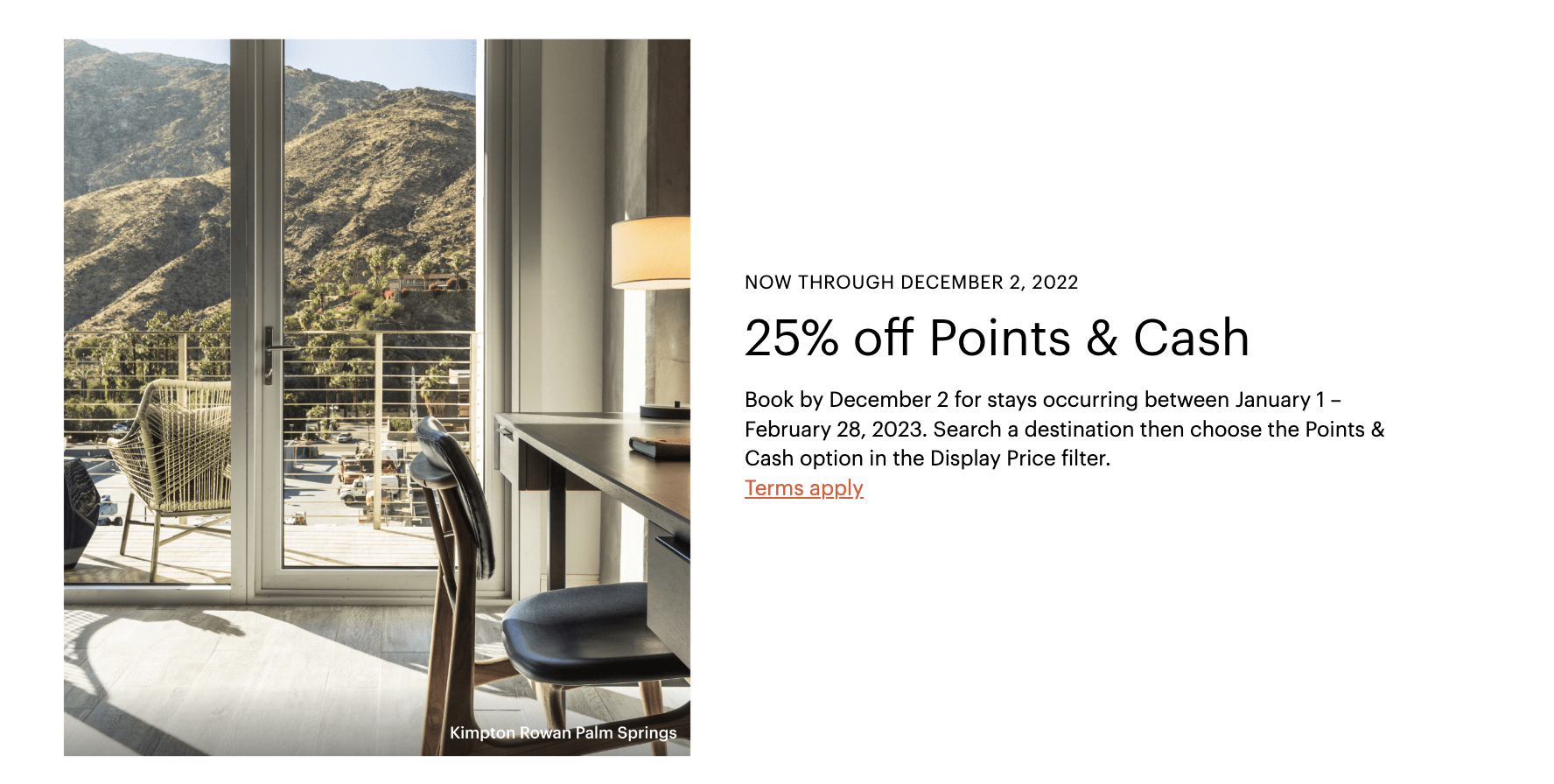

25% off cash and points booking

If you’re unfamiliar with how IHG Cash + Points work, here’s a little crash course. If the hotel is pricing at 40k points, but the cash and points is 30k + $60 you’re effectively buying the 10k points for $60. If you cancel that reservation you won’t get your cash back, but instead will get 40k points deposited to your account. I usually find that the best time to buy points is when IHG offers them for sale at 1/2 a penny a point. If you find a hotel that is pricing points via Cash + Points cheaper than that…it’s a great deal. If not…I’d skip it.

- Must book

- November 28, 2022 through December 2, 2022 (the “Booking Period”)

- Complete stay between

- January 1, 2023 through February 28,2023 (the “Stay Period”).

- This 25% discount is offered at time of booking and only applies to the cash cost of the booking.

Download the App get 1000 points

Download the App get 1000 points

If you haven’t done this…it’s a no brainer

- Must be a IHG One Rewards member

- only valid on first time app downloads

- Must be downloaded by 12/2/22

- Can only be redeemed once

- First time download only

Overall

If you are looking to stay at an IHG property for a couple of nights before the end of they year, this would be a great time take advantage of the 2 nights, 10k promo. Also…the app has been helpful to me in booking Six Senses properties that do a weird glitch online when trying to book points. It’s an easy 1k points…

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.