This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I have an evergreen “how to pay your taxes with a credit card” article which you can find here, but I wanted to share my own personal experience. I’ve always paid my estimated business taxes with a credit card, and I have family members who pay their estimated taxes with a credit card, but this was the first year I paid my federal taxes via credit card. So…how did it go and what was it like?

Why did I do it?

Primarily because I can arbitrage the processing fee and earn more value in points than I’m paying in fees.

Which card did I use?

I paid our personal federal and my business taxes with my Bilt Mastercard® and our state taxes with a Capital One Venture X. I should have paid with my Bilt Mastercard on rent day ( 4/1/24 ) to earn double points, but I was in Latvia and totally forgot.

I principally interested in getting my yearly spend above $25k so I’m eligible for 125% bonus transfer when they offer them.

That effectively means I’m earning 2.25 points when I choose to move them ( They’ve offered this bonus on Flying Blue, Emirates, Virgin, IHG, and Aeroplan ). Those 2.25 points are easily worth 4 cents per dollar when redeemed on Flying Blue, Aeroplan, Emirates, or Virgin; however, not when used on IHG ( that’s a bad transfer imo ).

I paid the other with Venture X because every purchase earns a fixed 2x per dollar and those points are easily worth 1.5 cents a piece meaning I’m netting out a minimum of 3 cents on a 1.87c fee.

What’s the cost?

