We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

This offer may no longer be available

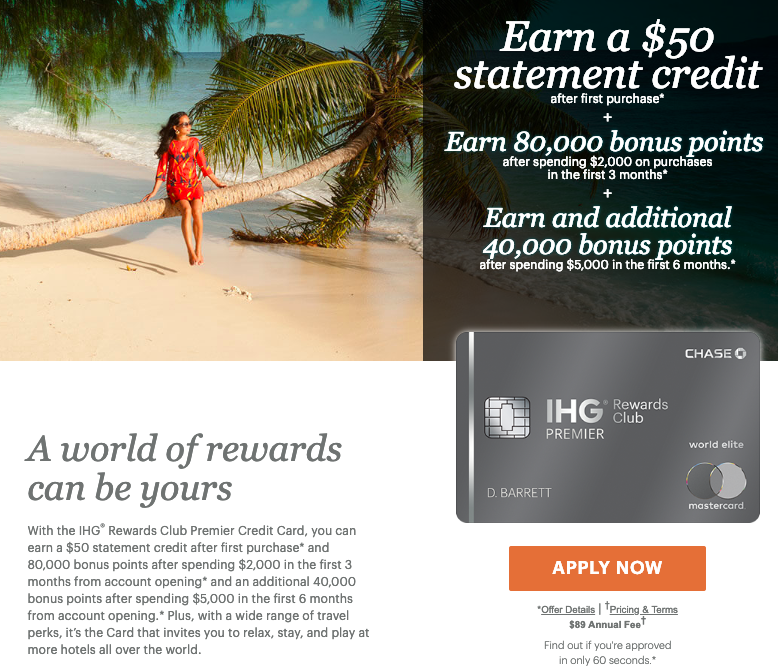

As reported by DOC, there is a new best ever offer in town on Chase’s IHG Premier. Personally, I think this is a great card to pick up for the annual night certificate, 4th night free on award bookings, Global Entry refund credit, and IHG Platinum status. With a best ever welcome bonus…you do the math.

The Offer:

- 80k after $2k spend in 3 months after account opening

- 40k after another $3k spend in 6 months after account opening

- $50 statement credit after a single purchase

All the same benefits like:

- A free night after each account anniversary year

- These are currently valid at properties 40k points and below

- 4th night free when redeeming points

- 20% off purchased points

- Can’t be stacked with points sales tho

- 10x points at IHG hotels

- 2x points at gas stations, grocery stores, and restaurants

- Platinum status at IHG while holding the card

- Global Entry/TSA Pre fee credit every 4 years ($100)

- No Foreign Transaction

- $89 annual fee

5/24

Now almost all Chase cards are limited by 5/24 so if you’re over…unfortunately you’re out of luck.

Is it worth it?

I think its a best ever offer on a card that keeps on giving each and every year you hold it. If you’re at all thinking of picking one up…this is a killer offer. The 40k annual night free combined with a 4th night free on award bookings are two of the biggest reasons this is a long term hold card for me and my family. Every situation is different so make sure you act in your own best interest, but I’m impressed with the offer.

120k would get you two nights at the Intercontinental Sydney

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.