This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Le Meridien Maldives announces incredible Marriott category 5 pricing

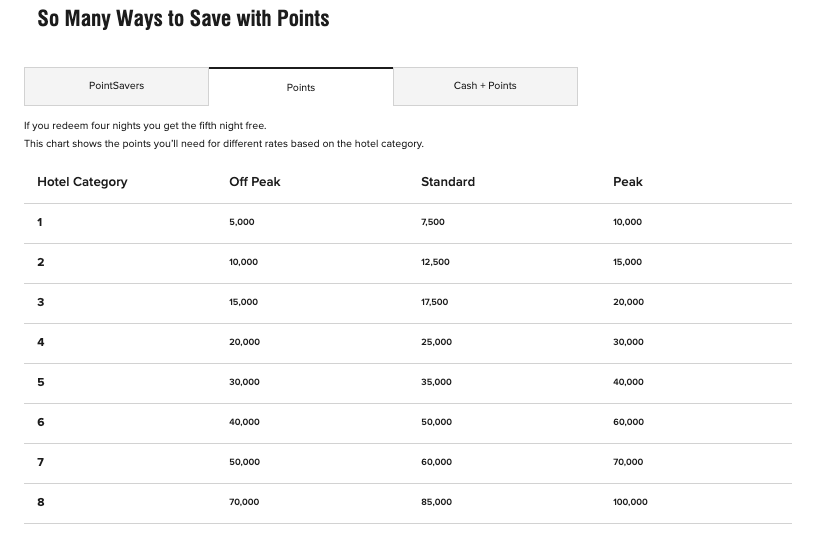

The Maldives is one of the most sought after destinations in the world. It’s gorgeous, remote, and has jaw dropping overwater bungalows that are insanely insta worthy. The list of properties available with points continues to expand ( St Regis Maldives, Ritz Carlton, JW Marriott, Park Hyatt, Conrad, Six Senses, Intercontinental, Waldorf Astoria, etc ) the Le Meridien Maldives may have made the biggest splash. MileValue discovered that the property, which opens in August of 2021, will debut as a Marriott Category 5 property. That is downright insanely fabulous. Cat 5s have a standard pricing of 35k per night and can be as low as 30k off peak. Compare that to the St Regis Maldives at a standard rate of 85k and you could stay nearly a week at the Le Meridien for what 2 nights would cost you at the St Regis. Is the St Regis THAT much nicer? Maybe…but for many, it won’t be.