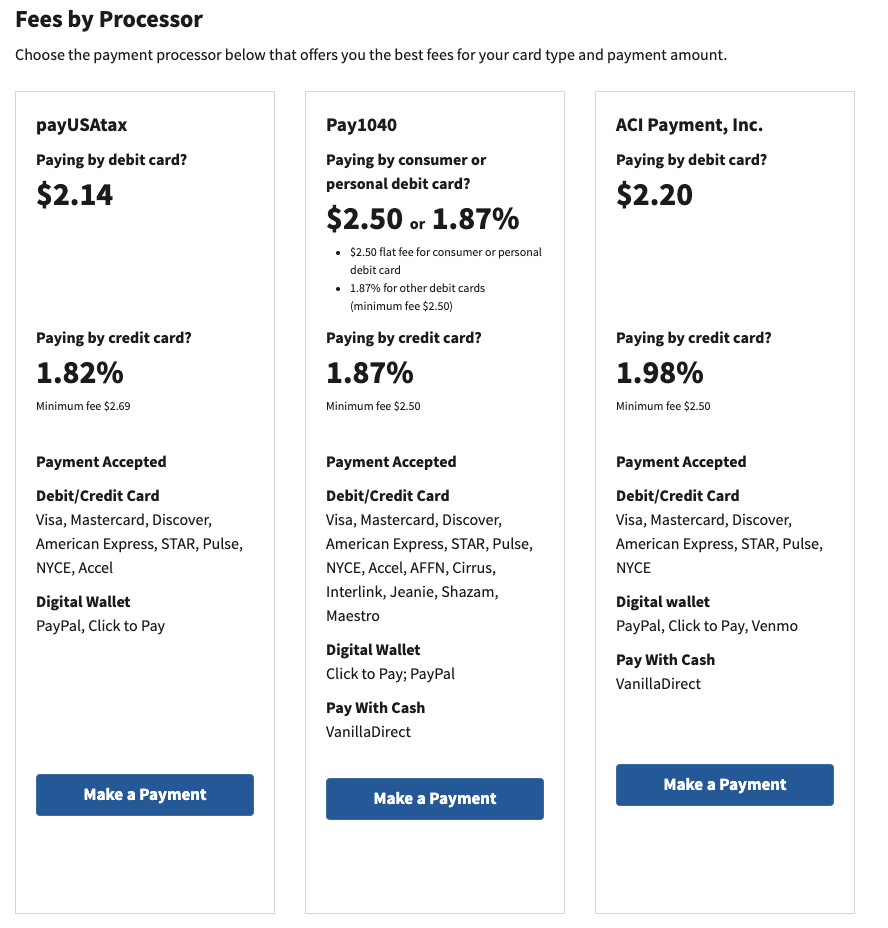

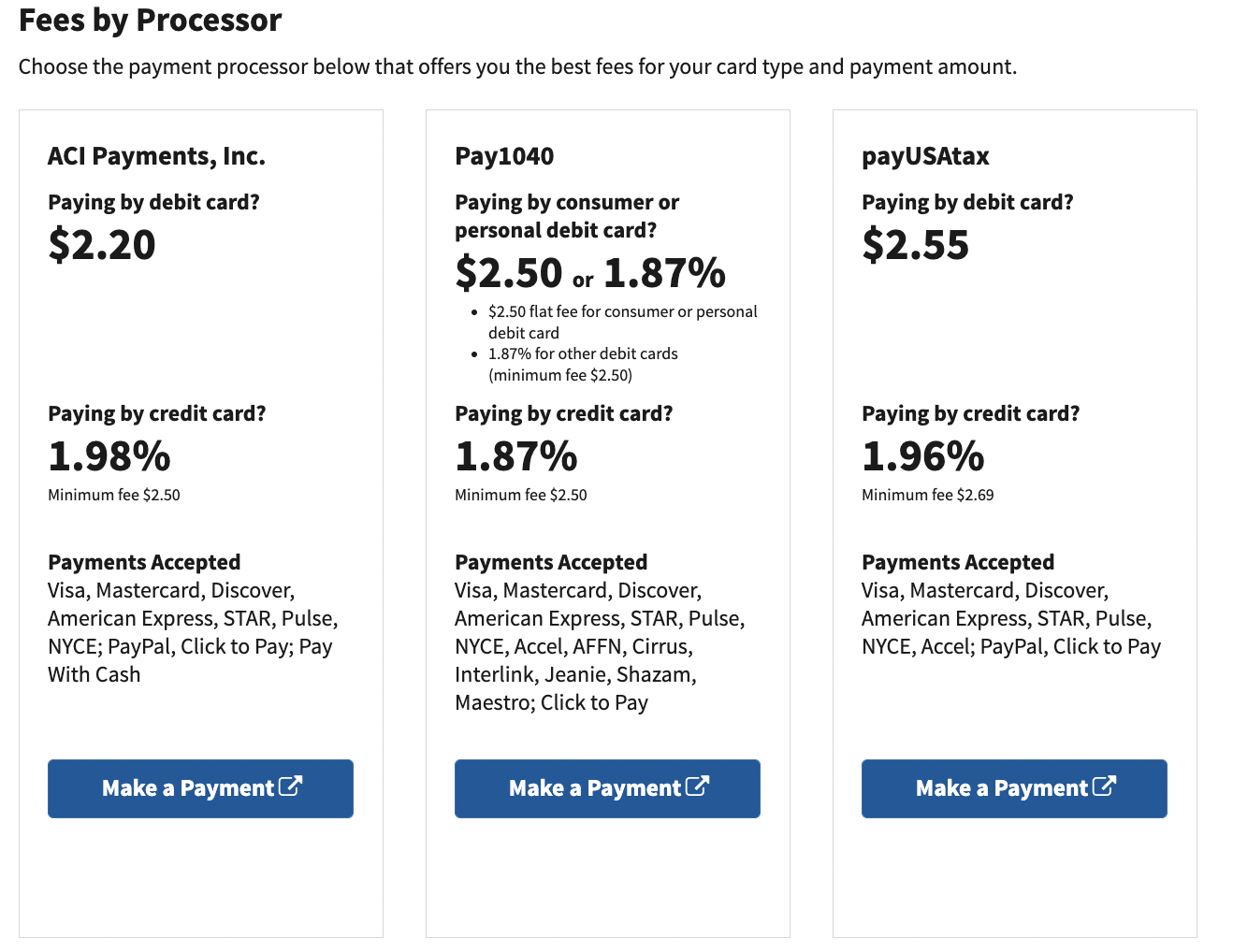

I paid a 1.87% fee to use Pay1040 which is an authorized IRS tax processing agent. I’m not sure why I didn’t choose payUSAtax since it offers a slightly lower fee, but I hastily chose Pay1040.

What information do you need?

As soon as you choose a payment agent, you’ll need:

- Total payment owed

- The type of taxes you’re paying – the form number

- Your Social

- Your Spouses Social should you be filing joint

- OF course your credit card

Documenting your taxes

Another reason this is quite beneficial is having a very straight forward record of payment. Several years ago I was told that I hadn’t paid some estimated taxes for my business in California. I didn’t have to dig through checks, etc to find a record and chase it down, I merely forwarded the payment receipt that had been emailed to me after payment. The one I received on my personal looked like this:

Is it right for everyone?

No… I’d highly suggest reading the full article, but if you can arbitrage the fee it can make a lot of sense. It’s especially valuable if your taxes can help you hit a big minimum spend requirement and unlock a massive bonus. Either way…this is what I did, and happy to have done it!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.