This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

MMMondayMemo: The Local Currency Trick

Each Monday Miles has decided to drop a tip, hint, tutorial, trick that maybe you’ve missed or haven’t heard before. If you’re an expert in this field, some of these may be things you already know, but there are a lot of beginners out there who are just getting their feet wet. This week the Monkey Miles Monday Memo focuses on Foreign Exchange rates, and using it to your advantage. The Local Currency Trick can save you some bucks and keep ultimately keep things simpler when traveling abroad.

The Local Currency Trick, example #1: Use ATMs while traveling abroad

Not so long ago you needed to travel with traveler’s checques. Those bad boys safeguarded you from worst case scenarios if your cash was stolen. Now, there really isn’t a reason to buy them because most every bank has relationships abroad to use ATMs. You can take out as much cash as you need, as you go, and the banks will have superior exchange rates between themselves than you could get at local currency exchange shop. You also save yourself the trouble of having to carry a bulk amount of cash/traveler’s checques and the stress that comes with it. Additionally, if you carry Private Client status, or the like, with your mother bank you may also get all your atm fees waived when using them abroad. By using Atms you’ll get a better exchange rate and save yourself the stress of carrying a lot of cash.

The Local Currency Trick, example #2: – Hotel exchange rates

Hotel exchange rates are often terrible. I was just recently hanging out at the Intercontinental Park Lane in London and noticed that the exchange rate at the hotel is $1.43/pound. WHAT?! That is ridiculous. USE THE ATM! Even with a fee, you’ll come out ahead.

At check out

Hotels will often ask if you’d like to pay in the local currency or they could charge you in your currency. NEVER pay in your home currency. The best float rate you’ll get is with your credit card. The bulk volume affords them the most competitive exchange rate and you can use that to your advantage. I mean, look at the above situation – My credit card won’t get exactly $1.29 per pound, but it’ll be roughly $1.30 vs the $1.43 the hotel would have charged me for the “convenience” of paying in dollars.

The Local Currency Trick, example #3: Search as if you’re in your destination country

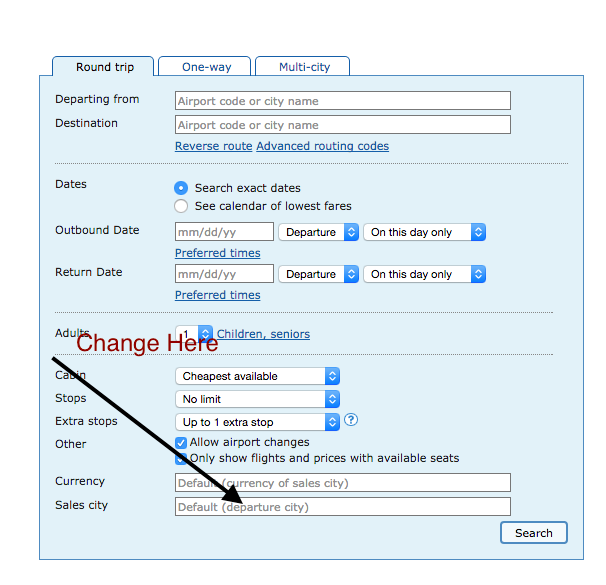

Last year I booked an Around the World trip that had me traveling through the Middle East, South Africa, and Asia. When I was looking into flight to get from South Africa to Tokyo I noticed that the fares on the ITA MATRIX were significantly cheaper priced in ZAR ( South African Rand) than they were in dollars. What I ultimately realized was if I searched my Cathay Pacific Business Class flights from the South African site rather than the US site it priced the tickets a couple grand cheaper. When I went to pay I entered all of my US information and bought the tickets. Often times Companies will have incentives for travel depending on where you are purchasing the fare vs the itinerary. Use this to your advantage!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.