We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

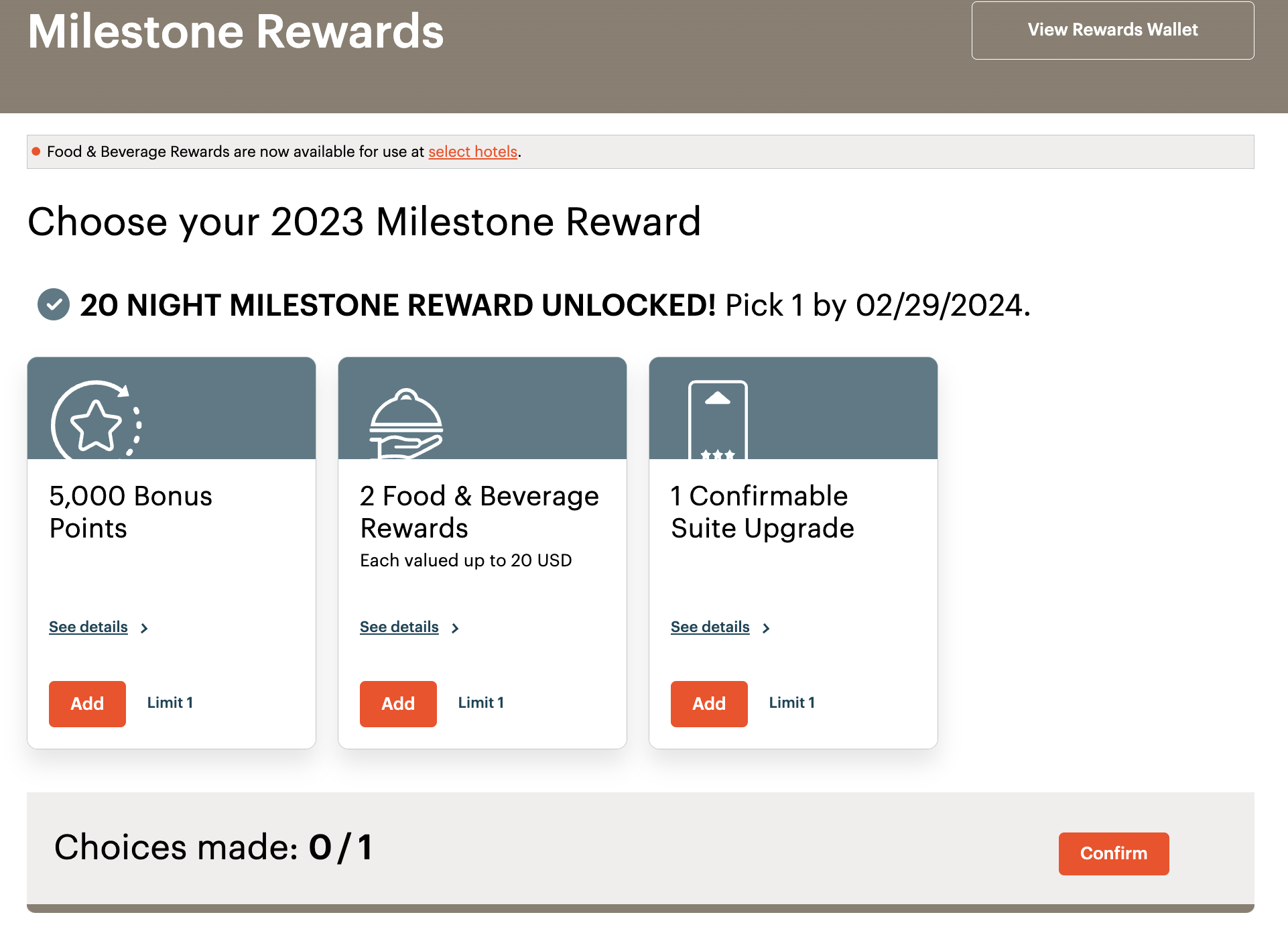

When IHG first rolled out confirmable suite upgrades they were only applicable on certain cash rates ( most pre-paid rates were excluded). I just hit 20 stays for the year and my account allowed me to choose my 20 night Milestone Reward. There isn’t really any doubt that I’m choosing the Suite Upgrade especially because upon reading the terms and conditions, it’s applicable on rewards stays. BYAH!

This makes the confirmable suite upgrades earned as Milestone Rewards, which are a choice at just 20 nights, a lot more desirable. Apparently this will become doable online at some point, according to LL, but you can apply them when phoning in. I look forward to doing this next year and teaming it with my Diamond Status.

1 Confirmable Suite upgrade information: Confirmed up to 14 days in advance for up to 5 nights

One thing to keep in mind is that these things expire 365 days after you select one. For me, I will wait until the last minute to give myself as much time as possible to take advantage of it…note it doesn’t expire until 02/29/24, so if I select it on the 28th I’d have until 2/28/25 to use it. This is a much, much better choice, in my opinion than anything else.