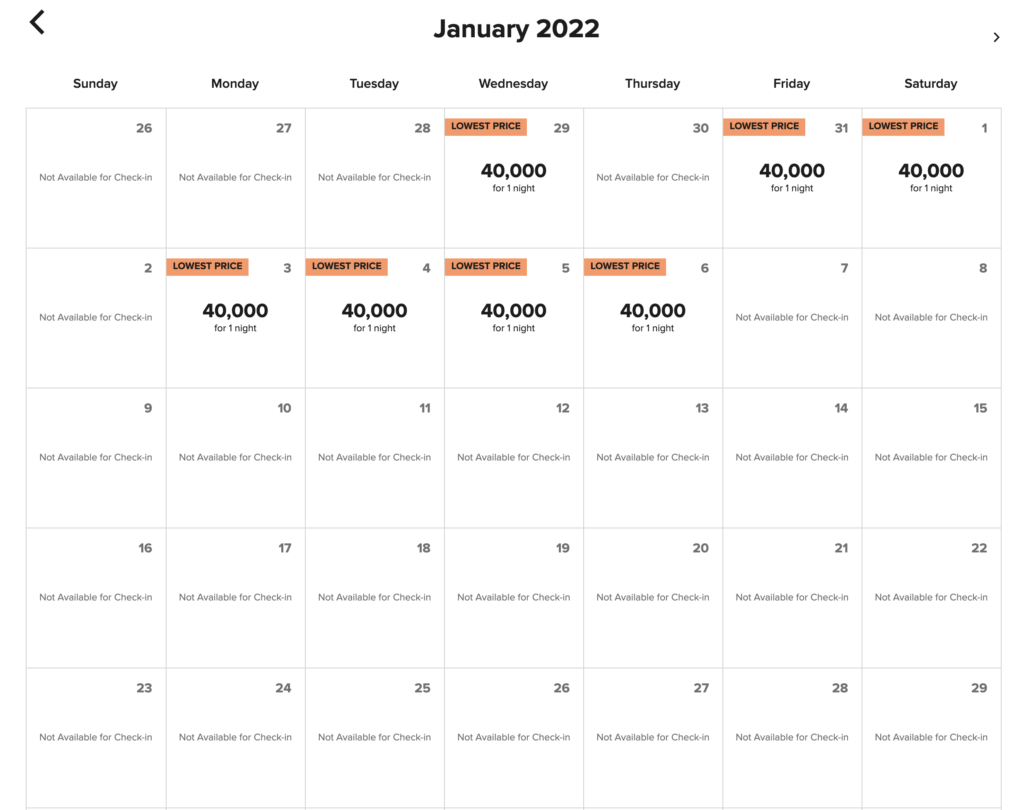

Le Meridien Maldives opens August 2021…here’s a look at avail going forward

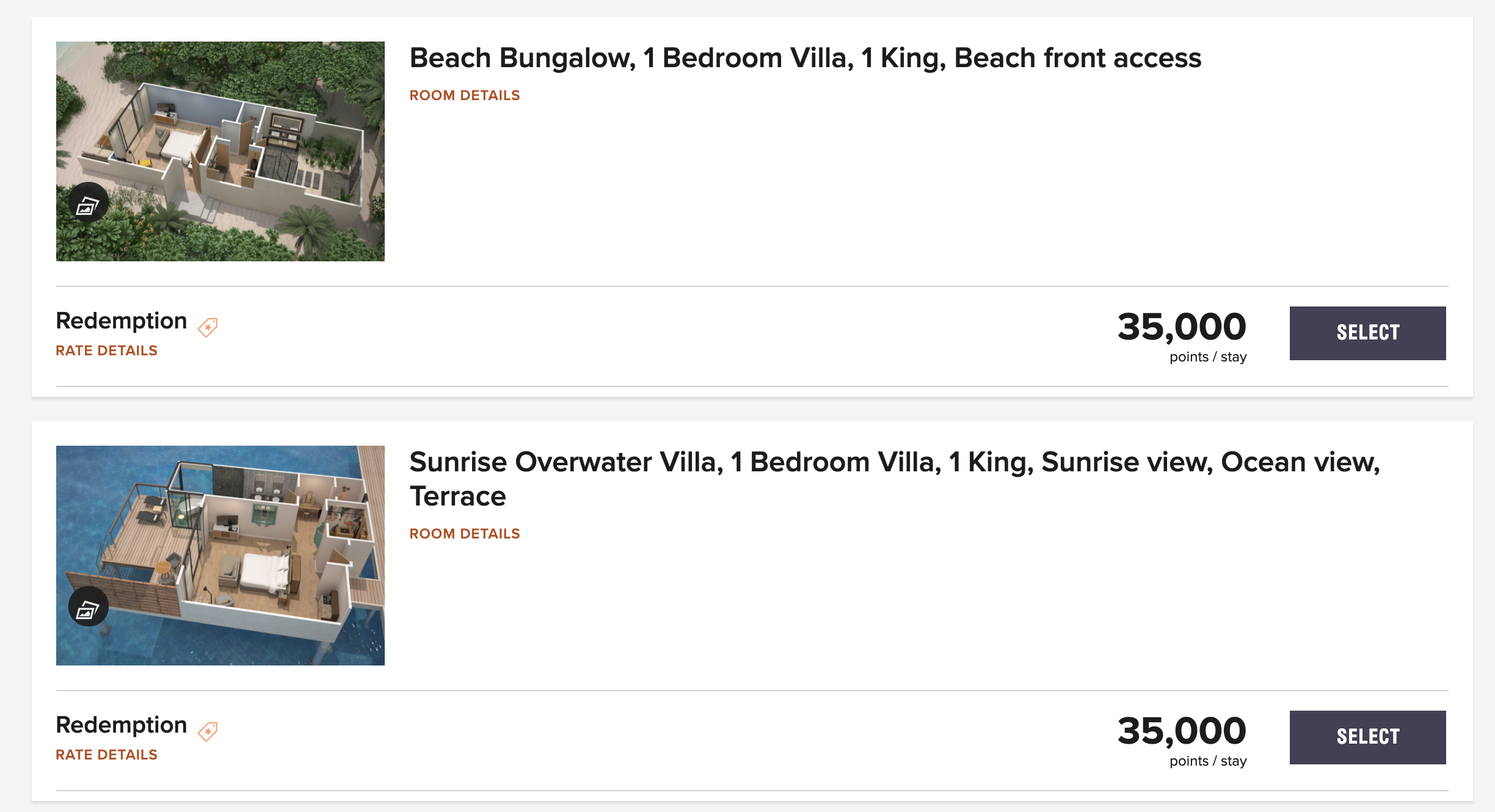

Both Beach and Overwater bungalows are pricing at standard rates

This is fantastic since normally you’ll need to pay a premium to stay in an overwater bungalow, but current pricing places both rooms at Le Meridien Maldives at the same pricing.

