This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

This perk just got better

One of the best, and most hidden perks, of the American Express Platinum ( any version ) charge card is the Platinum International Airline Program. It’s a perk I’ve written about before, but long story short: Amex offers its most valued customers, deeper discounts on premium international tickets. The International Airline Program has consistently offered great deals on flights ( my biggest savings for a client was over $2500 a ticket on flights to New Zealand); however, the biggest drawback was that you needed to phone in to pull rates or book.

That’s all changed. You can now do this via Amextravel chat

American Express International Airline quotes and booking can now be processed online via Chat.

Note: the following airlines participate in the program, and there are few requirement that need to be satisfied ( namely US cardholders, cardholder booked on itinerary, origin/return to US or Canada, and Premium Economy or better ). Centurion cardholders also get the $39 fee waived.

Widget not in any sidebars

I tried it out

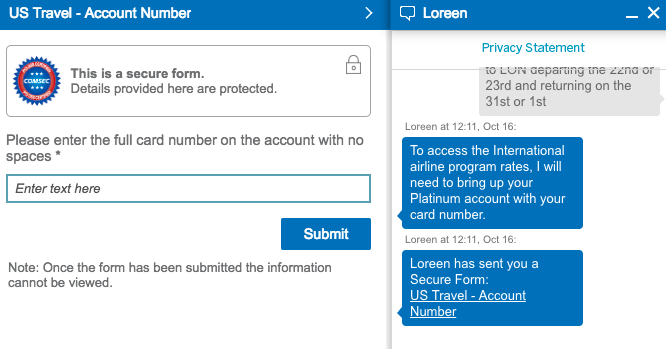

As I mentioned you need to do this via Amextravel and their chat function. You’ll be asked to submit your account number and a security question:

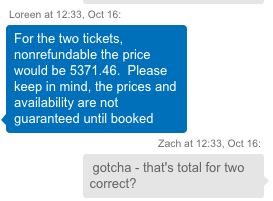

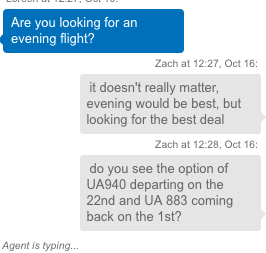

Once you’re verified, it’s very straight forward.

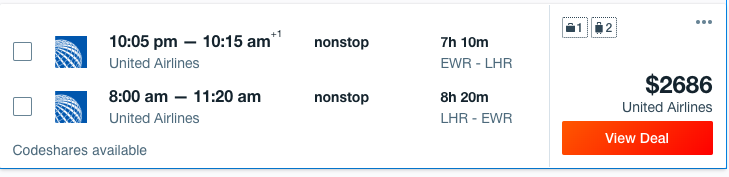

Commenter J asked why I was quoting United prices when they aren’t in the program. I had initially requested UA, AA, and BA – seeing the UA flights on Kayak as cheapest for those dates. The International Airline program prices were higher than I was seeing on Kayak and asked her to pull rates for United.

the rate she pulled was nearly identical.

Overall:

I found that it takes a bit longer that using the phone, but I was able to multitask easier while she was pulling rates. Additionally, I’m often in places where hopping on a phone call just isn’t feasible or I don’t want to discuss account details, plans, etc in public – this feature provides a great alternative.

As noted in this example, the Amex International Airline program isn’t always lower than other rates, but if you have the benefit, spending 15 mins double checking flight prices could ultimately save you a ton of cash, and worst case, ease your mind that you may have missed a bargain. 9 times out of 10, I’ve gotten lower rates than I’d ordinarily find through the airline or a consolidator ( amex travel included).

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.