We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

One of my favorite benefits of the American Express Business Platinum

The American Express Business Platinum card has a slew of benefits whose collective value exceeds the $450 annual fee. One of my favorites is the partnership with GoGo: the company that offers in-flight internet. You will receive 10 passes each calendar year that you are a cardmember. At the very minimum, I’d value you this perk at around $150.

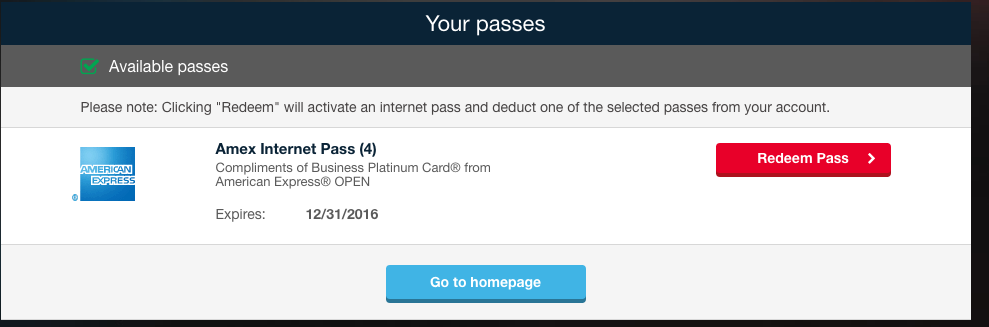

What the American Express Business Platinum passes will look like in your account:

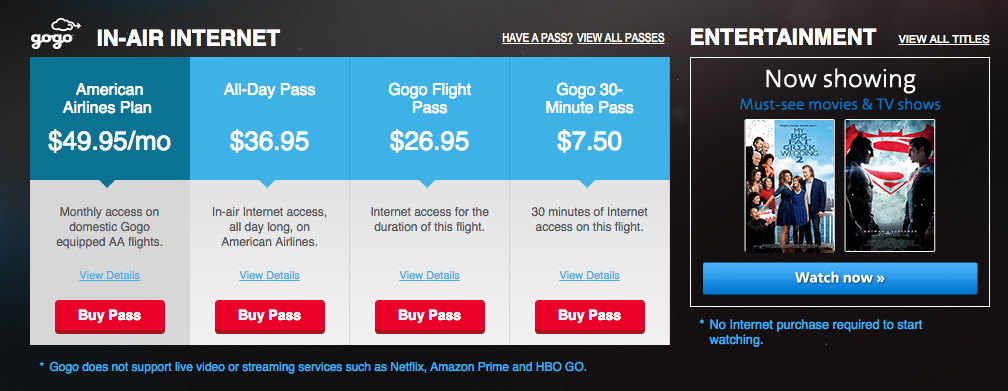

A Flight I recently took from the East coast to the West coast: $27 value!

Since these passes work for the entire flight, I tend to try and save them for the longer flights where the internet packages are more expensive. I’ve actually paid for shorter duration flights out of pocket in order to the Amex passes for more expensive redemption options. I’ve redeemed 6 of them so far and I would say I’m easily averaging between $15-20 per Amex flight pass. On the low end that’s $150 of the $450 annual fee recouped there. Add in the $200 in flight incidentals and global entry fee credit and you’ve made up the $450 annual fee entirely. Not bad!

Widget not in any sidebars

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.