Note…you’ll still be responsible for the transfer fee of $420 per person

Le Meridien is a Marriott Category 5 property

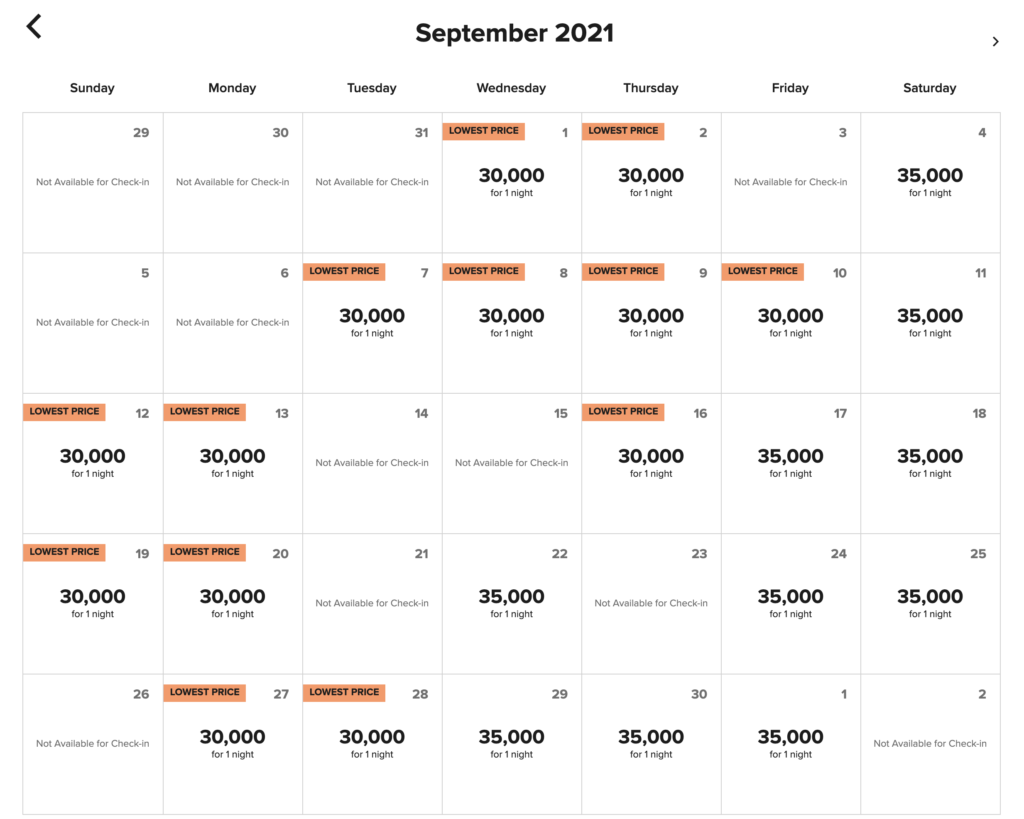

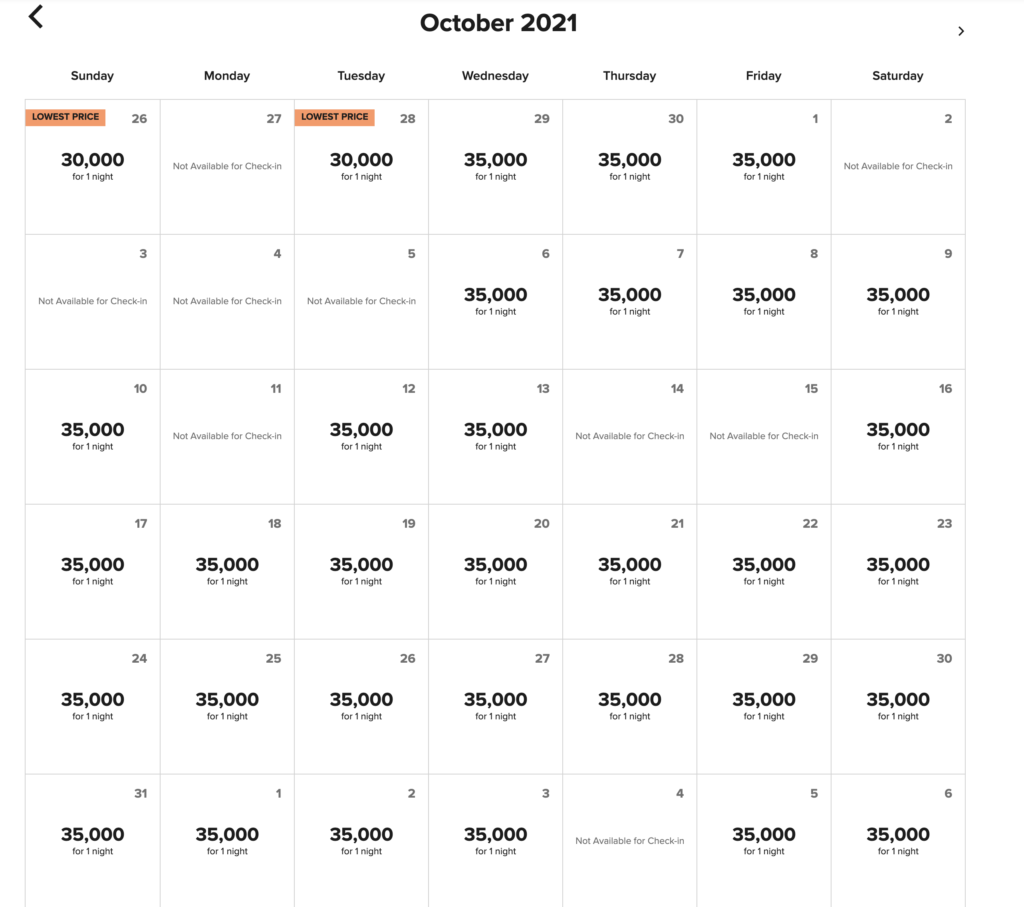

