This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Earlier this year we broke down the new partnership between AA and Hyatt and explained how you can Quad earn ( worth reading IMO ). Now, that program is live and you can link your accounts, start earning points, go after challenges, the whole kit and kaboodle. Here’s a quick overview of the program.

If you’re flying on American Airlines

- If you’re Discoverist, Explorist, or Globalist you’ll earn a bonus World of Hyatt point for every dollar spent on AA flights

If you’re staying at Hyatt hotels

- If you’re Gold, Platinum, Platinum Pro, Executive Platinum, or Concierge Key – you’ll earn a bonus Aadvantage mile for every eligible dollar you spend at qualifying Hyatt hotels.

If you’re one of the uber elite AA Concierge Key members, congratulations, you’ll receive comped Globalist status. Winner, winner, chicken dinner.

Earning status at an accelerated rate you may receive an email offer:

The way it works is, if you carry Elite status in AA or Hyatt, you may receive a targeted email to gain status in the partner program on an accelerated basis. Stay 10 nights within a certain amount of time, fly a certain number of EQM and spend EQD to achieve status. Personally, I carry Explorist status and

- Terms for AA

- Have a valid email address listed in your AAdvantage® account in order for American Airlines to email you in the event you are so selected. You can manage your AAdvantage® email preferences from your AAdvantage® account page.

- Have a valid email address listed in your World of Hyatt account in order for World of Hyatt to email you in the event you are so selected. You can manage your World of Hyatt email preferences from your World of Hyatt account page.

- Terms for Hyatt

- Have a valid email address listed in your World of Hyatt account in order for World of Hyatt to email you in the event you are so selected. You can manage your World of Hyatt email preferences from your World of Hyatt account page.

- You must have a valid email address listed in your AAdvantage® account in order for American Airlines to email you in the event you are so selected. You can manage your AAdvantage® email preferences from your AAdvantage® account page.

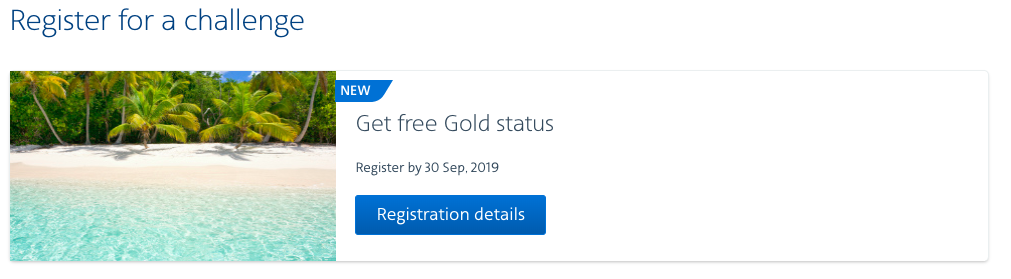

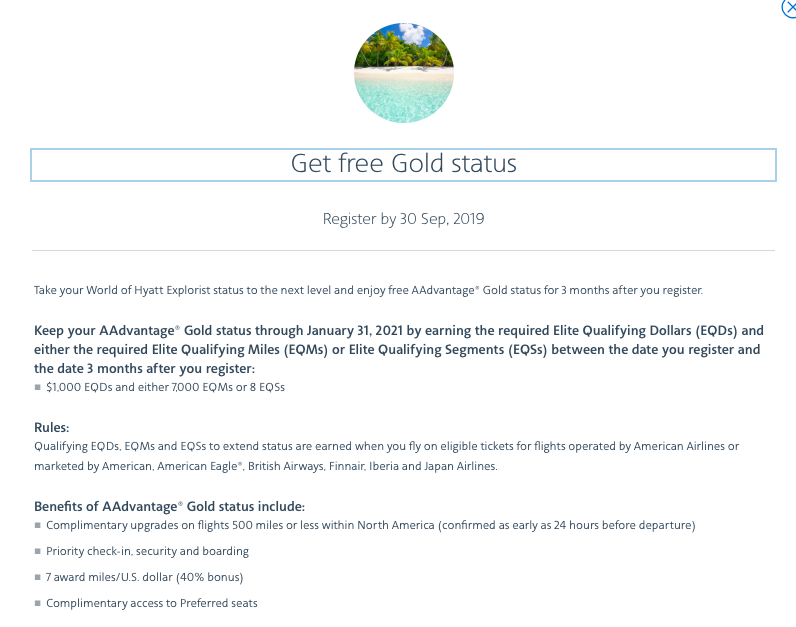

Roughly a week after I linked my accounts, my AA account had this targeted offer:

You can link your accounts via this link

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.