This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Alaska Airlines has long maintained a wide variety of award redemptions specific to each partner airline. Some, like Cathay Pacific, have had incredible award rates, and others like Aer Lingus aren’t the most attractive. For instance you could redeem US to Asia on Cathay Pacific for just 70k miles. That’s incredible. Not long ago, they introduced dynamic awards that permitted the use of Alaska miles to redeem non-saver rates awards that are outrageously expensive, and was a bit of a warning sign that dynamic pricing could creep its way in to other awards as well. Now, they’ve eliminated the award charts of each partner and replaced it with a general chart that doesn’t include any rates that originate outside the US/Canada. This Is certainly toeing the line of devaluation In my opinion and one step closer to Alaska eliminating charts completely and going fully dynamic.H/T VFTW

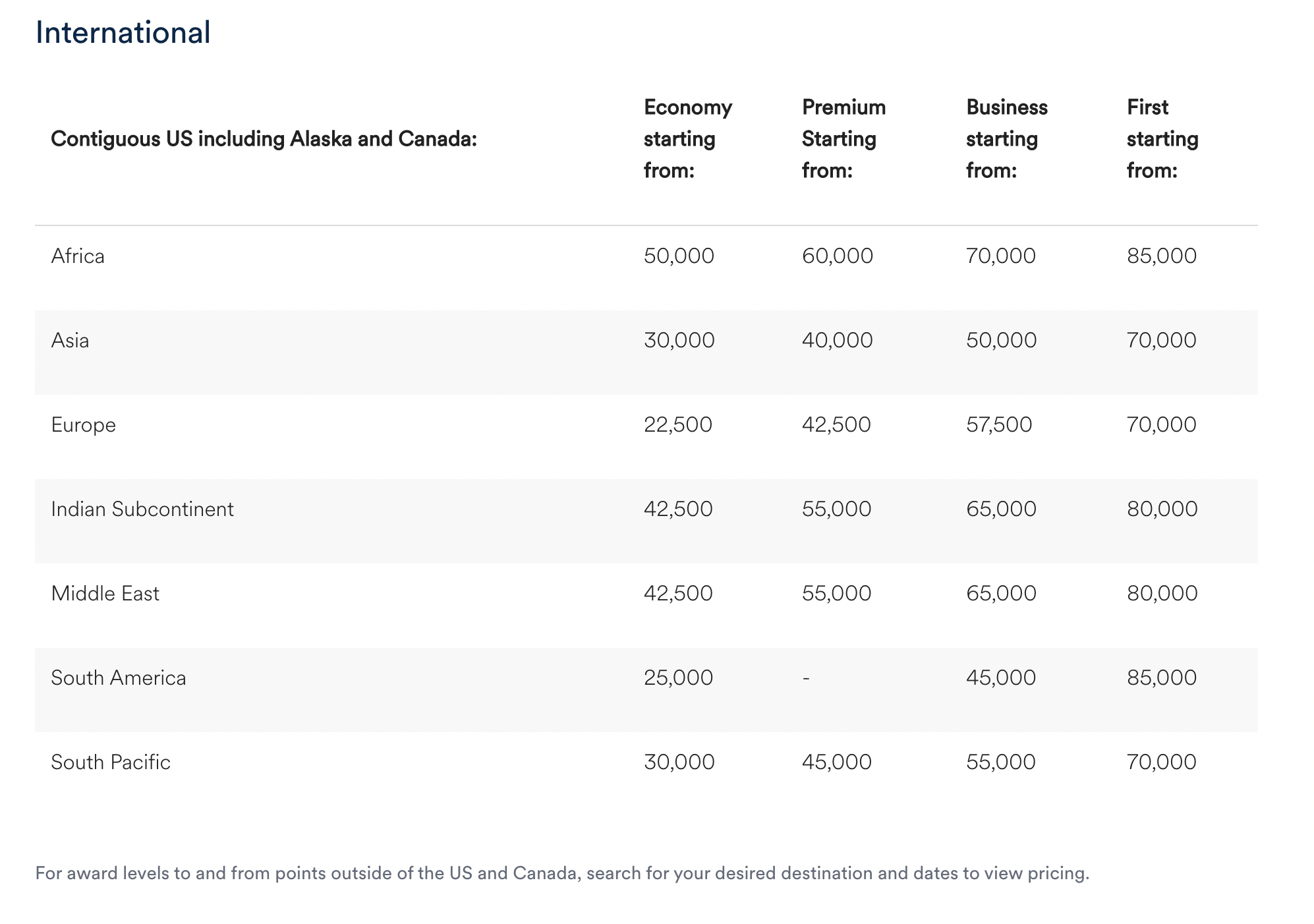

The new universal Alaska Airlines award chart for international flights

Notice the language at the bottom of the chart that you’ll have to search to view points from outside the US. Prior to this new award chart every airline had specific pricing for those routes.

Note…the award rates START at these prices. Since part of the Alaska chart is dynamic…the sky is the limit on those awards.

Booking terms you should pay attention to:

The most important ones are award flights with an origin and destination outside the US must be booked 72 hours prior to departure. This was implemented a few years ago and can be tricky if you’re trying to book Cathay from Hong Kong to Paris for instance since often those award will open up the day before departure. Keep that in mind.

The other one to pay attention to, is new to me at least, and that is stopovers are no longer allowed intra-region. If you’re flying from Vietnam to Beijing you wouldn’t be able to stop in Hong Kong en route for a couple of days.

-

Award flights with both an origin and destination outside of the US and Canada must be booked at least 72 hours before the departure time.

-

The purchaser of an award ticket is responsible for all applicable taxes, fees, and checked baggage charges imposed by the transporting carrier(s) or U.S. or international authorities. For itineraries that include one or more partner award segments, a $12.50 (USD) nonrefundable fee will be collected per person, each way.

-

Stopovers are not available on award redemptions within international regions (e.g. intra-Asia or Intra-Europe)

Overall

Personally, I think this is a bit shady. “Hey, we have an award chart and we haven’t changed award prices.” That’s great and how they will spin it. But it also creates just enough cover for them to slowly devalue without us noticing since they are saying routes START at the prices listed. I still believe Alaska has a great program with some incredible redemption opportunities, but this makes me feel like the days are numbered on some of the sweeter deals.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.