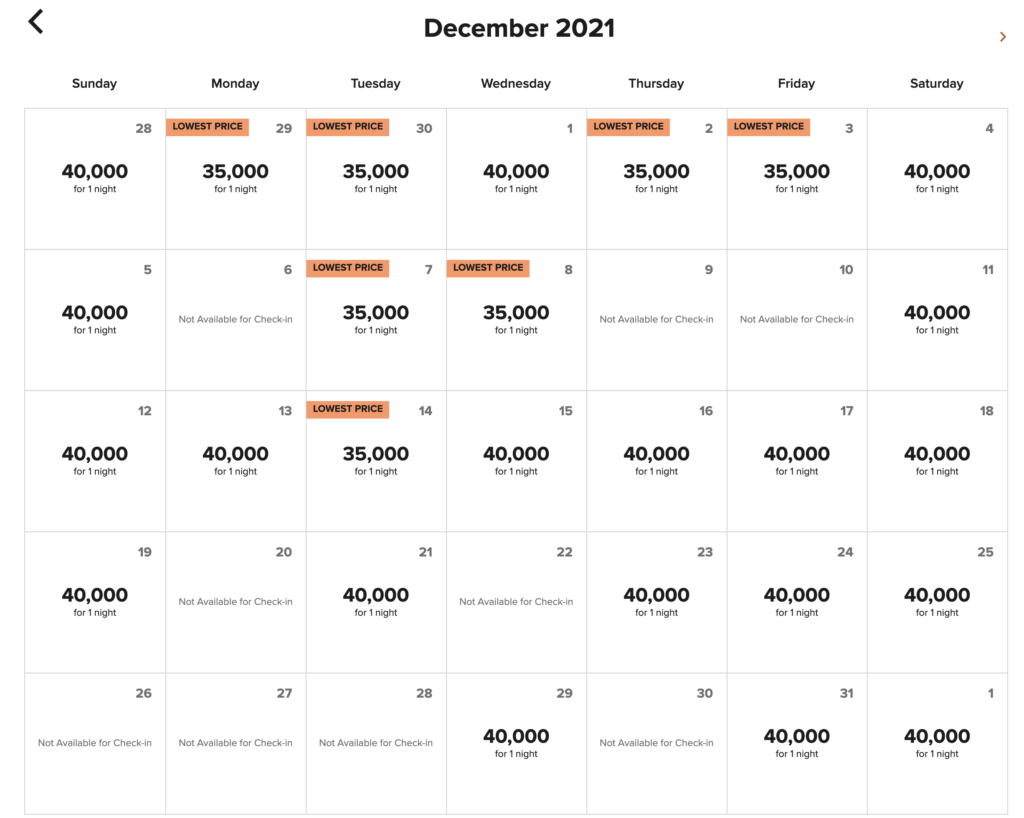

You can see in the chart below that the property ranges from 30k off peak to 40k in peak times. Standard pricing is 35k a night.