- Choice upon completing 20 Qualifying Nights

- Good up to 5 consecutive nights

- Confirmable 14 days to 24 hours prior to check In

- Expire after 365 days

It’s always nice to have a living room like this one at the Intercontinental Chicago Miracle Mile

Here are the IHG One Rewards Milestone Rewards

I have highlighted the ones I would choose at each level.

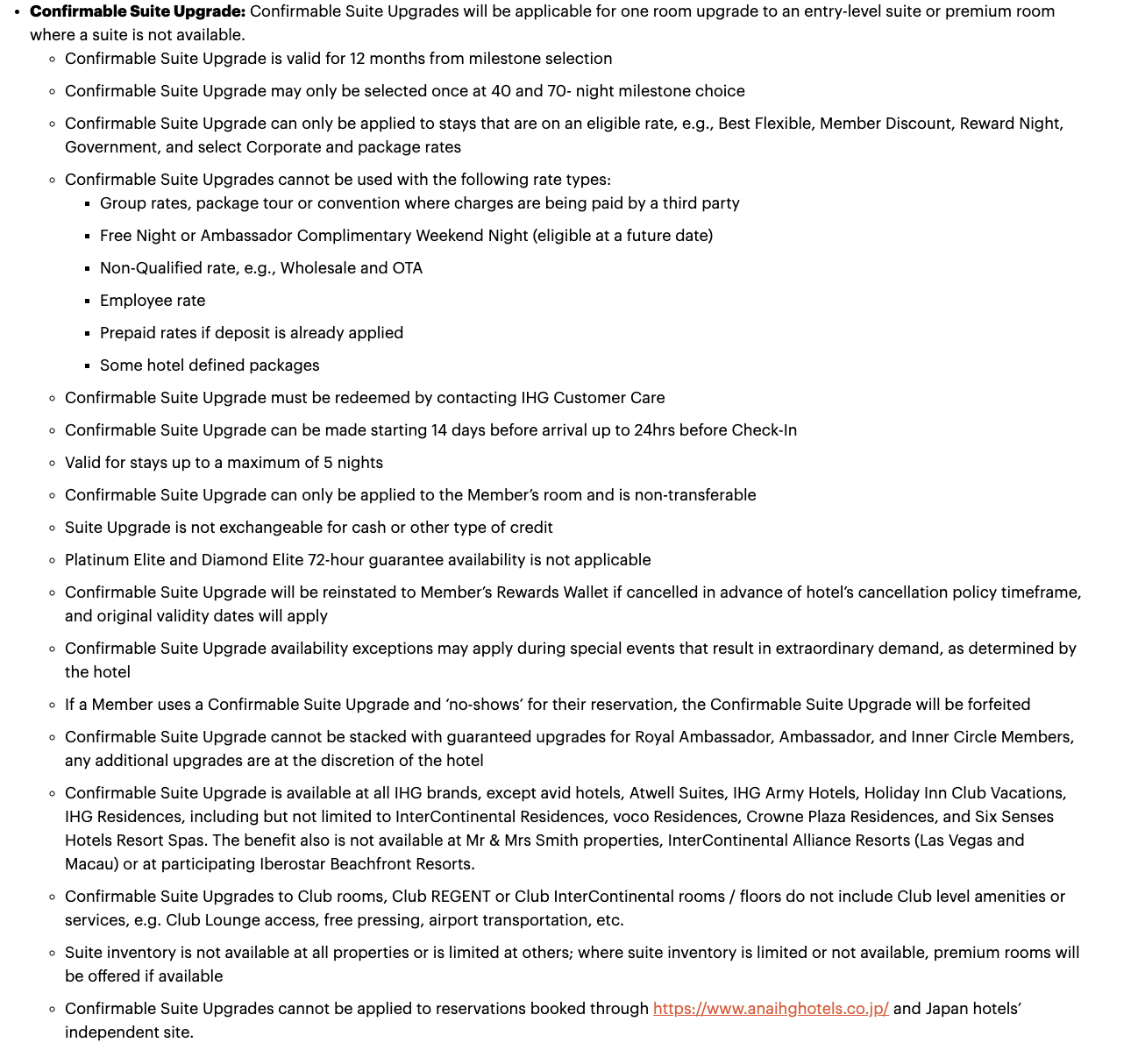

The Terms and Conditions of the Suite Upgrade – using on a reward night

A few things to keep in mind:

- In the 3rd term you can see that Rewards Night is listed – BOOM!

- You cannot use it with an IHG Ambassador Free Weekend Night

- If you upgrade to a CLUB room…you don’t get club access, pressing, etc. That is a big deal.

- There are some property exclusions

- No Six Senses

- No Holiday Inn Vacation Club

- No Mr and Mrs Smth…but they already left IHG so that doesn’t really apply anymore.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.