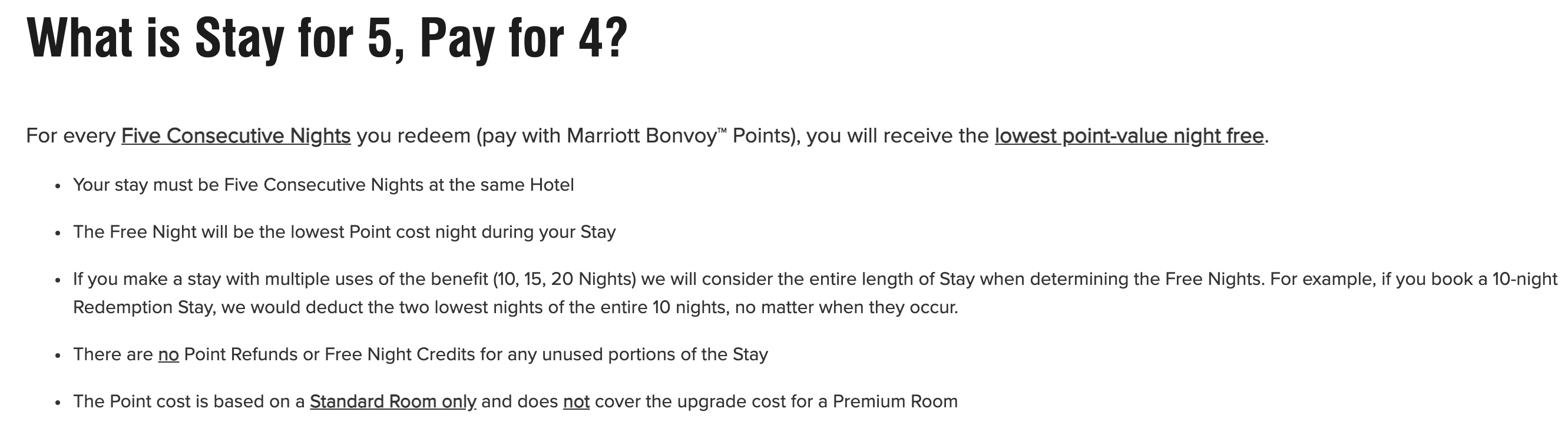

5th night free on all Marriott Bonvoy redemptions

Remember that Marriott Bonvoy members get a 5th night free on all redemptions.

- Off Peak = 120k Bonvoy Points

- Standard = 140k Bonvoy Points

- Peak = 160k Bonvoy Points

Credit Card Annual Night Certificates to extend your stay

The Le Meridien Maldives prices in at a category 5 – this means that you can use the free night certificates you receive on your credit card anniversary:

- Standard Pricing 35k night

- Use your Marriott Boundless free night

- Use your Marriott Bonvoy Business free night

- Marriott Bonvoy Brilliant Free night

- Peak Pricing 40k night

- Use Marriott Bonvoy Brilliant free night

Credit Card Transfers

Both Chase and Marriott are transfer partners of Marriott. This means you can convert your Ultimate Rewards or your Membership Rewards into Marriott Bonvoy points.

Chase Cards that I would recommend:

Note that in order to transfer into Marriott you need to hold a Chase Sapphire Preferred, Chase Sapphire Reserve, or Ink Business Preferred. The other cards mentioned below are amazing cards in tandem, but earn cashback.

- Chase Sapphire Preferred is a great starter premium card and one that I actually carry

- I think this is a great card to view as your Chase cornerstone

- Chase Freedom Flex and Chase Freedom Unlimited have amazing offers currently running and I would highly recommend both cards

- They were improved in September of 2020 and at least one should be in your wallet

- Chase Sapphire Reserve has an increased offer currently running and comes with added perks and benefits

- Chase Ink Business Preferred is one of the best business cards you can carry and I actually have two of them in my wallet ( different businesses )

- 3x on a litany of categories and earns transferrable points

- Chase Ink Business Cash

- rotating quartely 5x categories make this a great card to keep in your wallet to maximize spend

- Chase Ink Business Unlimited

- Get 1.5x on every single purchase your business makes.

Amex Cards I would Recommend

- American Express Platinum

- Lounge access, 5x on flights, Fine Hotels and Resorts, Uber Credits, and one of the best offers we’ve ever seen

- American Express Gold

- 4x on all dining, 4x on us supermarkets up to $25k a year, $120 a year in uber credits, $120 a year in dining credits, it’s one of my all time fave cards

- American Express Green

- A Chase Sapphire Reserve killer – 3x dining, 3x travel, transit plus Lounge Buddy and Clear credits

- American Express Business Platinum

- Lounge access, 1.5x on purchases over 5k, Dell Credits, etc

- American Express Business Gold

- 4x on your top two monthly categories including gas and dining

- American Express Blue Business Plus

- 2x on every single purchase up to $50k a year.

Currently…Amex is offering a 40% transfer bonus – 100k Amex points will get you a 5 night stay currently.

What a time to plan a trip to the Maldives!

Short on points? You could always Buy Marriott Points – they’re 30% off until June 20th, 2021

Marriott has increased the limit on purchasing points to 100k a year.

Summary

This is a stunning development, and if you’re in the midst of planning a honeymoon, getaway, etc – this could be a time to enjoy a brand new resort at a screamingly cheap redemption rate.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.